The 20 percent baseline tariff imposed by the US on goods from Taiwan, combined with an appreciating New Taiwan dollar, could significantly hurt the nation’s machinery industry, the Taiwan Association of Machinery Industry (TAMI, 台灣機械公會) said yesterday.

TAMI said that starting on Aug. 7, Washington began implementing reciprocal tariffs, setting a provisional 20 percent baseline for Taiwan — higher than the 15 percent applied to Japan and South Korea.

After adding the new 20 percent rate to existing most favored nation (MFN) duties and other trade remedy tariffs, Taiwanese machinery products shipped to the US will face an effective tariff about 10 percent higher than those from Japan and South Korea, the association said.

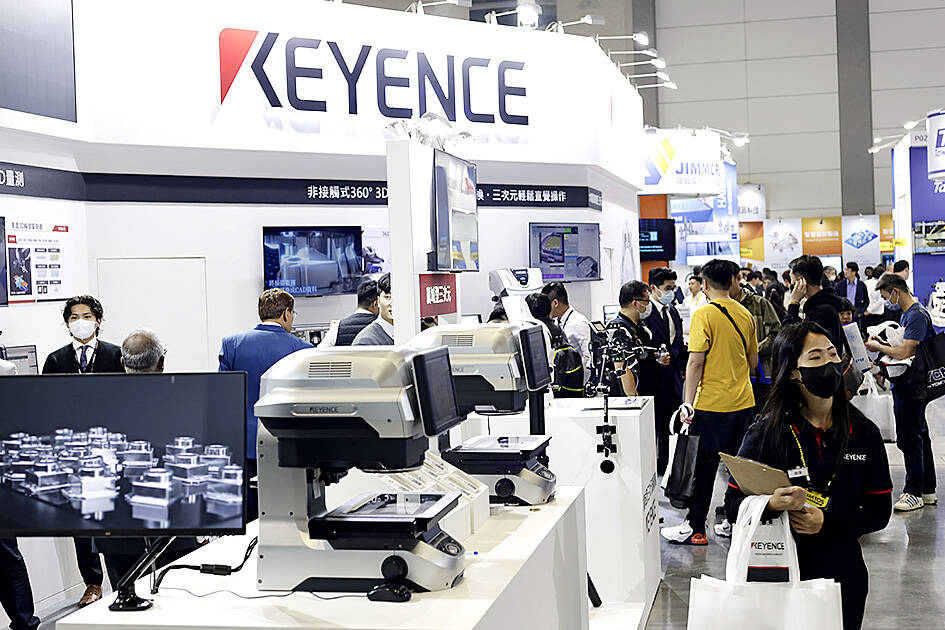

Photo: EPA-EFE

When factoring in the NT dollar’s sharp appreciation since April, the effective price gap with Japan and South Korea widens to about 20 percent, which TAMI warned could severely undermine the competitiveness of Taiwanese machinery exports.

Previously, the average tariff on Taiwanese machinery exports to the US was about 5 percent, while Japanese and Korean products often enjoyed zero tariffs, the TAMI noted.

The association said the stronger NT dollar has an even greater impact than the tariffs. From 2021 to July 31 this year, the NT dollar depreciated only 4.6 percent, compared with declines of 46.2 percent for the yen and 28 percent for the won.

Taiwan’s traditional price advantage — with equipment priced 20-30 percent lower than Japanese products — has effectively disappeared, especially for machine tool exports, leading to a sharp drop in orders, according to the association.

Given the higher US tariff rate for Taiwan compared with key competitors and the currency’s effect on export competitiveness, TAMI urged the government to take steps to safeguard the industry’s position in global markets.

Separately, the association yesterday reported that Taiwan’s machine tool exports last month reached US$2.79 billion, up 13.4 percent from a year ago, marking six consecutive months of growth.

From January to last month, machinery exports reached US$17.71 billion, an annual increase of 6.5 percent. In NT dollar terms, the total was NT$558.17 billion, up 5.1 percent.

The NT dollar’s appreciation this year has eroded both the real growth of exports and the actual income of companies, the TAMI said. The US and China remain Taiwan’s two largest export markets, with shipments to China rising 3.8 percent year-on-year to US$4.07 billion in the first seven months, and exports to the US increasing 16.1 percent to US$4.72 billion.

On Tuesday, US President Donald Trump weighed in on a pressing national issue: The rebranding of a restaurant chain. Last week, Cracker Barrel, a Tennessee company whose nationwide locations lean heavily on a cozy, old-timey aesthetic — “rocking chairs on the porch, a warm fire in the hearth, peg games on the table” — announced it was updating its logo. Uncle Herschel, the man who once appeared next to the letters with a barrel, was gone. It sparked ire on the right, with Donald Trump Jr leading a charge against the rebranding: “WTF is wrong with Cracker Barrel?!” Later, Trump Sr weighed

SinoPac Financial Holdings Co (永豐金控) is weighing whether to add a life insurance business to its portfolio, but would tread cautiously after completing three acquisitions in quick succession, president Stanley Chu (朱士廷) said yesterday. “We are carefully considering whether life insurance should play a role in SinoPac’s business map,” Chu told reporters ahead of an earnings conference. “Our priority is to ensure the success of the deals we have already made, even though we are tracking some possible targets.” Local media have reported that Mercuries Life Insurance Co (三商美邦人壽), which is seeking buyers amid financial strains, has invited three financial

OUTLOOK: Among the six sub-indices, only the stock market confidence sub-index rose due to strong equity performance and expectations of a US Federal Reserve rate cut Consumer confidence weakened further this month, sliding to its lowest level in two-and-a-half years as households grew increasingly uneasy about the economic outlook, job security and big-ticket spending, a survey by the National Central University showed yesterday. The consumer confidence index fell 1.07 points from last month to 63.31, the weakest number since May 2023, said the university’s Research Center for Taiwan Economic Development (RCTED), which conducts the monthly poll. “Although the Directorate-General of Budget, Accounting and Statistics recently increased Taiwan’s GDP growth forecast for this year to 4.45 percent, consumer sentiment tells a different story,” RCTED director Dachrahn Wu

Artificial intelligence (AI) chip designer Cambricon Technologies Corp (寒武紀科技) plunged almost 9 percent after warning investors about a doubling in its share price over just a month, a record gain that helped fuel a US$1 trillion Chinese market rally. Cambricon triggered the selloff with a Thursday filing in which it dispelled talk about nonexistent products in the pipeline, reminded investors it labors under US sanctions, and stressed the difficulties of ascending the technology ladder. The Shanghai-listed company’s stock dived by the most since April in early yesterday trading, while the market stood largely unchanged. The litany of warnings underscores growing scrutiny of