Staff writer, with CNA

Daniel Tsai (蔡明忠) and Richard Tsai (蔡明興), the brothers who run Fubon Group (富邦集團), topped the Forbes list of Taiwan’s 50 richest people this year, released on Wednesday in New York.

The magazine said that a stronger New Taiwan dollar pushed the combined wealth of Taiwan’s 50 richest people up 13 percent, from US$174 billion to US$197 billion, with 36 of the people on the list seeing their wealth increase.

Photo: CNA

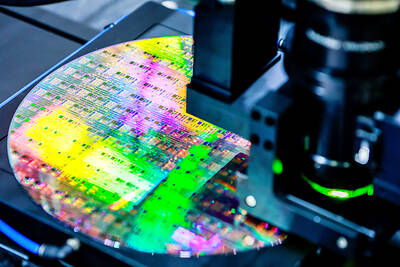

That came as Taiwan’s economy grew 4.6 percent last year, its fastest pace in three years, driven by the strong performance of the semiconductor industry, the magazine said.

The Tsai brothers, with a net worth of US$13.9 billion, returned to top spot with a US$3.2 billion increase from the previous year, Forbes said, adding that the rise was driven by a 16 percent gain in Fubon Financial Holding Co (富邦金控) shares thanks to expanded banking operations.

Last year’s richest person, Quanta Computer Inc (廣達電腦) chairman Barry Lam (林百里), dropped to second place despite an 8 percent increase in his wealth, which brought his net worth to US$12.6 billion, the magazine said.

Quanta is the world’s largest contract laptop manufacturer by sales volume.

Coming in third were brothers Tsai Hong-tu (蔡宏圖) and Tsai Cheng-ta (蔡政達) from financial conglomerate Lin Yuan Group (霖園集團), which owns Cathay Financial Holding Co (國泰金控), with a net worth of US$10.9 billion.

Next on the list is Terry Gou (郭台銘), founder of Hon Hai Precision Industry Co (鴻海精密), the world’s largest electronics contract manufacturer, with a net worth of US$10.98 billion, the magazine said.

Rounding out the top five are the Wei brothers — Wei Ing-chou (魏應州), Wei Ying-chiao (魏應交), Wei Yin-chun (魏應充) and Wei Yin-heng (魏應行) — who control Tingyi (Cayman Islands) Holding Corp (康師傅控股), one of China’s largest beverage and noodle companies.

The Koo brothers — Jeffrey Koo Jr (辜仲諒) and Angelo Koo (辜仲瑩) — who hold stakes in CTBC Financial Holding Co (中信金控) and KGI Financial Holding Co (凱基金控) respectively, saw the biggest percentage gains in wealth, with their fortunes more than doubling to US$4.7 billion (13th) and US$3.3 billion (20th) respectively, Forbes said.

Three people made their debut on this year’s list, with two of them benefiting from the global surge in demand for artificial intelligence servers.

They include Lin Tsung-chi (林聰吉), founder of King Slide Works Co (川湖科技), one of the largest suppliers of server rails. Lin’s net worth is estimated at US$2.9 billion and he ranked 24th.

Another is the Chao brothers — Chao Chung-hsin (趙宗信) and Chao Yung-tsang (趙永昌) — of Jentech Precision Industrial Co (健策精密), a supplier of cooling devices and other semiconductor components. They ranked 32nd with a net worth of US$2.1 billion.

The third newcomer to the list is Robin Chang (張重興), chairman of Taichung-based Apex Dynamics Inc (台灣精銳科技), one of the world’s largest suppliers of high-precision gearboxes. He ranks 47th with a net worth of US$1.51 billion, the magazine said.

TECH TITAN: Pandemic-era demand for semiconductors turbocharged the nation’s GDP per capita to surpass South Korea’s, but it still remains half that of Singapore Taiwan is set to surpass South Korea this year in terms of wealth for the first time in more than two decades, marking a shift in Asia’s economic ranks made possible by the ascent of Taiwan Semiconductor Manufacturing Co (TSMC, 台積電). According to the latest forecasts released on Thursday by the central bank, Taiwan’s GDP is expected to expand 4.55 percent this year, a further upward revision from the 4.45 percent estimate made by the statistics bureau last month. The growth trajectory puts Taiwan on track to exceed South Korea’s GDP per capita — a key measure of living standards — a

Samsung Electronics Co shares jumped 4.47 percent yesterday after reports it has won approval from Nvidia Corp for the use of advanced high-bandwidth memory (HBM) chips, which marks a breakthrough for the South Korean technology leader. The stock closed at 83,500 won in Seoul, the highest since July 31 last year. Yesterday’s gain comes after local media, including the Korea Economic Daily, reported that Samsung’s 12-layer HBM3E product recently passed Nvidia’s qualification tests. That clears the components for use in the artificial intelligence (AI) accelerators essential to the training of AI models from ChatGPT to DeepSeek (深度求索), and finally allows Samsung

Taiwan has imposed restrictions on the export of chips to South Africa over national security concerns, taking the unusual step of using its dominance of chip markets to pressure a country that is closely allied with China. Taiwan requires preapproval for the bulk of chips sold to the African nation, the International Trade Administration said in a statement. The decision emerged after Pretoria tried to downgrade Taipei’s representative office and force its move to Johannesburg from Pretoria, the Ministry of Foreign Affairs has said. The move reflects Taiwan’s economic clout and a growing frustration with getting sidelined by Beijing in the diplomatic community. Taiwan

READY TO HELP: Should TSMC require assistance, the government would fully cooperate in helping to speed up the establishment of the Chiayi plant, an official said Taiwan Semiconductor Manufacturing Co (TSMC, 台積電) yesterday said its investment plans in Taiwan are “unchanged” amid speculation that the chipmaker might have suspended construction work on its second chip packaging plant in Chiayi County and plans to move equipment arranged for the plant to the US. The Chinese-language Economic Daily News reported earlier yesterday that TSMC had halted the construction of the chip packaging plant, which was scheduled to be completed next year and begin mass production in 2028. TSMC did not directly address whether construction of the plant had halted, but said its investment plans in Taiwan remain “unchanged.” The chipmaker started