Business sentiment in Taiwan’s manufacturing sector weakened for the fourth consecutive month last month, reaching its lowest level in 29 months, primarily due to uncertainty surrounding US tariff policy, the Taiwan Institute of Economic Research (TIER, 台灣經濟研究院) said yesterday.

The institute’s latest composite index measuring business sentiment among local manufacturers dropped 4.74 points from a month earlier to 85.83, the fourth straight monthly decline and a new low since reaching 85.97 in December 2022.

Meanwhile, the service sector indicator also declined 0.35 points to 85.32, its fifth consecutive monthly drop, TIER data showed.

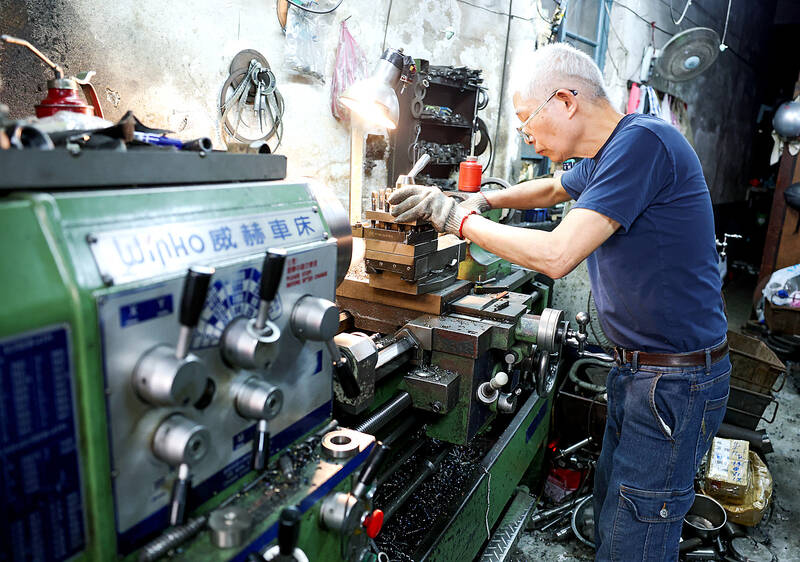

Photo: CNA

Despite strong demand in sectors such as artificial intelligence (AI), high-performance computing and cloud computing services, business revenue in the wafer foundry and semiconductor packaging and testing sectors showed slight declines last month, the data showed.

This decline was partly due to downstream wafer and packaging clients receiving early deliveries to avoid potential tariffs, leading to a high comparison base, the institute said in a report.

In addition, the significant appreciation of the New Taiwan dollar caused increased revenue fluctuations for the export-driven manufacturing sector, it said.

Ongoing weak demand for some non-high-tech products and pricing pressure from overseas competitors led manufacturers to adopt a more cautious outlook on the economic climate, the institute said.

Looking ahead, rising tensions in the Middle East, particularly between Israel and Iran, have raised concerns about energy, shipping and global economic stability, it said.

The lack of progress in trade negotiations between the US and other countries is also adding to global economic uncertainty, it added.

Most manufacturers are adopting a wait-and-see approach for the next six months, an institute survey showed.

However, TIER Economic Forecasting Center director Gordon Sun (孫明德) said that recent global developments indicate a potential turning point.

Regarding the US’ “reciprocal” tariffs, Sun said he expects Taiwan-US trade negotiations to yield results soon, and exchange rate fluctuations have become less volatile compared with previous months.

If a lasting ceasefire is achieved in the Israel-Iran conflict, the three key variables — tariffs, exchange rates and the Middle East situation — could all be trend in a positive direction, offering businesses relief in the second half of the year, he said.

TIER president Chang Chien-yi (張建一) said that the 7 percent drop in crude oil prices on Monday, amid signs of a ceasefire between Israel and Iran, suggests that the latest round of the crisis might be easing.

Chang also said that, compared with “reciprocal” tariffs, tariffs on semiconductors would have a more significant impact on Taiwan.

Meanwhile, TIER’s construction sector indicator declined for the fifth consecutive month, dropping 0.1 points to 90.41.

Arisa Liu (劉佩真), a researcher at TIER’s Taiwan Industry Economics Database, said that the economic outlook for the second half of the year remains uncertain due to unresolved tariff issues.

Regarding the real-estate market, Liu said that increased housing supply, cross-strait relations, and geopolitical conflicts are key factors influencing the local market.

DIVIDED VIEWS: Although the Fed agreed on holding rates steady, some officials see no rate cuts for this year, while 10 policymakers foresee two or more cuts There are a lot of unknowns about the outlook for the economy and interest rates, but US Federal Reserve Chair Jerome Powell signaled at least one thing seems certain: Higher prices are coming. Fed policymakers voted unanimously to hold interest rates steady at a range of 4.25 percent to 4.50 percent for a fourth straight meeting on Wednesday, as they await clarity on whether tariffs would leave a one-time or more lasting mark on inflation. Powell said it is still unclear how much of the bill would fall on the shoulders of consumers, but he expects to learn more about tariffs

NOT JUSTIFIED: The bank’s governor said there would only be a rate cut if inflation falls below 1.5% and economic conditions deteriorate, which have not been detected The central bank yesterday kept its key interest rates unchanged for a fifth consecutive quarter, aligning with market expectations, while slightly lowering its inflation outlook amid signs of cooling price pressures. The move came after the US Federal Reserve held rates steady overnight, despite pressure from US President Donald Trump to cut borrowing costs. Central bank board members unanimously voted to maintain the discount rate at 2 percent, the secured loan rate at 2.375 percent and the overnight lending rate at 4.25 percent. “We consider the policy decision appropriate, although it suggests tightening leaning after factoring in slackening inflation and stable GDP growth,”

Greek tourism student Katerina quit within a month of starting work at a five-star hotel in Halkidiki, one of the country’s top destinations, because she said conditions were so dire. Beyond the bad pay, the 22-year-old said that her working and living conditions were “miserable and unacceptable.” Millions holiday in Greece every year, but its vital tourism industry is finding it harder and harder to recruit Greeks to look after them. “I was asked to work in any department of the hotel where there was a need, from service to cleaning,” said Katerina, a tourism and marketing student, who would

i Gasoline and diesel prices at fuel stations are this week to rise NT$0.1 per liter, as tensions in the Middle East pushed crude oil prices higher last week, CPC Corp, Taiwan (台灣中油) and Formosa Petrochemical Corp (台塑石化) said yesterday. International crude oil prices last week rose for the third consecutive week due to an escalating conflict between Israel and Iran, as the market is concerned that the situation in the Middle East might affect crude oil supply, CPC and Formosa said in separate statements. Front-month Brent crude oil futures — the international oil benchmark — rose 3.75 percent to settle at US$77.01