Powerchip Semiconductor Manufacturing Corp (力積電) yesterday said it had terminated a deal with SBI Holdings Inc to help build a chip manufacturing plant in Japan, as Powerchip found it unpractical to take the full responsibility of operating a plant it does not own for more than 10 years.

Powerchip, Taiwan’s third-largest contract chipmaker, inked a non-binding memorandum of understanding (MOU) with SBI in July last year to explore the possibility of building a 12-inch chip fab in Japan.

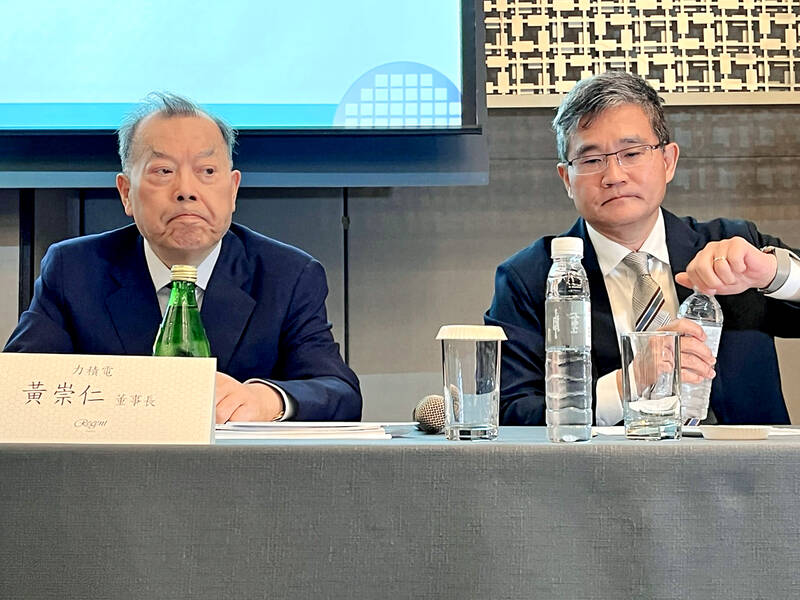

According to the MOU, Powerchip’s role was that of a technology provider, as the company hopes to generate a new revenue stream, chairman Frank Huang (黃崇仁) said.

Photo: Grace Hung, Taipei Times

The fab would belong to JSMC Holdings Inc, which is owned by SBI, and Powerchip would have no stake in it, Huang said.

His company was requested to apply for Japanese government subsidies of about ¥140 billion (US$929.1 million) to fund the construction, as SBI, a financial service provider, was not eligible to apply for such subsidies.

Nonetheless, “Powerchip has to withdraw from the project, because it cannot promise that it would take the responsibility of running the fab for 10 years, which is requested by the Japanese government,” Huang said.

Huang denied SBI Holdings chairman Yoshitaka Kitao’s accusation that Powerchip was dishonest and did not commit to creating a semiconductor venture in Japan.

There are also fears the fab would lack competitiveness, given its expensive manufacturing costs and relatively small scale in capacity, he said.

The company would focus on India instead, where it has agreed to provide its technologies to Indian partner Tata Electronics Pvt Ltd to help the company build an advanced chip fab, Huang said.

Tata Electronics would apply for Indian government subsidies, he said.

Powerchip expects to gain NT$20 billion (US$623.9 million) from the partnership with Tata Electronics over four years, he said.

Powerchip last quarter reported its fifth unprofitable quarter in a row, with losses ballooning to NT2.28 billion, following losses of NT$1.96 billion in the second quarter.

The company said the losses stemmed from heavy depreciation caused by a new factory in Miaoli County’s Tongluo Science Park (銅鑼科學園區) as well as growing competition from Chinese competitors.

Powerchip said it expects sluggish demand for display driver ICs and mounting price pressure this quarter.

Demand for power management chips also looks flat this quarter compared with last quarter, it said.

DRAM chip prices are expected to go down amid a global supply glut, it said.

Meanwhile, the company plans to invest NT$2 billion initially on 3D artificial intelligence chips and expects to ramp up production by the end of next year, it said.

Taiwan Semiconductor Manufacturing Co (TSMC, 台積電) last week recorded an increase in the number of shareholders to the highest in almost eight months, despite its share price falling 3.38 percent from the previous week, Taiwan Stock Exchange data released on Saturday showed. As of Friday, TSMC had 1.88 million shareholders, the most since the week of April 25 and an increase of 31,870 from the previous week, the data showed. The number of shareholders jumped despite a drop of NT$50 (US$1.59), or 3.38 percent, in TSMC’s share price from a week earlier to NT$1,430, as investors took profits from their earlier gains

In a high-security Shenzhen laboratory, Chinese scientists have built what Washington has spent years trying to prevent: a prototype of a machine capable of producing the cutting-edge semiconductor chips that power artificial intelligence (AI), smartphones and weapons central to Western military dominance, Reuters has learned. Completed early this year and undergoing testing, the prototype fills nearly an entire factory floor. It was built by a team of former engineers from Dutch semiconductor giant ASML who reverse-engineered the company’s extreme ultraviolet lithography (EUV) machines, according to two people with knowledge of the project. EUV machines sit at the heart of a technological Cold

Taiwan’s long-term economic competitiveness will hinge not only on national champions like Taiwan Semiconductor Manufacturing Co. (TSMC, 台積電) but also on the widespread adoption of artificial intelligence (AI) and other emerging technologies, a US-based scholar has said. At a lecture in Taipei on Tuesday, Jeffrey Ding, assistant professor of political science at the George Washington University and author of "Technology and the Rise of Great Powers," argued that historical experience shows that general-purpose technologies (GPTs) — such as electricity, computers and now AI — shape long-term economic advantages through their diffusion across the broader economy. "What really matters is not who pioneers

TAIWAN VALUE CHAIN: Foxtron is to fully own Luxgen following the transaction and it plans to launch a new electric model, the Foxtron Bria, in Taiwan next year Yulon Motor Co (裕隆汽車) yesterday said that its board of directors approved the disposal of its electric vehicle (EV) unit, Luxgen Motor Co (納智捷汽車), to Foxtron Vehicle Technologies Co (鴻華先進) for NT$787.6 million (US$24.98 million). Foxtron, a half-half joint venture between Yulon affiliate Hua-Chuang Automobile Information Technical Center Co (華創車電) and Hon Hai Precision Industry Co (鴻海精密), expects to wrap up the deal in the first quarter of next year. Foxtron would fully own Luxgen following the transaction, including five car distributing companies, outlets and all employees. The deal is subject to the approval of the Fair Trade Commission, Foxtron said. “Foxtron will be