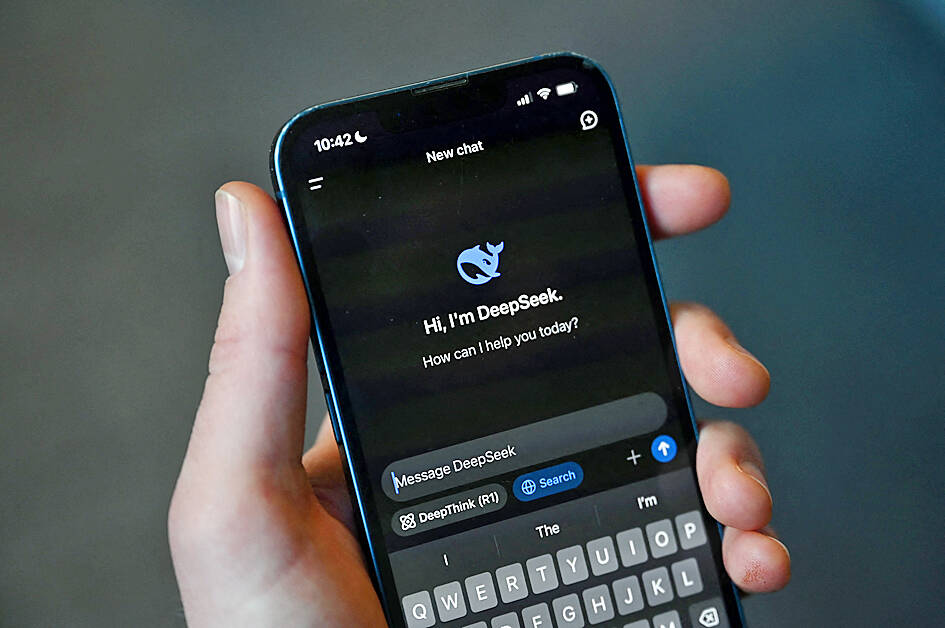

Chinese artificial intelligence (AI) start-up DeepSeek’s (深度求索) eponymous AI assistant rocketed to the top of Apple Inc’s iPhone download charts, stirring doubts in Silicon Valley about the strength of the US’ technological dominance.

The app’s underlying AI model is widely seen as competitive with OpenAI and Meta Platforms Inc’s latest.

Its claim that it cost much less to train and develop triggered share moves across Asia’s supply chain.

Photo: AFP

Chinese tech firms linked to DeepSeek, such as Iflytek Co (科大訊飛), surged yesterday, while chipmaking tool makers like Advantest Corp slumped on the potential threat to demand for Nvidia Corp’s AI accelerators.

US stock index futures also tumbled amid concerns that DeepSeek’s AI models might disrupt US technological leadership. Markets were closed for holidays in Taiwan and South Korea.

Lauded by investor Marc Andreessen as “one of the most amazing and impressive breakthroughs,” DeepSeek’s assistant shows its work and reasoning as it addresses a user’s written query or prompt.

Reviews on Apple’s app store and Alphabet Inc’s Android Play Store praised that transparency.

The app topped the free downloads chart on iPhones in the US and is among the most downloaded productivity apps in the Play Store.

“DeepSeek shows that it is possible to develop powerful AI models that cost less,” Union Bancaire Privee SA managing director Ling Vey-sern (凌煒森) said. “It can potentially derail the investment case for the entire AI supply chain, which is driven by high spending from a small handful of hyperscalers.”

Founded by quant fund chief Liang Wenfeng (梁文鋒), DeepSeek’s open-sourced AI model is spurring a rethink of the billions of dollars that companies have been spending to stay ahead in the AI race.

“While it remains to be seen if DeepSeek will prove to be a viable, cheaper alternative in the long term, initial worries are centered on whether US tech giants’ pricing power is being threatened and if their massive AI spending needs re-evaluation,” IG Asia Pte market strategist Yeap Jun Rong (葉俊榮) said.

Like all other Chinese-made AI models, DeepSeek self-censors on topics deemed politically sensitive in China. Unlike ChatGPT, DeepSeek deflects questions about Tiananmen Square, Chinese President Xi Jinping (習近平) or the possibility of China invading Taiwan. That might prove jarring to international users, who may not have come into direct contact with Chinese chatbots earlier.

The initial success provides a counterpoint to expectations that the most advanced AI would require increasing amounts of computing power and energy — an assumption that has driven shares in Nvidia and its suppliers to all-time highs.

The exact cost of development and energy consumption of DeepSeek are not fully documented, but the start-up has presented figures that suggest its cost was only a fraction of OpenAI’s latest models.

The DeepSeek product “is deeply problematic for the thesis that the significant capital expenditure and operating expenses that Silicon Valley has incurred is the most appropriate way to approach the AI trend,’ said Nirgunan Tiruchelvam, head of consumer and internet at Singapore-based Aletheia Capital. “It calls into question the massive resources that have been dedicated to AI.”

That a small and efficient AI model emerged from China, which has been subject to escalating US trade sanctions on advanced Nvidia chips, is also challenging the effectiveness of such measures.

“The US is great at research and innovation and especially breakthrough, but China is better at engineering,” computer scientist Lee Kai-fu (李開復) said earlier this month at the Asian Financial Forum in Hong Kong.

“In this day and age, when you have limited compute power and money, you learn how to build things very efficiently,” he said.

NOT JUSTIFIED: The bank’s governor said there would only be a rate cut if inflation falls below 1.5% and economic conditions deteriorate, which have not been detected The central bank yesterday kept its key interest rates unchanged for a fifth consecutive quarter, aligning with market expectations, while slightly lowering its inflation outlook amid signs of cooling price pressures. The move came after the US Federal Reserve held rates steady overnight, despite pressure from US President Donald Trump to cut borrowing costs. Central bank board members unanimously voted to maintain the discount rate at 2 percent, the secured loan rate at 2.375 percent and the overnight lending rate at 4.25 percent. “We consider the policy decision appropriate, although it suggests tightening leaning after factoring in slackening inflation and stable GDP growth,”

DIVIDED VIEWS: Although the Fed agreed on holding rates steady, some officials see no rate cuts for this year, while 10 policymakers foresee two or more cuts There are a lot of unknowns about the outlook for the economy and interest rates, but US Federal Reserve Chair Jerome Powell signaled at least one thing seems certain: Higher prices are coming. Fed policymakers voted unanimously to hold interest rates steady at a range of 4.25 percent to 4.50 percent for a fourth straight meeting on Wednesday, as they await clarity on whether tariffs would leave a one-time or more lasting mark on inflation. Powell said it is still unclear how much of the bill would fall on the shoulders of consumers, but he expects to learn more about tariffs

Greek tourism student Katerina quit within a month of starting work at a five-star hotel in Halkidiki, one of the country’s top destinations, because she said conditions were so dire. Beyond the bad pay, the 22-year-old said that her working and living conditions were “miserable and unacceptable.” Millions holiday in Greece every year, but its vital tourism industry is finding it harder and harder to recruit Greeks to look after them. “I was asked to work in any department of the hotel where there was a need, from service to cleaning,” said Katerina, a tourism and marketing student, who would

i Gasoline and diesel prices at fuel stations are this week to rise NT$0.1 per liter, as tensions in the Middle East pushed crude oil prices higher last week, CPC Corp, Taiwan (台灣中油) and Formosa Petrochemical Corp (台塑石化) said yesterday. International crude oil prices last week rose for the third consecutive week due to an escalating conflict between Israel and Iran, as the market is concerned that the situation in the Middle East might affect crude oil supply, CPC and Formosa said in separate statements. Front-month Brent crude oil futures — the international oil benchmark — rose 3.75 percent to settle at US$77.01