The Dutch government on Tuesday said that ASML Holding NV needs a license to provide spare parts and software updates for computer chipmaking equipment it previously sold to Chinese customers that now fall under export restrictions.

That includes the two additional tools that the Dutch government added to its national control list on Friday last week in a move to coordinate policy with the US, the Dutch Ministry of Foreign Affairs said in a statement.

The clarification follows confusion over whether the Dutch government is planning additional servicing restrictions on ASML, Europe’s largest technology firm, which the ministry indicated is not the case.

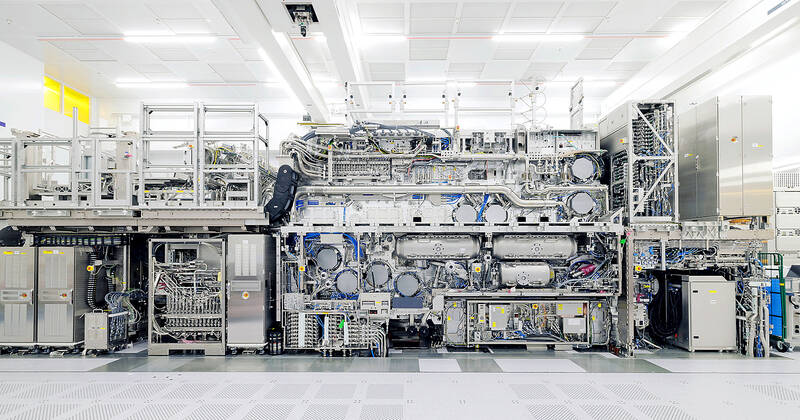

Photo: Reuters

“Servicing ... is vetted under the licensing requirement (and includes) ... parts, software and technology developed specially for this equipment,” the ministry said.

“As of Sept. 6, 2024 this licensing obligation is expanded” to include ASML’s 1980di and 1970di machines, it added.

ASML, which on Friday said it did not expect the change to impact on its earnings, declined to comment.

The company dominates the market for deep ultraviolet (DUV) and extreme ultraviolet (EUV) lithography tools, essential to chipmakers for creating the circuitry of chips.

After an initial round of Dutch restrictions last year, the company instructed its customers in China — its third-largest market after Taiwan and South Korea — not to expect licenses to import its most advanced DUV tools after Jan. 1.

ASML has never been able to sell its EUV machines to China amid pressure from the US government.

ASML CEO Christophe Fouquet at an event in New York on Wednesday last week said that he expects the US government to continue pushing for additional restrictions on the company’s exports to China.

“That is a bipartisan issue, so I think whatever happens in November this will stay,” he said, referring to the US presidential election.

He added that he expects pushback from the Dutch government against additional US restrictions, which he said are increasingly motivated by economic rather than security considerations.

NEW IDENTITY: Known for its software, India has expanded into hardware, with its semiconductor industry growing from US$38bn in 2023 to US$45bn to US$50bn India on Saturday inaugurated its first semiconductor assembly and test facility, a milestone in the government’s push to reduce dependence on foreign chipmakers and stake a claim in a sector dominated by China. Indian Prime Minister Narendra Modi opened US firm Micron Technology Inc’s semiconductor assembly, test and packaging unit in his home state of Gujarat, hailing the “dawn of a new era” for India’s technology ambitions. “When young Indians look back in the future, they will see this decade as the turning point in our tech future,” Modi told the event, which was broadcast on his YouTube channel. The plant would convert

‘SEISMIC SHIFT’: The researcher forecast there would be about 1.1 billion mobile shipments this year, down from 1.26 billion the prior year and erasing years of gains The global smartphone market is expected to contract 12.9 percent this year due to the unprecedented memorychip shortage, marking “a crisis like no other,” researcher International Data Corp (IDC) said. The new forecast, a dramatic revision down from earlier estimates, gives the latest accounting of the ongoing memory crunch that is affecting every corner of the electronics industry. The demand for advanced memory to power artificial intelligence (AI) tasks has drained global supply until well into next year and jeopardizes the business model of many smartphone makers. IDC forecast about 1.1 billion mobile shipments this year, down from 1.26 billion the prior

People stand in a Pokemon store in Tokyo on Thursday. One of the world highest-grossing franchises is celebrated its 30th anniversary yesterday.

Zimbabwe’s ban on raw lithium exports is forcing Chinese miners to rethink their strategy, speeding up plans to process the metal locally instead of shipping it to China’s vast rechargeable battery industry. The country is Africa’s largest lithium producer and has one of the world’s largest reserves, according to the US Geological Survey (USGS). Zimbabwe already banned the export of lithium ore in 2022 and last year announced it would halt exports of lithium concentrates from January next year. However, on Wednesday it imposed the ban with immediate effect, leaving unclear what the lithium mining sector would do in the