Local flat-panel makers AUO Corp (友達) and Innolux Corp (群創) are expected to eke out modest profits in the second half of this year, benefiting from production cuts by Chinese peers to tame overcapacity and bolster panel prices, market researcher Omdia said yesterday.

Chinese flat-panel makers launched a new strategy of managing factory utilization at a profitable range of 75 percent to 80 percent, as decade-long capacity expansions have led to oversupply, it said.

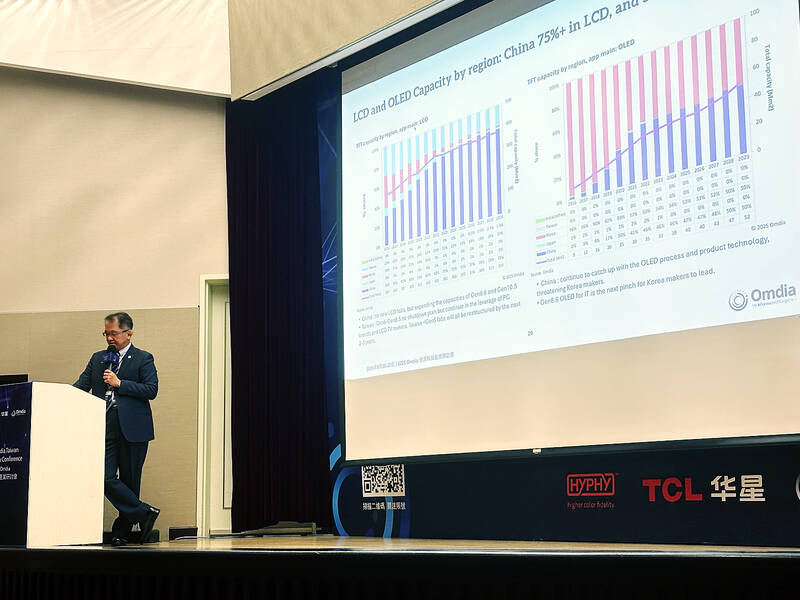

China commands about 76 percent of the global LCD market, greatly surpassing Taiwan’s 19 percent and South Korea’s 4 percent, Omdia data showed.

Photo: Chen Mei-ying, Taipei Times

“Chinese flat-panel makers significantly adjusted their factory utilization when market demand started weakening last month and this month. Such utilization management is very likely to bring the market back to stabilization next month,” Omdia senior director David Hsieh (謝勤益) said at a seminar in Taipei.

The production reduction has yielded positive results and panel prices have stabilized this month, Hsieh said.

That would help supply and demand to reach parity next quarter, he said.

“Keeping factory utilization fluctuating at a narrow range would help safeguard flat-panel makers’ profitability,” Hsieh said.

The global LCD industry follows a human-made production cycle, rather than seasonal cycles or market forces, as it did before, he said, adding that factory utilization for most manufacturers is forecast to hover at about 80 percent this quarter and drop to about 75 percent next quarter.

AUO and Innolux would enjoy stable profits, benefiting from order flux from Chinese TV vendors, he said.

AUO and Innolux swung into profits of NT$5.24 billion and NT$201 million (US$171.5 million and US$6.58 million) in the first half of this year respectively, compared with losses of NT$3.76 billion and NT$2.97 billion in the same period last year.

Omdia trimmed its global flat-panel revenue growth forecast to 3 percent for this year, from the previous 6 percent, on concerns that US tariffs would inflate consumer prices and dent consumer spending, Hsieh said.

The impact was “indirect,” as most display products are exempted from Washington’s tariffs, he said.

Taiwanese panel makers are in the process of transformation by revamping existing factories and expanding into more profitable businesses, he said.

“They have realized 50 percent of their transformation,” Hsieh said. “They have installed all the resources necessary.”

AUO and Innolux are targeting to expand their presence in the car display markets and look at next-generation micro-LED technology through acquisition, Hsieh said.

Innolux last month acquired Japan’s Pioneer Corp to enhance its smart cockpit product lineups, while AUO acquired Germany’s Behr-Hella Thermocontrol GmbH in 2023, he said.

Omdia said it expects Taiwanese firms to continue streamlining manufacturing facilities by retiring less advanced fifth-generation fabs, or even sixth-generation fabs in the next two to three years.

Sweeping policy changes under US Secretary of Health and Human Services Robert F. Kennedy Jr are having a chilling effect on vaccine makers as anti-vaccine rhetoric has turned into concrete changes in inoculation schedules and recommendations, investors and executives said. The administration of US President Donald Trump has in the past year upended vaccine recommendations, with the country last month ending its longstanding guidance that all children receive inoculations against flu, hepatitis A and other diseases. The unprecedented changes have led to diminished vaccine usage, hurt the investment case for some biotechs, and created a drag that would likely dent revenues and

Global semiconductor stocks advanced yesterday, as comments by Nvidia Corp chief executive officer Jensen Huang (黃仁勳) at Davos, Switzerland, helped reinforce investor enthusiasm for artificial intelligence (AI). Samsung Electronics Co gained as much as 5 percent to an all-time high, helping drive South Korea’s benchmark KOSPI above 5,000 for the first time. That came after the Philadelphia Semiconductor Index rose more than 3 percent to a fresh record on Wednesday, with a boost from Nvidia. The gains came amid broad risk-on trade after US President Donald Trump withdrew his threat of tariffs on some European nations over backing for Greenland. Huang further

CULPRITS: Factors that affected the slip included falling global crude oil prices, wait-and-see consumer attitudes due to US tariffs and a different Lunar New Year holiday schedule Taiwan’s retail sales ended a nine-year growth streak last year, slipping 0.2 percent from a year earlier as uncertainty over US tariff policies affected demand for durable goods, data released on Friday by the Ministry of Economic Affairs showed. Last year’s retail sales totaled NT$4.84 trillion (US$153.27 billion), down about NT$9.5 billion, or 0.2 percent, from 2024. Despite the decline, the figure was still the second-highest annual sales total on record. Ministry statistics department deputy head Chen Yu-fang (陳玉芳) said sales of cars, motorcycles and related products, which accounted for 17.4 percent of total retail rales last year, fell NT$68.1 billion, or

HSBC Bank Taiwan Ltd (匯豐台灣商銀) and the Taiwan High Prosecutors Office recently signed a memorandum of understanding (MOU) to enhance cooperation on the suspicious transaction analysis mechanism. This landmark agreement makes HSBC the first foreign bank in Taiwan to establish such a partnership with the High Prosecutors Office, underscoring its commitment to active anti-fraud initiatives, financial inclusion, and the “Treating Customers Fairly” principle. Through this deep public-private collaboration, both parties aim to co-create a secure financial ecosystem via early warning detection and precise fraud prevention technologies. At the signing ceremony, HSBC Taiwan CEO and head of banking Adam Chen (陳志堅)