China Steel Corp (CSC, 中鋼), the nation’s largest steelmaker, yesterday slashed steel quotation prices for domestic deliveries next month and next quarter as already sluggish demand worsened.

The Kaohsiung-based steelmaker is to cut prices next month by NT$800 to NT$1,200 per tonne, compared with cuts of NT$500 to NT$600 per tonne this month.

It is also to cut prices next quarter by NT$500 to NT$1,500 per tonne for most products, but would keep unchanged the price of SM570M-type steel plates for building use, it said in a statement.

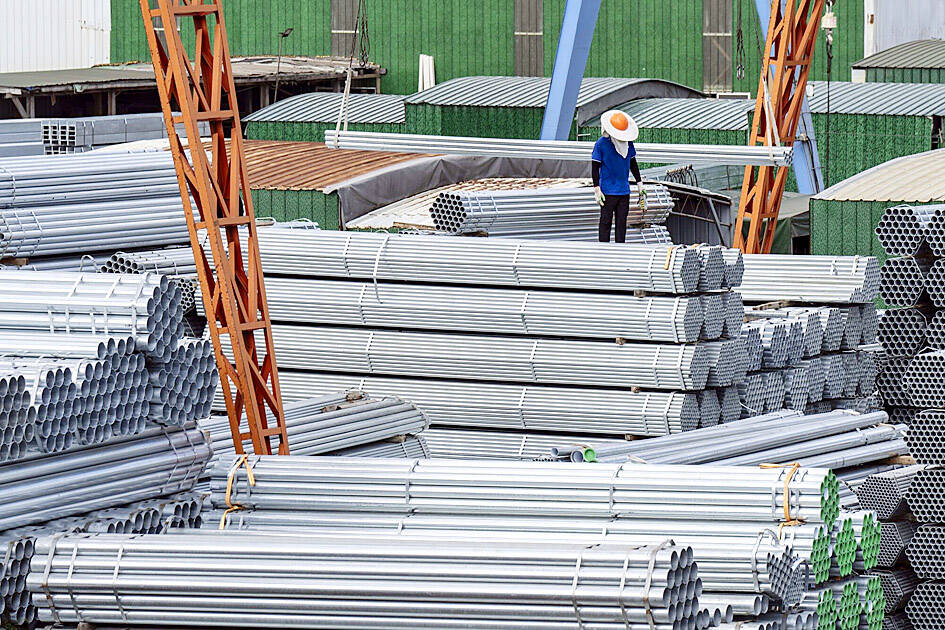

Photo: Bloomberg

“The global steel market remains weak. At home, the market is rife with wait-and-see sentiment, and firms in the supply chain are grappling with an industrial slump,” the company said.

“The company has decided to significantly lower our quotation prices to fend off competition from cheaper imports and match domestic market trends,” it said.

Global steel demand has shrunk amid a soft recovery in the manufacturing sector, especially in the US, the company said.

In China, Angang Steel Co (鞍本鋼鐵) reduced its price quotations of hot-rolled products for next month by about 200 yuan (US$28) to 250 yuan per tonne due to sagging demand, while China Baowu Steel Group Corp (寶武鋼鐵集), the world’s largest, recently announced no changes in its price quotations for delivery next month, without providing clear order visibility for the near term, CSC said.

With an excess of cheaper Chinese steel goods entering regional markets, the prices of hot-rolled steel products in Southeast Asia plunged US$35 per tonne last month, the company said. Formosa Ha Tinh Steel Corp (台塑河靜鋼) in Vietnam cut quotation prices by US$16 per tonne in its latest move to match weak market demand, it added.

CSC reported pretax profits of NT$582 million (US$18.22 million) for July, down 15 percent from NT$681 million in June.

During the first seven months of this year, pretax profits surged 218 percent to NT$4.08 billion from NT$1.28 billion in the same period last year. Consolidated revenue grew 1.2 percent annually to NT$217.6 billion during the period.

The company told investors in June that its bottom line would be better in the second half of this year than the first half, given that the final quarter of a year is usually the strongest season for the steel industry.

The Eurovision Song Contest has seen a surge in punter interest at the bookmakers, becoming a major betting event, experts said ahead of last night’s giant glamfest in Basel. “Eurovision has quietly become one of the biggest betting events of the year,” said Tomi Huttunen, senior manager of the Online Computer Finland (OCS) betting and casino platform. Betting sites have long been used to gauge which way voters might be leaning ahead of the world’s biggest televised live music event. However, bookmakers highlight a huge increase in engagement in recent years — and this year in particular. “We’ve already passed 2023’s total activity and

Nvidia Corp CEO Jensen Huang (黃仁勳) today announced that his company has selected "Beitou Shilin" in Taipei for its new Taiwan office, called Nvidia Constellation, putting an end to months of speculation. Industry sources have said that the tech giant has been eyeing the Beitou Shilin Science Park as the site of its new overseas headquarters, and speculated that the new headquarters would be built on two plots of land designated as "T17" and "T18," which span 3.89 hectares in the park. "I think it's time for us to reveal one of the largest products we've ever built," Huang said near the

China yesterday announced anti-dumping duties as high as 74.9 percent on imports of polyoxymethylene (POM) copolymers, a type of engineering plastic, from Taiwan, the US, the EU and Japan. The Chinese Ministry of Commerce’s findings conclude a probe launched in May last year, shortly after the US sharply increased tariffs on Chinese electric vehicles, computer chips and other imports. POM copolymers can partially replace metals such as copper and zinc, and have various applications, including in auto parts, electronics and medical equipment, the Chinese ministry has said. In January, it said initial investigations had determined that dumping was taking place, and implemented preliminary

Intel Corp yesterday reinforced its determination to strengthen its partnerships with Taiwan’s ecosystem partners including original-electronic-manufacturing (OEM) companies such as Hon Hai Precision Industry Co (鴻海精密) and chipmaker United Microelectronics Corp (UMC, 聯電). “Tonight marks a new beginning. We renew our new partnership with Taiwan ecosystem,” Intel new chief executive officer Tan Lip-bu (陳立武) said at a dinner with representatives from the company’s local partners, celebrating the 40th anniversary of the US chip giant’s presence in Taiwan. Tan took the reins at Intel six weeks ago aiming to reform the chipmaker and revive its past glory. This is the first time Tan