Artificial intelligence (AI) collaborative robot (cobot) maker Techman Robot Inc (達明機器人) expects revenue to grow 20 to 30 percent next year, driven by potential wider adoption of its cobots and a low comparison base this year, vice president William Wang (王偉霖) told the Taipei Times by telephone yesterday.

The company, a subsidiary of Quanta Computer Inc (廣達電腦), aims to outpace industry growth over the next five years by expanding use among existing customers and extending its applications to other sectors, such as logistics, Wang said.

Techman supplies its cobots mainly to semiconductor, food and medical manufacturers, with visual inspection as the largest application, he said.

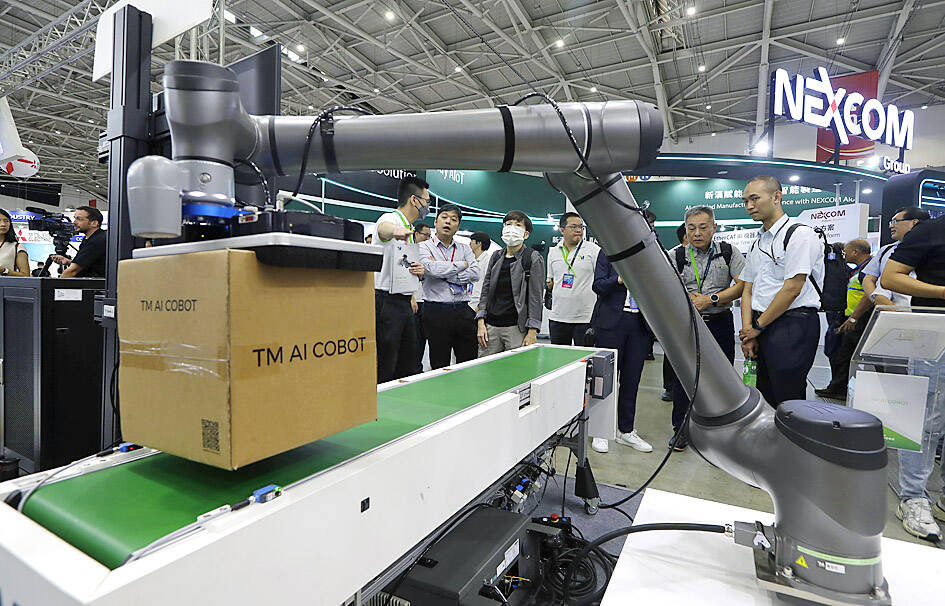

Photo: Chiang Ying-ying, AP

Visual inspection enables cobots to identify and assess products, components or processes, he added.

The company is a robotic arm partner of Nvidia Corp. Its main production base is in New Taipei City’s Linkou District (林口), with after-sales sites set up in the US, South Korea, China, Japan, Thailand and the Netherlands.

While the US tariff rates on cobots are uncertain, pending a Section 232 investigation under the US Trade Expansion Act of 1962, the company is still considering setting up a production center in the US or Mexico if needed, Wang said.

Any potential plant would likely be limited to assembly and after-sales service, leveraging Quanta’s facilities in Fremont, California; La Vergne, Tennessee; and a site in Mexico, he said.

Techman said it has partnered with medical device maker Advantech Technologies Japan since 2018 to cobrand its cobots and develop next-generation models compatible with mobile platforms.

Several chipmakers, particularly in Taiwan and China, have been steadily integrating Techman’s cobots with autonomous mobile robots in their production lines, Wang said.

Techman is in talks with a Taiwanese logistics firm to deploy its cobots in material carrying and picking, he said.

Techman reported revenue of NT$1.17 billion (US$38.4 million) in the first eight months of the year, up 22.2 percent from a year earlier.

China accounted for about 30 percent of sales, followed by Europe at 20 percent, Taiwan and Japan at 10 percent each, Southeast Asia at less than 10 percent, and the US at less than 5 percent, Wang said.

Fourth-quarter sales are expected to exceed those of the third quarter and top last year’s levels, supported by steady demand from existing customers, he said, without offering an exact growth figure.

Nvidia Corp chief executive officer Jensen Huang (黃仁勳) on Monday introduced the company’s latest supercomputer platform, featuring six new chips made by Taiwan Semiconductor Manufacturing Co (TSMC, 台積電), saying that it is now “in full production.” “If Vera Rubin is going to be in time for this year, it must be in production by now, and so, today I can tell you that Vera Rubin is in full production,” Huang said during his keynote speech at CES in Las Vegas. The rollout of six concurrent chips for Vera Rubin — the company’s next-generation artificial intelligence (AI) computing platform — marks a strategic

REVENUE PERFORMANCE: Cloud and network products, and electronic components saw strong increases, while smart consumer electronics and computing products fell Hon Hai Precision Industry Co (鴻海精密) yesterday posted 26.51 percent quarterly growth in revenue for last quarter to NT$2.6 trillion (US$82.44 billion), the strongest on record for the period and above expectations, but the company forecast a slight revenue dip this quarter due to seasonal factors. On an annual basis, revenue last quarter grew 22.07 percent, the company said. Analysts on average estimated about NT$2.4 trillion increase. Hon Hai, which assembles servers for Nvidia Corp and iPhones for Apple Inc, is expanding its capacity in the US, adding artificial intelligence (AI) server production in Wisconsin and Texas, where it operates established campuses. This

US President Donald Trump on Friday blocked US photonics firm HieFo Corp’s US$3 million acquisition of assets in New Jersey-based aerospace and defense specialist Emcore Corp, citing national security and China-related concerns. In an order released by the White House, Trump said HieFo was “controlled by a citizen of the People’s Republic of China” and that its 2024 acquisition of Emcore’s businesses led the US president to believe that it might “take action that threatens to impair the national security of the United States.” The order did not name the person or detail Trump’s concerns. “The Transaction is hereby prohibited,”

Garment maker Makalot Industrial Co (聚陽) yesterday reported lower-than-expected fourth-quarter revenue of NT$7.93 billion (US$251.44 million), down 9.48 percent from NT$8.76 billion a year earlier. On a quarterly basis, revenue fell 10.83 percent from NT$8.89 billion, company data showed. The figure was also lower than market expectations of NT$8.05 billion, according to data compiled by Yuanta Securities Investment and Consulting Co (元大投顧), which had projected NT$8.22 billion. Makalot’s revenue this quarter would likely increase by a mid-teens percentage as the industry is entering its high season, Yuanta said. Overall, Makalot’s revenue last year totaled NT$34.43 billion, down 3.08 percent from its record NT$35.52