Soaring global demand for semiconductors fueled by a boom in artificial intelligence (AI) sent South Korea’s exports to their highest-ever level last year, official data showed yesterday.

Total exports last year were valued at more than US$700 billion, up 3.8 percent from the previous year, South Korean Ministry of Trade,

Industry and Energy data showed.

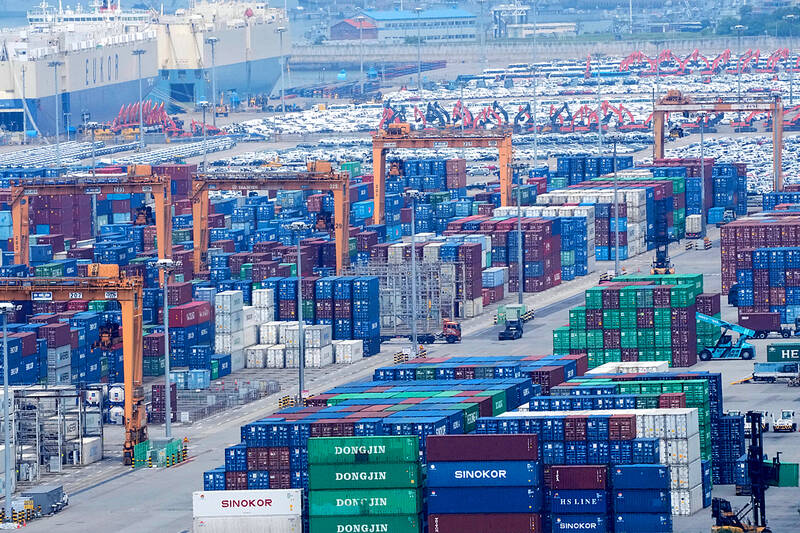

Photo: AP

The worldwide surge in interest in AI saw semiconductor industry exports reach US$173.4 billion last year — a record high and an increase of more than 20 percent from the previous year, the ministry said.

High-priced memory chips used in AI data centers were in strong demand, the ministry added.

Semiconductor exports last month alone rose more than 40 percent year-on-year, posting gains for a 10th consecutive month and marking a record-high monthly figure.

South Korean tech juggernaut Samsung Electronics Co is one of the world’s top memorychip makers, providing crucial components for the AI industry and the infrastructure it relies on.

The country is also home to SK Hynix Inc, a key player in the global semiconductor market.

South Korean President Lee Jae-myung has vowed to triple spending on AI this year, aiming to propel the nation into the world’s top three AI powers behind the US and China.

Vehicles, South Korea’s other key export, performed strongly, with auto shipments rising to US$72 billion, the highest on record despite US tariff pressures.

Other sectors such as agriculture and cosmetics also recorded their highest-ever figures, buoyed by strong global interest in the country’s pop culture powerhouse, its food and beauty products.

Exports rose everywhere except to the US and China, weighed down by tariffs on steel, automobiles and machinery.

Asia’s fourth-largest economy was initially hit with a 25 percent across-the-board tariff by the US, but secured a last-minute agreement for a reduced 15 percent rate.

South Korea is one of Washington’s biggest trade partners.

The new record was “achieved amid challenging domestic and external conditions,” South Korean Minister of Trade and Industry Kim Jung-kwan said in a statement.

It “serves as an indicator of the South Korean economy’s solid resilience and growth potential,” he said.

However, “export conditions this year are expected to remain difficult, as uncertainties persist in the trade environment, including the sustainability of semiconductor demand,” he added.

GROWING OWINGS: While Luxembourg and China swapped the top three spots, the US continued to be the largest exposure for Taiwan for the 41st consecutive quarter The US remained the largest debtor nation to Taiwan’s banking sector for the 41st consecutive quarter at the end of September, after local banks’ exposure to the US market rose more than 2 percent from three months earlier, the central bank said. Exposure to the US increased to US$198.896 billion, up US$4.026 billion, or 2.07 percent, from US$194.87 billion in the previous quarter, data released by the central bank showed on Friday. Of the increase, about US$1.4 billion came from banks’ investments in securitized products and interbank loans in the US, while another US$2.6 billion stemmed from trust assets, including mutual funds,

Micron Memory Taiwan Co (台灣美光), a subsidiary of US memorychip maker Micron Technology Inc, has been granted a NT$4.7 billion (US$149.5 million) subsidy under the Ministry of Economic Affairs A+ Corporate Innovation and R&D Enhancement program, the ministry said yesterday. The US memorychip maker’s program aims to back the development of high-performance and high-bandwidth memory chips with a total budget of NT$11.75 billion, the ministry said. Aside from the government funding, Micron is to inject the remaining investment of NT$7.06 billion as the company applied to participate the government’s Global Innovation Partnership Program to deepen technology cooperation, a ministry official told the

Taiwan Semiconductor Manufacturing Co (TSMC, 台積電), the world’s leading advanced chipmaker, officially began volume production of its 2-nanometer chips in the fourth quarter of this year, according to a recent update on the company’s Web site. The low-key announcement confirms that TSMC, the go-to chipmaker for artificial intelligence (AI) hardware providers Nvidia Corp and iPhone maker Apple Inc, met its original roadmap for the next-generation technology. Production is currently centered at Fab 22 in Kaohsiung, utilizing the company’s first-generation nanosheet transistor technology. The new architecture achieves “full-node strides in performance and power consumption,” TSMC said. The company described the 2nm process as

JOINT EFFORTS: MediaTek would partner with Denso to develop custom chips to support the car-part specialist company’s driver-assist systems in an expanding market MediaTek Inc (聯發科), the world’s largest mobile phone chip designer, yesterday said it is working closely with Japan’s Denso Corp to build a custom automotive system-on-chip (SoC) solution tailored for advanced driver-assistance systems and cockpit systems, adding another customer to its new application-specific IC (ASIC) business. This effort merges Denso’s automotive-grade safety expertise and deep vehicle integration with MediaTek’s technologies cultivated through the development of Media- Tek’s Dimensity AX, leveraging efficient, high-performance SoCs and artificial intelligence (AI) capabilities to offer a scalable, production-ready platform for next-generation driver assistance, the company said in a statement yesterday. “Through this collaboration, we are bringing two