Technology products are no longer purely commercial goods, but are closely intertwined with geopolitical competition and cooperation, Pegatron Corp chairman Tung Tzu-hsien (童子賢) said yesterday, citing media reports that China might allow the import of Nvidia Corp’s H200 artificial intelligence (AI) chips.

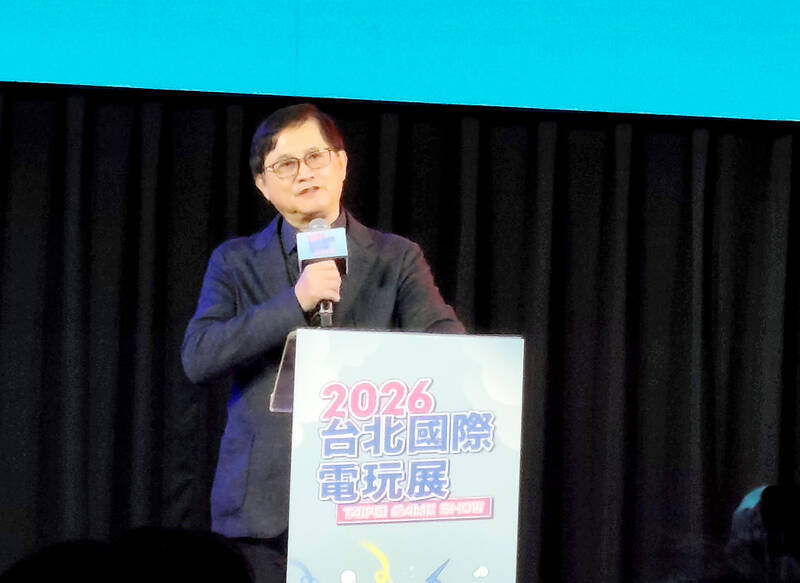

Global technology and industrial development are increasingly shaped by geopolitics, with chips, AI and semiconductor equipment serving as bargaining chips between national economies, Tung told reporters on the sidelines of the Taipei Game Show.

Technology was once a force that improved people’s lives and promoted cross-border cooperation, but is increasingly used as a tool in geopolitical negotiations, he said.

Photo: CNA

Under former US president Joe Biden, Washington adopted a technology containment strategy toward China, while US President Donald Trump’s approach is that “everything can be negotiated with money,” with market access increasingly tied to economic conditions, Tung said.

Taking the possible sale of H200 chips in China as an example, he said that shipments would be subject to a so-called “toll,” requiring US companies to pay a 25 percent export tax to the US government.

Shipment volumes would be capped, he added.

China has signaled its response, with reports indicating that exports of H200 chips would be allowed only on a limited basis and restricted to companies such as Alibaba Group Holding Ltd (阿里巴巴), Tencent Holdings Ltd (騰訊) and ByteDance Ltd (字節跳動), Tung said.

Chinese authorities would simultaneously encourage the adoption of domestically developed systems to reduce reliance on foreign high-end semiconductors, he said.

Tung’s remarks came on the same day after Nvidia chief executive Jensen Huang (黃仁勳) expressed optimism that Beijing would permit the sale of the H200 chips to Chinese buyers.

“The actual license for H200 is being finalized,” Huang said. “I’m hoping ... the Chinese government would allow Nvidia to sell [the] H200, so they have to decide, and I’m looking forward to a favorable decision.”

Taiwan Semiconductor Manufacturing Co (TSMC, 台積電) founder Morris Chang (張忠謀) once said “globalization is dead” as the global trade development faced rising competition between the US and China, as well as the growing threats of protectionist measures worldwide.

Tung yesterday said the recent developments do not herald the end of globalization, but rather that technology and trade have become increasingly shaped by geopolitics.

With Taiwan’s technology sector caught in the middle of the US-China rivalry, the era of simply “making good products and doing business happily” is over, he said.

Companies must navigate more cautiously in the increasingly complex environment and find the best path forward, he added.

Trump’s recent decision to raise tariffs on South Korea to 25 percent from the previously agreed 15 percent reflects his governing style of frequently adjusting policy in a short period of time, he said.

It was not only directed at South Korea, but served as a signal to other countries engaged in trade negotiations with Washington, he said.

While demand for advanced chips used in servers and AI applications remains strong, Taiwan must proceed cautiously amid potential challenges, he added.

Additional reporting by AFP

NEW IDENTITY: Known for its software, India has expanded into hardware, with its semiconductor industry growing from US$38bn in 2023 to US$45bn to US$50bn India on Saturday inaugurated its first semiconductor assembly and test facility, a milestone in the government’s push to reduce dependence on foreign chipmakers and stake a claim in a sector dominated by China. Indian Prime Minister Narendra Modi opened US firm Micron Technology Inc’s semiconductor assembly, test and packaging unit in his home state of Gujarat, hailing the “dawn of a new era” for India’s technology ambitions. “When young Indians look back in the future, they will see this decade as the turning point in our tech future,” Modi told the event, which was broadcast on his YouTube channel. The plant would convert

‘SEISMIC SHIFT’: The researcher forecast there would be about 1.1 billion mobile shipments this year, down from 1.26 billion the prior year and erasing years of gains The global smartphone market is expected to contract 12.9 percent this year due to the unprecedented memorychip shortage, marking “a crisis like no other,” researcher International Data Corp (IDC) said. The new forecast, a dramatic revision down from earlier estimates, gives the latest accounting of the ongoing memory crunch that is affecting every corner of the electronics industry. The demand for advanced memory to power artificial intelligence (AI) tasks has drained global supply until well into next year and jeopardizes the business model of many smartphone makers. IDC forecast about 1.1 billion mobile shipments this year, down from 1.26 billion the prior

People stand in a Pokemon store in Tokyo on Thursday. One of the world highest-grossing franchises is celebrated its 30th anniversary yesterday.

Zimbabwe’s ban on raw lithium exports is forcing Chinese miners to rethink their strategy, speeding up plans to process the metal locally instead of shipping it to China’s vast rechargeable battery industry. The country is Africa’s largest lithium producer and has one of the world’s largest reserves, according to the US Geological Survey (USGS). Zimbabwe already banned the export of lithium ore in 2022 and last year announced it would halt exports of lithium concentrates from January next year. However, on Wednesday it imposed the ban with immediate effect, leaving unclear what the lithium mining sector would do in the