US President Donald Trump is readying plans for industry-specific tariffs to kick in alongside his country-by-country duties in two weeks, ramping up his push to reshape the US’ standing in the global trading system by penalizing purchases from abroad.

Administration officials could release details of Trump’s planned 50 percent duty on copper in the days before they are set to take effect on Friday next week, a person familiar with the matter said.

That is the same date Trump’s “reciprocal” levies on products from more than 100 nations are slated to begin.

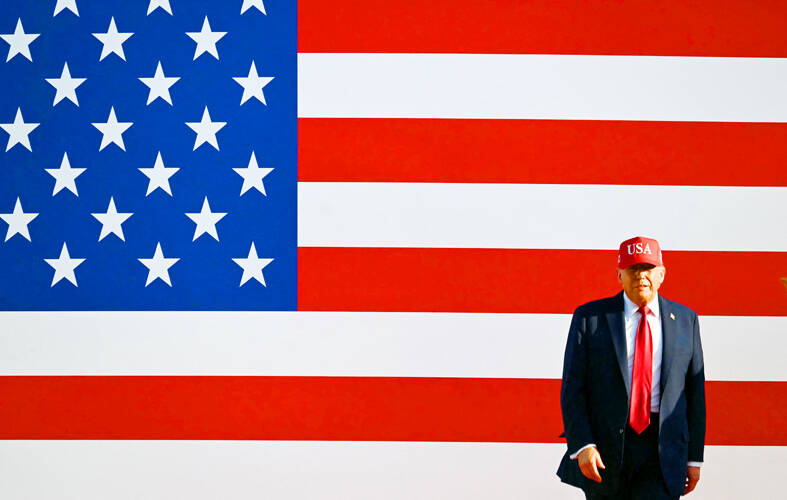

Photo: AFP

Trump on Tuesday said that he is likely to impose tariffs on pharmaceuticals by month’s end, adding that import taxes on semiconductors could come soon as well.

One person familiar with the process said that after copper, Trump’s team had discussed making announcements on lumber, chips, critical minerals and drugs in that order, although that cadence had not been finalized.

Those would follow existing duties on steel, aluminum, vehicles and auto parts.

Once fully implemented, all the sectoral tariffs would cover 30 to 70 percent of a country’s imports, with much of the rest being hit by country-specific charges, a person familiar with the matter said.

After investigations that could last about nine months, sectoral duties are being imposed on national security grounds under Section 232 of the US Trade Expansion Act.

Chip tariffs are on a “similar” timeline to drugs and are “actually less complicated,” Trump said on Tuesday last week.

Semiconductors were exempted earlier this year from US tariffs on China to give the administration time to develop separate duties. The wide array of exempted products, including inputs for consumer electronics, suggests a broad consideration of the item that could get hit later.

Tech companies, auto manufacturers, boat makers and cryptocurrency enthusiasts are among those who have registered complaints over potential levies, according to public comments on the probe, which started in April.

The charges would not just hit the chips themselves, but popular products including Apple Inc’s and Samsung Electronics Co’s smartphones and laptops. It is even brought together rivals Tesla Inc, General Motors Co and Ford Motor Co, which have all voiced reservations.

Taiwan Semiconductor Manufacturing Co (TSMC, 台積電) in a letter dated on May 5 said that any US tariffs on Taiwanese semiconductors could reduce demand for chips and derail its pledge to increase its investment in Arizona.

“New import restrictions could jeopardize current US leadership in the competitive technology industry and create uncertainties for many committed semiconductor capital projects in the US, including TSMC Arizona’s significant investment plan in Phoenix,” the chipmaker wrote in the letter to the US Department of Commerce.

TSMC is investing US$65 billion to build three advanced wafer fabs in Arizona. In March, the company pledged an additional US$100 billion of investment in Arizona to build three more wafer fabs, two packaging and testing plants and a research-and-development center to bring the total investment to US$165 billion.

Additional reporting by CNA

NO BREAKTHROUGH? More substantial ‘deliverables,’ such as tariff reductions, would likely be saved for a meeting between Trump and Xi later this year, a trade expert said China launched two probes targeting the US semiconductor sector on Saturday ahead of talks between the two nations in Spain this week on trade, national security and the ownership of social media platform TikTok. China’s Ministry of Commerce announced an anti-dumping investigation into certain analog integrated circuits (ICs) imported from the US. The investigation is to target some commodity interface ICs and gate driver ICs, which are commonly made by US companies such as Texas Instruments Inc and ON Semiconductor Corp. The ministry also announced an anti-discrimination probe into US measures against China’s chip sector. US measures such as export curbs and tariffs

The US on Friday penalized two Chinese firms that acquired US chipmaking equipment for China’s top chipmaker, Semiconductor Manufacturing International Corp (SMIC, 中芯國際), including them among 32 entities that were added to the US Department of Commerce’s restricted trade list, a US government posting showed. Twenty-three of the 32 are in China. GMC Semiconductor Technology (Wuxi) Co (吉姆西半導體科技) and Jicun Semiconductor Technology (Shanghai) Co (吉存半導體科技) were placed on the list, formally known as the Entity List, for acquiring equipment for SMIC Northern Integrated Circuit Manufacturing (Beijing) Corp (中芯北方積體電路) and Semiconductor Manufacturing International (Beijing) Corp (中芯北京), the US Federal Register posting said. The

India’s ban of online money-based games could drive addicts to unregulated apps and offshore platforms that pose new financial and social risks, fantasy-sports gaming experts say. Indian Prime Minister Narendra Modi’s government banned real-money online games late last month, citing financial losses and addiction, leading to a shutdown of many apps offering paid fantasy cricket, rummy and poker games. “Many will move to offshore platforms, because of the addictive nature — they will find alternate means to get that dopamine hit,” said Viren Hemrajani, a Mumbai-based fantasy cricket analyst. “It [also] leads to fraud and scams, because everything is now

MORTGAGE WORRIES: About 34% of respondents to a survey said they would approach multiple lenders to pay for a home, while 29.2% said they would ask family for help New housing projects in Taiwan’s six special municipalities, as well as Hsinchu city and county, are projected to total NT$710.65 billion (US$23.61 billion) in the upcoming fall sales season, a record 30 percent decrease from a year earlier, as tighter mortgage rules prompt developers to pull back, property listing platform 591.com (591新建案) said yesterday. The number of projects has also fallen to 312, a more than 20 percent decrease year-on-year, underscoring weakening sentiment and momentum amid lingering policy and financing headwinds. New Taipei City and Taoyuan bucked the downturn in project value, while Taipei, Hsinchu city and county, Taichung, Tainan and Kaohsiung