China has threatened severe economic retaliation against Japan if Tokyo further restricts sales and servicing of chipmaking equipment to Chinese firms, complicating US-led efforts to cut the world’s second-largest economy off from advanced technology.

Senior Chinese officials have repeatedly outlined that position in recent meetings with their Japanese counterparts, people familiar with the matter said.

Toyota Motor Corp privately told officials in Tokyo that one specific fear in Japan is that Beijing could react to new semiconductor controls by cutting the country’s access to critical minerals essential for automotive production, the people said, declining to be named discussing private affairs.

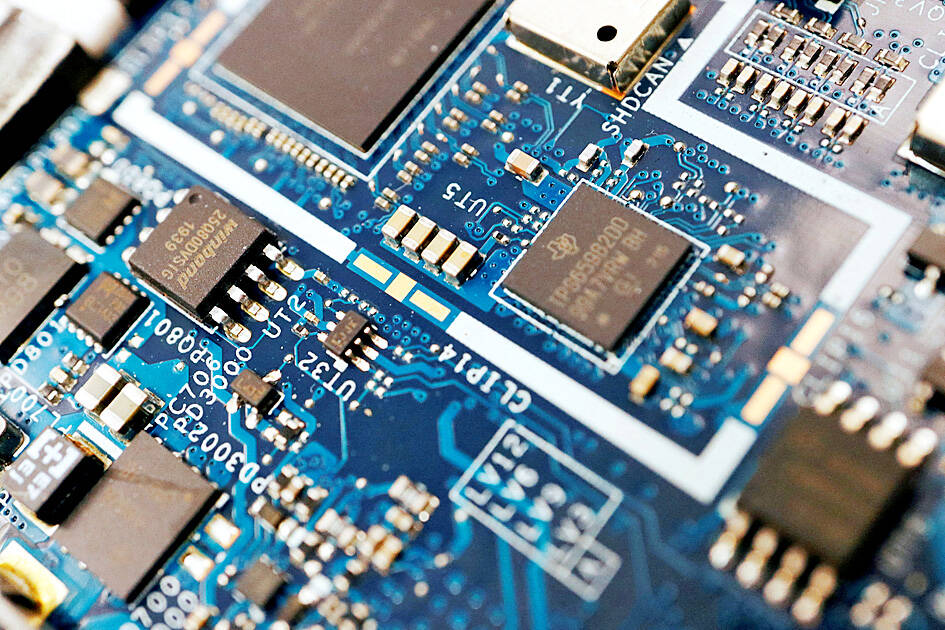

Photo: Reuters

Toyota is among the most important companies in Japan and is deeply involved in the country’s chip policy, partly reflected in that it has invested in a new chip campus being built by Taiwan Semiconductor Manufacturing Co (台積電) in Kumamoto, one of the people said.

That makes its concerns a major consideration for Japanese officials, in addition to those of Tokyo Electron Ltd, the semiconductor gear-maker that would be principally affected by any new Japanese export controls.

The US has been pressuring Japan to impose additional restrictions on the ability of firms including Tokyo Electron to sell advanced chipmaking tools to China, part of a long-running campaign to curtail China’s semiconductor progress.

With those talks, senior US officials have been working with their Japanese counterparts on a strategy to ensure adequate supplies of critical minerals, some of the people said, especially as China imposed restrictions on the exports of gallium, germanium and graphite last year.

The concern about Toyota has some historical precedent. In 2010, China temporarily suspended exports of rare earths to Japan after a clash in waters of the East China Sea claimed by both sides.

The move shook Japan’s electronics sector and threatened to choke off global supplies of high-power magnets produced in Japan employing rare earths from China. Tokyo has since worked with mixed success to reduce its reliance on Chinese rare earth imports.

The administration of US President Joe Biden is confident that they can assuage Tokyo’s concerns and reach an agreement with Japan by the end of this year, some of the people said.

However, there are more aggressive options: Behind the scenes, the US has been wielding a power known as the foreign direct product rule (FDPR), which allows Washington to control sales of products made anywhere in the world, provided they use even the smallest amount of US technology.

In the current talks, US officials so far have refrained from invoking that authority against Japan and other key allies, which see the rule as a draconian step. A senior administration official said the US would prefer to reach a diplomatic solution, but would not rule out the use of the FDPR.

South Korean Minister for Trade Cheong In-kyo said the US should offer incentives and more flexibility to encourage allies to collaborate on China chip controls.

“For countries or companies trying to comply with the US in good faith, there should be some kind of carrots,” Cheong said in his first interview with media since he took office in January. “That would help US policy be embraced more easily.”

South Korea is unable to send China the types of chipmaking equipment that would enable next-generation technology, Cheong said.

He said he anticipates overall semiconductor trade between the two countries to decline in the long run due to various limitations.

Cheong declined to specify what US incentives would be welcome, or comment on whether Seoul and Washington are in talks over export controls on the latest technology.

He said his country would respond to any additional restrictions by exploring ways to reduce business disruptions.

“We’ll have to find a way to the extent that the impact on our companies’ business is minimized,” he said.

In Italy’s storied gold-making hubs, jewelers are reworking their designs to trim gold content as they race to blunt the effect of record prices and appeal to shoppers watching their budgets. Gold prices hit a record high on Thursday, surging near US$5,600 an ounce, more than double a year ago as geopolitical concerns and jitters over trade pushed investors toward the safe-haven asset. The rally is putting undue pressure on small artisans as they face mounting demands from customers, including international brands, to produce cheaper items, from signature pieces to wedding rings, according to interviews with four independent jewelers in Italy’s main

Japanese Prime Minister Sanae Takaichi has talked up the benefits of a weaker yen in a campaign speech, adopting a tone at odds with her finance ministry, which has refused to rule out any options to counter excessive foreign exchange volatility. Takaichi later softened her stance, saying she did not have a preference for the yen’s direction. “People say the weak yen is bad right now, but for export industries, it’s a major opportunity,” Takaichi said on Saturday at a rally for Liberal Democratic Party candidate Daishiro Yamagiwa in Kanagawa Prefecture ahead of a snap election on Sunday. “Whether it’s selling food or

CONCERNS: Tech companies investing in AI businesses that purchase their products have raised questions among investors that they are artificially propping up demand Nvidia Corp chief executive officer Jensen Huang (黃仁勳) on Saturday said that the company would be participating in OpenAI’s latest funding round, describing it as potentially “the largest investment we’ve ever made.” “We will invest a great deal of money,” Huang told reporters while visiting Taipei. “I believe in OpenAI. The work that they do is incredible. They’re one of the most consequential companies of our time.” Huang did not say exactly how much Nvidia might contribute, but described the investment as “huge.” “Let Sam announce how much he’s going to raise — it’s for him to decide,” Huang said, referring to OpenAI

The global server market is expected to grow 12.8 percent annually this year, with artificial intelligence (AI) servers projected to account for 16.5 percent, driven by continued investment in AI infrastructure by major cloud service providers (CSPs), market researcher TrendForce Corp (集邦科技) said yesterday. Global AI server shipments this year are expected to increase 28 percent year-on-year to more than 2.7 million units, driven by sustained demand from CSPs and government sovereign cloud projects, TrendForce analyst Frank Kung (龔明德) told the Taipei Times. Demand for GPU-based AI servers, including Nvidia Corp’s GB and Vera Rubin rack systems, is expected to remain high,