South Korea would seek favorable terms for US tariffs on imports of memory chips, a presidential office spokesperson told a news conference yesterday.

The country last year released a joint fact sheet on its trade deal with the US that included terms ensuring South Korea would not receive unfavorable treatment from US tariffs on imported chips compared to key competitors, the official said, when asked about US President Donald Trump administration’s proclamation on imposing tariffs on artificial intelligence chips.

South Korean Minister of Trade, Industry and Resources Kim Jung-kwan on Saturday said US tariffs on some advanced computing chips would have a limited impact on South Korean companies.

Photo: Bloomberg

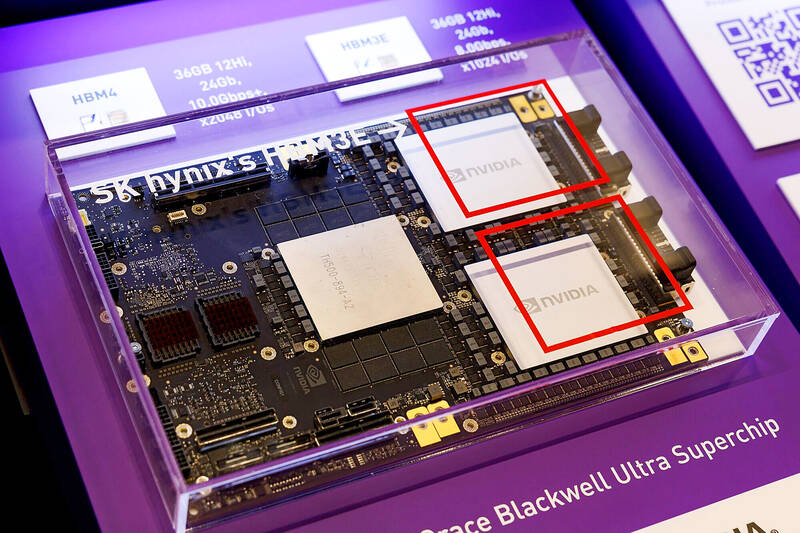

South Korea’s Samsung Electronics Co and SK Hynix Inc are among the world’s biggest producers of memory chips.

Under an accord with South Korea announced in July last year, the US would charge a 15 percent tariff on most goods from the country, while sparing, for now, imports of chips.

The agreement between Washington and Seoul includes a US$350 billion South Korean fund for US investments, yet those plans are still taking shape and it is unclear how much more Samsung and SK Hynix would agree to spend in the US beyond their earlier commitments.

Samsung in 2024 unveiled plans to invest more than US$40 billion in the US, including US$17 billion for an advanced packaging facility in Texas for high-bandwidth memory chips.

Meanwhile, SK Hynix has said it intends to spend nearly US$4 billion on advanced packaging in Indiana, part of US$15 billion for production and research in the US.

South Korean memory makers and Taiwanese companies that are not investing in the US could face up to 100 percent tariffs unless they commit to increased production on US soil, US Secretary of Commerce Howard Lutnick said.

Following a groundbreaking ceremony for a new Micron Technology Inc plant outside Syracuse, New York, Lutnick said that potential levies spelled out under a trade accord with Taiwan could also affect chipmakers from South Korea.

“Everyone who wants to build memory has two choices: They can pay a 100 percent tariff, or they can build in America,” Lutnick said on Friday in response to a reporter’s question, without naming any particular companies. “That’s industrial policy.”

Lutnick’s comments echoed a warning on Thursday following the signing of the Taiwan trade deal, which grants quota-based tariff relief to companies committing to investing in US-based manufacturing.

“If they don’t build in America, the tariff is likely to be 100 percent,” Lutnick told CNBC.

POWERING UP: PSUs for AI servers made up about 50% of Delta’s total server PSU revenue during the first three quarters of last year, the company said Power supply and electronic components maker Delta Electronics Inc (台達電) reported record-high revenue of NT$161.61 billion (US$5.11 billion) for last quarter and said it remains positive about this quarter. Last quarter’s figure was up 7.6 percent from the previous quarter and 41.51 percent higher than a year earlier, and largely in line with Yuanta Securities Investment Consulting Co’s (元大投顧) forecast of NT$160 billion. Delta’s annual revenue last year rose 31.76 percent year-on-year to NT$554.89 billion, also a record high for the company. Its strong performance reflected continued demand for high-performance power solutions and advanced liquid-cooling products used in artificial intelligence (AI) data centers,

SIZE MATTERS: TSMC started phasing out 8-inch wafer production last year, while Samsung is more aggressively retiring 8-inch capacity, TrendForce said Chipmakers are expected to raise prices of 8-inch wafers by up to 20 percent this year on concern over supply constraints as major contract chipmakers Taiwan Semiconductor Manufacturing Co (TSMC, 台積電) and Samsung Electronics Co gradually retire less advanced wafer capacity, TrendForce Corp (集邦科技) said yesterday. It is the first significant across-the-board price hike since a global semiconductor correction in 2023, the Taipei-based market researcher said in a report. Global 8-inch wafer capacity slid 0.3 percent year-on-year last year, although 8-inch wafer prices still hovered at relatively stable levels throughout the year, TrendForce said. The downward trend is expected to continue this year,

‘BASICALLY A BAN’: Sources said the wording governing H200 imports from officials was severe, but added that the regulations might change if the situation evolves Chinese customs authorities told customs agents this week that Nvidia Corp’s H200 artificial intelligence (AI) chips are not permitted to enter China, three people briefed on the matter said. Chinese government officials also summoned domestic technology companies to meetings on Tuesday, at which they were explicitly instructed not to purchase the chips unless necessary, two of the people and a third source said. “The wording from the officials is so severe that it is basically a ban for now, though this might change in the future should things evolve,” one of the people said. The H200, Nvidia’s second-most powerful AI chip, is one

A proposed billionaires’ tax in California has ignited a political uproar in Silicon Valley, with tech titans threatening to leave the state while California Governor Gavin Newsom of the Democratic Party maneuvers to defeat a levy that he fears would lead to an exodus of wealth. A technology mecca, California has more billionaires than any other US state — a few hundred, by some estimates. About half its personal income tax revenue, a financial backbone in the nearly US$350 billion budget, comes from the top 1 percent of earners. A large healthcare union is attempting to place a proposal before