The central bank yesterday kept its key interest rates unchanged for a fifth consecutive quarter, aligning with market expectations, while slightly lowering its inflation outlook amid signs of cooling price pressures.

The move came after the US Federal Reserve held rates steady overnight, despite pressure from US President Donald Trump to cut borrowing costs.

Central bank board members unanimously voted to maintain the discount rate at 2 percent, the secured loan rate at 2.375 percent and the overnight lending rate at 4.25 percent.

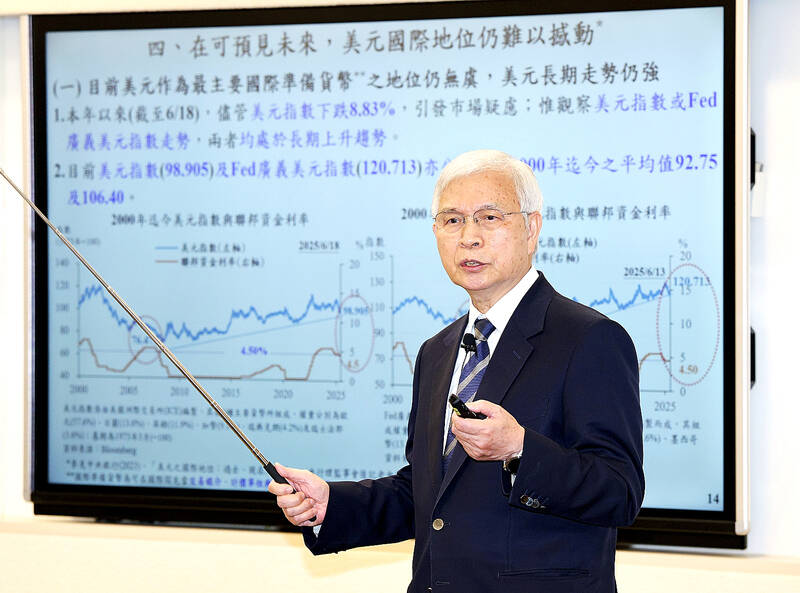

Photo: CNA

“We consider the policy decision appropriate, although it suggests tightening leaning after factoring in slackening inflation and stable GDP growth,” central bank Governor Yang Chin-long (楊金龍) said.

The central bank retained its full-year GDP growth forecast at 3.05 percent, citing stronger-than-expected economic performance so far this year, helped by keen demand for artificial intelligence hardware and front-loading by businesses to deal with potential US tariff hikes.

However, the central bank is looking at a sharp economic slowdown moving forward, forecasting 0.78 percent GDP growth for the second half of the year, as momentum linked to front-loading is not sustainable, Yang said.

Furthermore, the central bank lowered its projection for consumer price index (CPI) growth from 1.89 percent to 1.81 percent, he said, adding that core CPI, which excludes energy, vegetables, fruits and other volatile items, was estimated to be 1.69 percent.

The predictions were lower than last year’s 2.18 percent and 1.88 percent respectively, the central bank said.

“While inflation is mitigating, we have not seen a significant enough slowdown in the economy to justify a rate cut,” Yang said.

A rate cut is only possible when inflation falls below 1.5 percent and economic conditions deteriorate — which have not yet been detected nor seen in the near future, the governor said.

The central bank said service sector prices would continue their gradual easing trajectory and so would international crude oil prices, in light of the world’s escalating economic uncertainties and geopolitical tensions, Yang said.

Yang refused to comment on whether the central bank would intervene to defend the NT$29.5 mark against the US dollar.

“Maintaining market stability is the central bank’s responsibility, but it does not mean defending a specific exchange rate,” he said.

The local currency appeared severely underestimated in the first quarter, and the present value better reflects Taiwan’s GDP showing, Yang said.

The NT dollar closed at NT$29.621 to the greenback yesterday in Taipei trading, down NT$0.079 from the previous session, central bank data showed.

As for the property market, the central bank did not introduce new mortgage curbs while refraining from loosening existing rules.

Yang dismissed speculation over a new wave of credit tightening, saying: “That won’t happen.”

Real-estate lending last month constituted 37.1 percent of total loans, a level that does not merit credit easing, although housing transactions slowed significantly, he said.

LIMITED IMPACT: Investor confidence was likely sustained by its relatively small exposure to the Chinese market, as only less advanced chips are made in Nanjing Taiwan Semiconductor Manufacturing Co (TSMC, 台積電) saw its stock price close steady yesterday in a sign that the loss of the validated end user (VEU) status for its Nanjing, China, fab should have a mild impact on the world’s biggest contract chipmaker financially and technologically. Media reports about the waiver loss sent TSMC down 1.29 percent during the early trading session yesterday, but the stock soon regained strength and ended at NT$1,160, unchanged from Tuesday. Investors’ confidence in TSMC was likely built on its relatively small exposure to the Chinese market, as Chinese customers contributed about 9 percent to TSMC’s revenue last

With this year’s Semicon Taiwan trade show set to kick off on Wednesday, market attention has turned to the mass production of advanced packaging technologies and capacity expansion in Taiwan and the US. With traditional scaling reaching physical limits, heterogeneous integration and packaging technologies have emerged as key solutions. Surging demand for artificial intelligence (AI), high-performance computing (HPC) and high-bandwidth memory (HBM) chips has put technologies such as chip-on-wafer-on-substrate (CoWoS), integrated fan-out (InFO), system on integrated chips (SoIC), 3D IC and fan-out panel-level packaging (FOPLP) at the center of semiconductor innovation, making them a major focus at this year’s trade show, according

DEBUT: The trade show is to feature 17 national pavilions, a new high for the event, including from Canada, Costa Rica, Lithuania, Sweden and Vietnam for the first time The Semicon Taiwan trade show, which opens on Wednesday, is expected to see a new high in the number of exhibitors and visitors from around the world, said its organizer, SEMI, which has described the annual event as the “Olympics of the semiconductor industry.” SEMI, which represents companies in the electronics manufacturing and design supply chain, and touts the annual exhibition as the most influential semiconductor trade show in the world, said more than 1,200 enterprises from 56 countries are to showcase their innovations across more than 4,100 booths, and that the event could attract 100,000 visitors. This year’s event features 17

Hon Hai Precision Industry Co (鴻海精密), which assembles servers for Nvidia Corp, yesterday said that revenue last month rose 10.61 percent year-on-year, driven by strong growth in cloud and networking products amid continued front-loading orders for artificial intelligence (AI) server racks. Consolidated revenue expanded to NT$606.51 billion (US$19.81 billion) last month from NT$548.31 billion a year earlier, marking the highest ever in August, the company said in a statement. On a monthly basis, revenue was down 1.2 percent from NT$613.86 billion. Hon Hai, which is also a major iPhone assembler, added that its electronic components division saw significant revenue growth last month, boosted