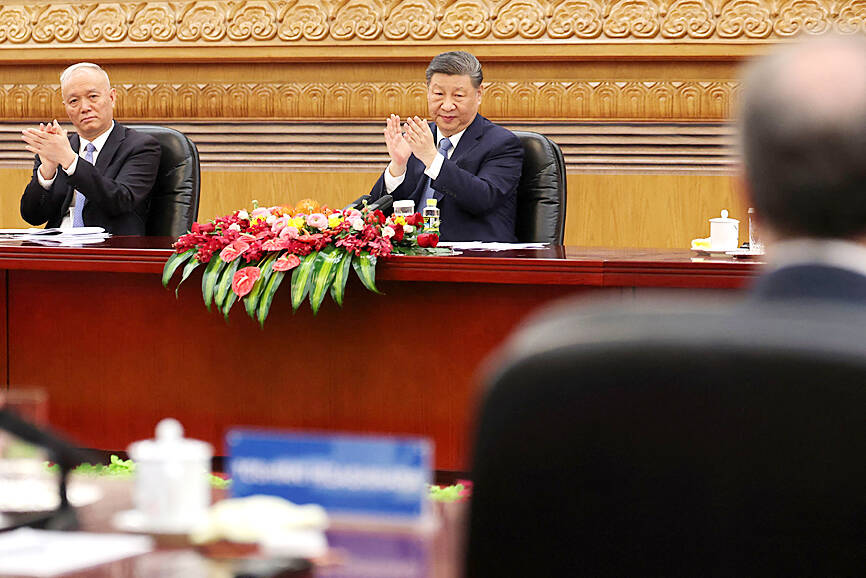

Chinese President Xi Jinping (習近平) yesterday met with a group of global business leaders in Beijing in an effort to boost investor sentiment as rising tariffs fuel uncertainty about the economy and international trade.

Xi sat down with representatives of international industrial and business firms at the Great Hall of the People in Beijing yesterday morning, Xinhua news agency reported, without elaborating.

They included Rajesh Subramaniam of FedEx Corp, Bill Winters of Standard Chartered PLC, Paul Hudson of Sanofi SA, Pascal Soriot of AstraZeneca PLC and Miguel Angel Lopez Borrego of ThyssenKrupp AG.

Photo: Reuters

Officials in attendance included Chinese Minister of Foreign Affairs Wang Yi (王毅), Minister of Commerce Wang Wentao (王文濤) and Minister of Finance Lan Foan (藍佛安).

After the meeting, Xi said in front of reporters that seven business representatives shared their views that the Chinese government would “study and consider.”

“All of you are welcome to keep your lines of communication with us,” Xi said, praising the attendees for contributing to China’s growth and creating job opportunities.

“Foreign businesses are important participants in China’s modernization,” he added.

Slowing economic expansion and mounting geopolitical tensions have hurt the appeal of investing in the world’s second-biggest economy, with inbound investment tumbling last year to its lowest in more than three decades.

More headwinds might come next month, when the US is set to complete a review of Beijing’s compliance with the phase-one trade deal struck during US President Donald Trump’s first term and impose reciprocal duties globally.

Chinese Premier Li Qiang (李強) on Sunday said that the country is prepared for “shocks that exceed expectations,” as the government targets an ambitious growth target of about 5 percent this year.

Economists estimate that Beijing would need to unleash trillions of yuan in stimulus to hit that goal if tariffs surge.

China’s interaction with the top business figures underscores the message it has been sending that the nation is open for business — contrasting itself with Trump’s more protectionist “America first” policies.

Beijing is also trying to cast itself as a supporter of private enterprise, illustrated by Xi’s meeting last month with entrepreneurs such as Alibaba Group Holding Ltd (阿里巴巴) cofounder Jack Ma (馬雲).

Many global chief executive officers had traveled to China for the annual China Development Forum and the Boao Forum for Asia, which concluded yesterday.

The meeting marked an upgrade from earlier years when China’s No. 2 official met executives on the sidelines of the China Development Forum, although Xi broke precedent last year to meet with a group of US businesspeople.

US Senator Steve Daines, a member of the Senate Foreign Relations Committee, met with several Chinese leaders, including Li, earlier this week, in what has been seen as an initial step to set up a summit between Xi and Trump.

Several US firms have already been caught in the crossfire of deteriorating bilateral relations.

Chinese authorities summoned Walmart Inc executives this month over reports it asked suppliers to bear rising costs incurred by increased US tariffs.

Beijing earlier placed Calvin Klein owner PVH Corp and US gene sequencing company Illumina Inc onto a so-called blacklist of entities as US tariffs took effect.

South Korea’s equity benchmark yesterday crossed a new milestone just a month after surpassing the once-unthinkable 5,000 mark as surging global memory demand powers the country’s biggest chipmakers. The KOSPI advanced as much as 2.6 percent to a record 6,123, with Samsung Electronics Co and SK Hynix Inc each gaining more than 2 percent. With the benchmark now up 45 percent this year, South Korea’s stock market capitalization has also moved past France’s, following last month’s overtaking of Germany’s. Long overlooked by foreign funds, despite being undervalued, South Korean stocks have now emerged as clear winners in the global market. The so-called “artificial intelligence

NEW IDENTITY: Known for its software, India has expanded into hardware, with its semiconductor industry growing from US$38bn in 2023 to US$45bn to US$50bn India on Saturday inaugurated its first semiconductor assembly and test facility, a milestone in the government’s push to reduce dependence on foreign chipmakers and stake a claim in a sector dominated by China. Indian Prime Minister Narendra Modi opened US firm Micron Technology Inc’s semiconductor assembly, test and packaging unit in his home state of Gujarat, hailing the “dawn of a new era” for India’s technology ambitions. “When young Indians look back in the future, they will see this decade as the turning point in our tech future,” Modi told the event, which was broadcast on his YouTube channel. The plant would convert

‘SEISMIC SHIFT’: The researcher forecast there would be about 1.1 billion mobile shipments this year, down from 1.26 billion the prior year and erasing years of gains The global smartphone market is expected to contract 12.9 percent this year due to the unprecedented memorychip shortage, marking “a crisis like no other,” researcher International Data Corp (IDC) said. The new forecast, a dramatic revision down from earlier estimates, gives the latest accounting of the ongoing memory crunch that is affecting every corner of the electronics industry. The demand for advanced memory to power artificial intelligence (AI) tasks has drained global supply until well into next year and jeopardizes the business model of many smartphone makers. IDC forecast about 1.1 billion mobile shipments this year, down from 1.26 billion the prior

People stand in a Pokemon store in Tokyo on Thursday. One of the world highest-grossing franchises is celebrated its 30th anniversary yesterday.