South Korea’s top trade negotiator yesterday said he would raise concerns about potential US restrictions on chipmakers in China when he meets US officials in Washington this week for the third round of technical discussions in tariff talks.

“I will pass on the concerns among those in the industry and take utmost care,” South Korean Minister for Trade Yeo Han-koo told reporters before leaving for Washington, when asked about concerns the US might adopt policies to make it difficult for foreign chipmakers to operate in China.

Yeo was appointed to the role this month by South Korean President Lee Jae-myung, who won a snap election on June 3.

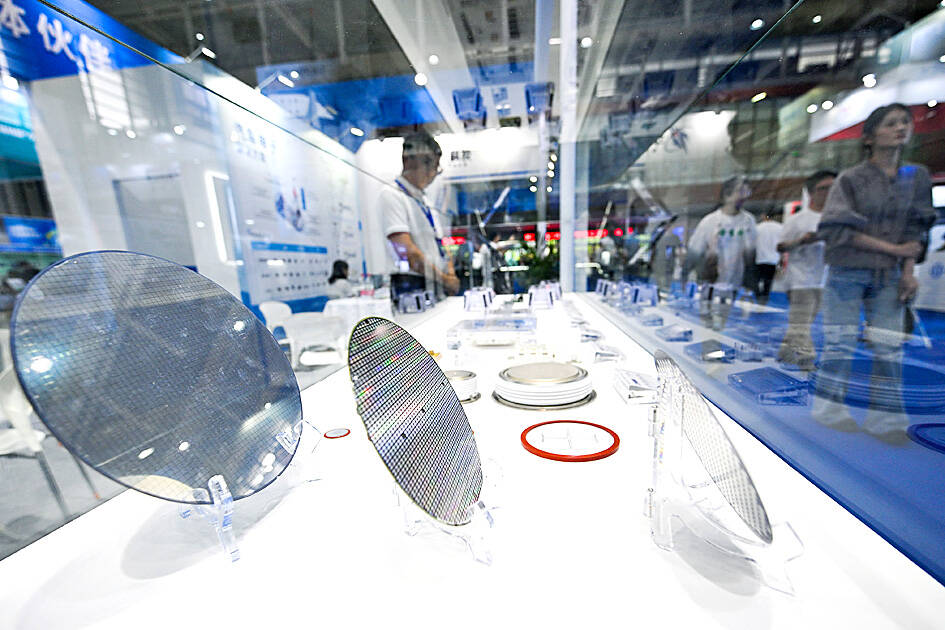

Photo: AFP

The US Department of Commerce is considering revoking authorizations granted in recent years to global chipmakers Taiwan Semiconductor Manufacturing Co (TSMC, 台積電), Samsung Electronics Co and SK Hynix Inc, making it more difficult for them to receive US goods and technology at their plants in China, people familiar with the matter said.

The chances of the US withdrawing the authorizations are unclear.

A White House official on Friday said that the US was “just laying the groundwork” in case the truce reached between the two countries fell apart, but expressed confidence that the trade agreement would go forward and that rare earths would flow from China, as agreed.

“There is currently no intention of deploying this tactic,” the official said. “It’s another tool we want in our toolbox in case either this agreement falls through or any other catalyst throws a wrench in bilateral relations.”

The Philadelphia Stock Exchange Semiconductor Index, a closely watched benchmark, fell as much as 2 percent after the Wall Street Journal first reported the news earlier on Friday.

Shares of US chip equipment makers that supply plants in China also fell, with KLA Corp dropping 2.4 percent, Lam Research Corp falling 1.9 percent and Applied Materials Inc sinking 2 percent. The Netherlands’ ASML Holding NV slid as much as 1.9 percent.

The US depositary receipts of TSMC, the world’s largest contract manufacturer of chips, dropped as much as 2.5 percent.

In October 2022, after the US placed sweeping restrictions on US chipmaking equipment to China, it gave foreign manufacturers such as Samsung and Hynix letters authorizing them to receive goods.

In 2023 and last year, the companies received what is known as a Validated End User (VEU) status to continue the trade.

A company with a VEU status is able to receive designated goods from a US company without the supplier obtaining multiple export licenses to ship to them. A VEU status enables entities to receive US-controlled products and technologies “more easily, quickly and reliably,” as the US Department of Commerce’s Web site puts it.

The VEU authorizations come with conditions, including prohibitions on certain equipment and reporting requirements.

“Chipmakers will still be able to operate in China,” a commerce department spokesperson said in a statement when asked about the possible revocations. “The new enforcement mechanisms on chips mirror licensing requirements that apply to other semiconductor companies that export to China and ensure the US has an equal and reciprocal process.”

Industry sources said that if it became more difficult for US semiconductor equipment companies to ship to foreign multinationals, it would only help domestic Chinese competitors.

“It’s a gift,” one said.

Sweeping policy changes under US Secretary of Health and Human Services Robert F. Kennedy Jr are having a chilling effect on vaccine makers as anti-vaccine rhetoric has turned into concrete changes in inoculation schedules and recommendations, investors and executives said. The administration of US President Donald Trump has in the past year upended vaccine recommendations, with the country last month ending its longstanding guidance that all children receive inoculations against flu, hepatitis A and other diseases. The unprecedented changes have led to diminished vaccine usage, hurt the investment case for some biotechs, and created a drag that would likely dent revenues and

Global semiconductor stocks advanced yesterday, as comments by Nvidia Corp chief executive officer Jensen Huang (黃仁勳) at Davos, Switzerland, helped reinforce investor enthusiasm for artificial intelligence (AI). Samsung Electronics Co gained as much as 5 percent to an all-time high, helping drive South Korea’s benchmark KOSPI above 5,000 for the first time. That came after the Philadelphia Semiconductor Index rose more than 3 percent to a fresh record on Wednesday, with a boost from Nvidia. The gains came amid broad risk-on trade after US President Donald Trump withdrew his threat of tariffs on some European nations over backing for Greenland. Huang further

CULPRITS: Factors that affected the slip included falling global crude oil prices, wait-and-see consumer attitudes due to US tariffs and a different Lunar New Year holiday schedule Taiwan’s retail sales ended a nine-year growth streak last year, slipping 0.2 percent from a year earlier as uncertainty over US tariff policies affected demand for durable goods, data released on Friday by the Ministry of Economic Affairs showed. Last year’s retail sales totaled NT$4.84 trillion (US$153.27 billion), down about NT$9.5 billion, or 0.2 percent, from 2024. Despite the decline, the figure was still the second-highest annual sales total on record. Ministry statistics department deputy head Chen Yu-fang (陳玉芳) said sales of cars, motorcycles and related products, which accounted for 17.4 percent of total retail rales last year, fell NT$68.1 billion, or

HSBC Bank Taiwan Ltd (匯豐台灣商銀) and the Taiwan High Prosecutors Office recently signed a memorandum of understanding (MOU) to enhance cooperation on the suspicious transaction analysis mechanism. This landmark agreement makes HSBC the first foreign bank in Taiwan to establish such a partnership with the High Prosecutors Office, underscoring its commitment to active anti-fraud initiatives, financial inclusion, and the “Treating Customers Fairly” principle. Through this deep public-private collaboration, both parties aim to co-create a secure financial ecosystem via early warning detection and precise fraud prevention technologies. At the signing ceremony, HSBC Taiwan CEO and head of banking Adam Chen (陳志堅)