The central bank yesterday kept its benchmark discount rate at 2 percent for the seventh consecutive quarter and maintained its selective credit controls on the property market, citing low inflation and the need to oversee real-estate lending.

The decision comes as the economy posts unexpectedly strong growth, fueled by global demand for artificial intelligence (AI) hardware, which has propelled the technology sector even as traditional industries remain subdued.

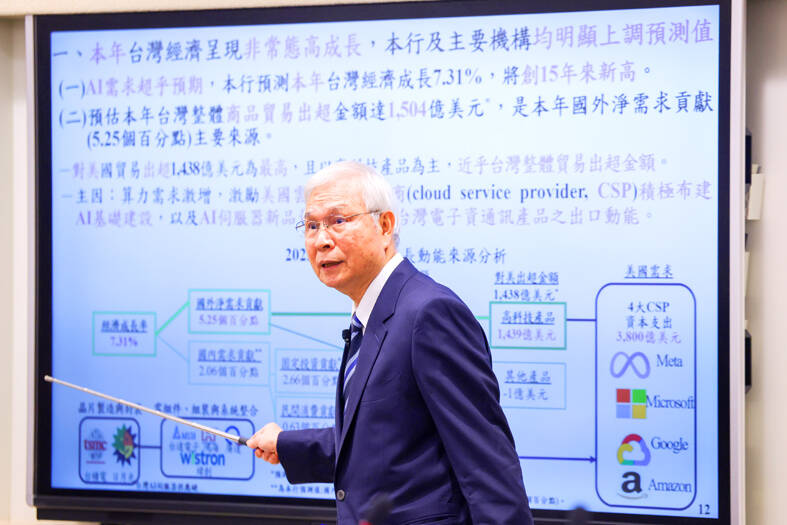

The central bank steeply raised its GDP growth forecast for this year to 7.31 percent, the fastest pace in 15 years, up from earlier estimates of 4.55 percent. It projects 3.67 percent growth for next year, compared with prior estimates of 2.68 percent.

Photo: CNA

“Taiwan’s GDP growth has been widely underestimated by both domestic and international institutions, as global demand for AI hardware has outpaced expectations and is set to continue driving expansion next year,” central bank Governor Yang Chin-long (楊金龍) said following the bank’s policy meeting.

The unexpected strength in the technology sector has offset slower growth in traditional industries. Yang also noted that potential risks from the ongoing US semiconductor probe have not materialized and warned that any tariffs on chips would ultimately harm the US, which relies on Taiwan’s components to deploy AI technologies.

Meanwhile, the central bank maintained its selective property lending measures, noting that housing prices showed little change even as transactions slowed and loan-to-value ratios declined.

Real-estate loans accounted for 36.7 percent of total lending last month, down from 37.61 percent in June last year. Most banks have met the central bank’s lending targets and property loan indicators have stabilized, Yang said.

Starting next year, the central bank would modestly relax its oversight of property exposure, allowing banks to manage real-estate lending internally without further reduction measures, he said.

Financial institutions would be required to submit monthly reports on property loans, while the central bank would conduct targeted inspections to ensure compliance.

The governor said that some lenders previously categorized property loans as working capital, underscoring the need for continued oversight.

The measures aim to help channel credit to first-time buyers, government-backed urban renewal and social housing projects, and productive capital investment, he said.

The government’s preferential lending terms are scheduled to expire in July next year, prompting the Cabinet to plan a revised program aimed at supporting buyers with genuine housing needs.

Yang said that such programs carry both benefits and risks, cautioning that excessively loose credit could reignite property speculation and threaten the nation’s financial stability.

He urged lenders to uphold prudent credit assessments, saying that the cost of curbing previous housing market overheating had been “high.”

In Italy’s storied gold-making hubs, jewelers are reworking their designs to trim gold content as they race to blunt the effect of record prices and appeal to shoppers watching their budgets. Gold prices hit a record high on Thursday, surging near US$5,600 an ounce, more than double a year ago as geopolitical concerns and jitters over trade pushed investors toward the safe-haven asset. The rally is putting undue pressure on small artisans as they face mounting demands from customers, including international brands, to produce cheaper items, from signature pieces to wedding rings, according to interviews with four independent jewelers in Italy’s main

Japanese Prime Minister Sanae Takaichi has talked up the benefits of a weaker yen in a campaign speech, adopting a tone at odds with her finance ministry, which has refused to rule out any options to counter excessive foreign exchange volatility. Takaichi later softened her stance, saying she did not have a preference for the yen’s direction. “People say the weak yen is bad right now, but for export industries, it’s a major opportunity,” Takaichi said on Saturday at a rally for Liberal Democratic Party candidate Daishiro Yamagiwa in Kanagawa Prefecture ahead of a snap election on Sunday. “Whether it’s selling food or

CONCERNS: Tech companies investing in AI businesses that purchase their products have raised questions among investors that they are artificially propping up demand Nvidia Corp chief executive officer Jensen Huang (黃仁勳) on Saturday said that the company would be participating in OpenAI’s latest funding round, describing it as potentially “the largest investment we’ve ever made.” “We will invest a great deal of money,” Huang told reporters while visiting Taipei. “I believe in OpenAI. The work that they do is incredible. They’re one of the most consequential companies of our time.” Huang did not say exactly how much Nvidia might contribute, but described the investment as “huge.” “Let Sam announce how much he’s going to raise — it’s for him to decide,” Huang said, referring to OpenAI

The global server market is expected to grow 12.8 percent annually this year, with artificial intelligence (AI) servers projected to account for 16.5 percent, driven by continued investment in AI infrastructure by major cloud service providers (CSPs), market researcher TrendForce Corp (集邦科技) said yesterday. Global AI server shipments this year are expected to increase 28 percent year-on-year to more than 2.7 million units, driven by sustained demand from CSPs and government sovereign cloud projects, TrendForce analyst Frank Kung (龔明德) told the Taipei Times. Demand for GPU-based AI servers, including Nvidia Corp’s GB and Vera Rubin rack systems, is expected to remain high,