Advanced Micro Devices Inc (AMD), the second-largest maker of artificial intelligence (AI) processors, said the chipmaker’s return to the crucial China market is difficult to predict, overshadowing a generally upbeat forecast for its AI business.

As part of its quarterly earnings report on Tuesday, AMD declined to predict Chinese sales of the Instinct MI308, an AI processor that the company designed for the Asian country. The uncertainty weighed on the shares, sending them down about 5 percent in extended trading.

The US President Donald Trump's administration had barred shipments of such chips to China in April, though it reversed course last month, raising hopes that AMD and rival Nvidia Corp could soon resume sales. China is the largest market for semiconductors, and the restrictions have threatened to erase billions of dollars in total revenue from both companies.

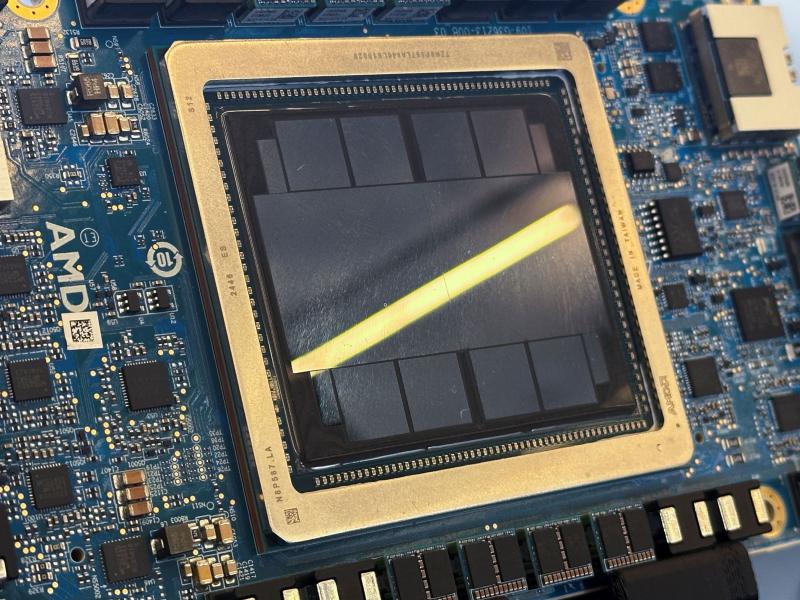

Photo: Max A. Cherney, Reuters

“As our licenses are still under review, we are not including any MI308 revenue in our third-quarter guidance,” AMD chief executive officer Lisa Su (蘇姿丰) said on a conference call with analysts.

Su was optimistic about the overall market for AI computing. “Looking ahead, we see a clear path to scaling our AI business to tens of billions of dollars in annual revenue,” she said during the call. The company also is ramping up its new MI350 lineup, she said.

AMD shares had gained 44 percent this year through the close, making AMD the best-performing stock in the semiconductor industry.

Three months ago, AMD said it was taking US$800 million in writedowns related to the Chinese export restrictions and warned that the curbs would cost it US$1.5 billion in revenue this year. Wall Street has been waiting for guidance on how that has changed, given the US policy shift.

On the conference call, analysts repeatedly asked for a specific outlook on how much China AI revenue the company will get and when. They also tried to get Su to commit to long-term predictions for overall AI chip revenue.

But Su and chief financial officer Jean Hu (胡錦) stuck to their message: While the executives are confident about the AI market, the specifics remain difficult to forecast. Earlier writedowns of Chinese inventory can’t be converted into revenue because they involved incomplete chips that will require further manufacturing work, they said.

Despite the uncertainties, AMD’s third-quarter revenue forecast easily cleared analysts’ estimates. The sales will be about US$8.7 billion, the company said, compared with an average projection of US$8.37 billion.

Second-quarter sales rose 32 percent year-on-year to US$7.7 billion, compared with a US$7.43 billion average estimate. Profit was US$0.48 a share, minus certain items. Analysts projected US$0.49. Data center sales gained 14 percent to US$3.2 billion in the period. On average, analysts had predicted US$3.25 billion. Personal computer-related sales climbed 67 percent to US$2.5 billion. The average prediction was US$2.56 billion.

AMD is the second-biggest provider of graphics chips, which form the basis for the AI accelerators that run in data centers. Its microprocessors, meanwhile, go head to head with Intel Corp products in the markets for PCs and servers.

AMD’s market capitalization is now roughly US$200 billion higher than Intel’s. Still, neither company has matched the runaway success of Nvidia, whose dominance of AI accelerators has made it the world’s most valuable business.

In Italy’s storied gold-making hubs, jewelers are reworking their designs to trim gold content as they race to blunt the effect of record prices and appeal to shoppers watching their budgets. Gold prices hit a record high on Thursday, surging near US$5,600 an ounce, more than double a year ago as geopolitical concerns and jitters over trade pushed investors toward the safe-haven asset. The rally is putting undue pressure on small artisans as they face mounting demands from customers, including international brands, to produce cheaper items, from signature pieces to wedding rings, according to interviews with four independent jewelers in Italy’s main

Macronix International Co (旺宏), the world’s biggest NOR flash memory supplier, yesterday said it would spend NT$22 billion (US$699.1 million) on capacity expansion this year to increase its production of mid-to-low-density memory chips as the world’s major memorychip suppliers are phasing out the market. The company said its planned capital expenditures are about 11 times higher than the NT$1.8 billion it spent on new facilities and equipment last year. A majority of this year’s outlay would be allocated to step up capacity of multi-level cell (MLC) NAND flash memory chips, which are used in embedded multimedia cards (eMMC), a managed

CULPRITS: Factors that affected the slip included falling global crude oil prices, wait-and-see consumer attitudes due to US tariffs and a different Lunar New Year holiday schedule Taiwan’s retail sales ended a nine-year growth streak last year, slipping 0.2 percent from a year earlier as uncertainty over US tariff policies affected demand for durable goods, data released on Friday by the Ministry of Economic Affairs showed. Last year’s retail sales totaled NT$4.84 trillion (US$153.27 billion), down about NT$9.5 billion, or 0.2 percent, from 2024. Despite the decline, the figure was still the second-highest annual sales total on record. Ministry statistics department deputy head Chen Yu-fang (陳玉芳) said sales of cars, motorcycles and related products, which accounted for 17.4 percent of total retail rales last year, fell NT$68.1 billion, or

In the wake of strong global demand for AI applications, Taiwan’s export-oriented economy accelerated with the composite index of economic indicators flashing the first “red” light in December for one year, indicating the economy is in booming mode, the National Development Council (NDC) said yesterday. Moreover, the index of leading indicators, which gauges the potential state of the economy over the next six months, also moved higher in December amid growing optimism over the outlook, the NDC said. In December, the index of economic indicators rose one point from a month earlier to 38, at the lower end of the “red” light.