Taiwan’s semiconductor industry is an ecosystem formed by an industry cluster that cannot be easily replaced, newly appointed National Science and Technology Council (NSTC) Deputy Minister Su Chen-kang (蘇振綱) said yesterday.

Su, former Southern Taiwan Science Park Bureau director-general, made the comments when asked if countries’ increased emphasis on creating their own semiconductor supply chains might affect Taiwan.

The advantage Taiwan’s semiconductor industry has over others is that it is a cluster, forming an entire ecosystem created over three to four decades, Su told reporters at a news conference in Taipei.

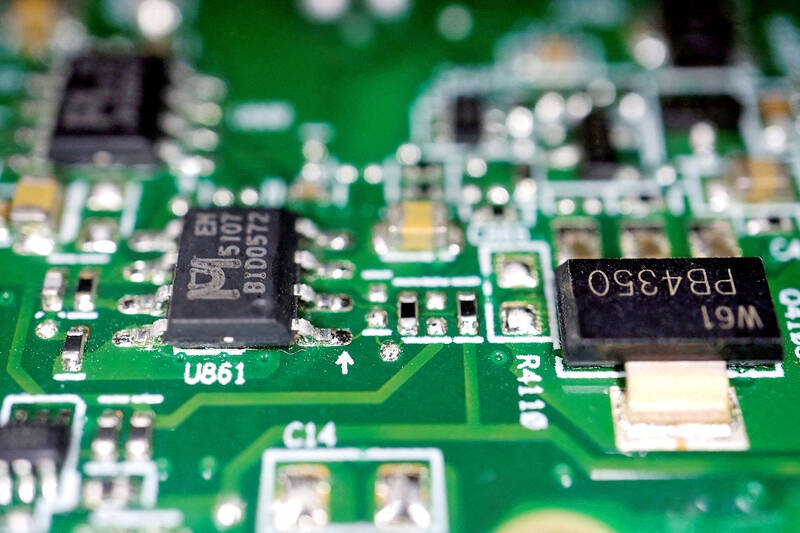

Photo: Florence Lo, Reuters

“We can confidently say that it is difficult to be replaced or copied,” Su said, adding that Taiwan’s science parks continue to see foreign companies’ investment.

“Being close to the supply chain, talent, and infrastructure can all be determining factors for a company’s investment decisions,” he said.

The continued growth of the country’s science parks proves the world’s enterprises still have a need for Taiwan, Su said.

Before joining the NSTC, Su oversaw the expansion into Chiayi and Pingtung of the previously Tainan and Kaohsiung-based Southern Taiwan Science Park (南部科學園區).

In March, the Southern Taiwan Science Park reported that its revenues hit a record high NT$1.59 trillion last year, surpassing Hsinchu Science Park’s (新竹科學園區) NT$1.42 trillion for the first time.

The growth of the southern science park has been attributed to the eruption of the global need for artificial intelligence (AI) chips.

Asked how his experience could aid him in his role at the NSTC, Su said that his work at the Southern Taiwan Science Park would help build Taiwan into an “AI island” and balance the country’s development.

“The science park is an innovation hub that drives the development of not only industries in the park but also helps build up supply chains or value chains outside the park,” he added.

Su said he expects the science parks, overseen by the council, to help enhance Taiwan’s industrial development in semiconductors, AI, net-zero emissions and many other crucial sectors.

“The NSTC has two hands,” one of which is science parks and the other is academic research, he said, stressing that close cooperation between the two can create synergistic effects.

Su joined the council earlier this week replacing Chen Tzong-chyuan (陳宗權), who has been appointed to lead the Hsinchu Science Park Bureau.

POWERING UP: PSUs for AI servers made up about 50% of Delta’s total server PSU revenue during the first three quarters of last year, the company said Power supply and electronic components maker Delta Electronics Inc (台達電) reported record-high revenue of NT$161.61 billion (US$5.11 billion) for last quarter and said it remains positive about this quarter. Last quarter’s figure was up 7.6 percent from the previous quarter and 41.51 percent higher than a year earlier, and largely in line with Yuanta Securities Investment Consulting Co’s (元大投顧) forecast of NT$160 billion. Delta’s annual revenue last year rose 31.76 percent year-on-year to NT$554.89 billion, also a record high for the company. Its strong performance reflected continued demand for high-performance power solutions and advanced liquid-cooling products used in artificial intelligence (AI) data centers,

SIZE MATTERS: TSMC started phasing out 8-inch wafer production last year, while Samsung is more aggressively retiring 8-inch capacity, TrendForce said Chipmakers are expected to raise prices of 8-inch wafers by up to 20 percent this year on concern over supply constraints as major contract chipmakers Taiwan Semiconductor Manufacturing Co (TSMC, 台積電) and Samsung Electronics Co gradually retire less advanced wafer capacity, TrendForce Corp (集邦科技) said yesterday. It is the first significant across-the-board price hike since a global semiconductor correction in 2023, the Taipei-based market researcher said in a report. Global 8-inch wafer capacity slid 0.3 percent year-on-year last year, although 8-inch wafer prices still hovered at relatively stable levels throughout the year, TrendForce said. The downward trend is expected to continue this year,

Vincent Wei led fellow Singaporean farmers around an empty Malaysian plot, laying out plans for a greenhouse and rows of leafy vegetables. What he pitched was not just space for crops, but a lifeline for growers struggling to make ends meet in a city-state with high prices and little vacant land. The future agriculture hub is part of a joint special economic zone launched last year by the two neighbors, expected to cost US$123 million and produce 10,000 tonnes of fresh produce annually. It is attracting Singaporean farmers with promises of cheaper land, labor and energy just over the border.

A proposed billionaires’ tax in California has ignited a political uproar in Silicon Valley, with tech titans threatening to leave the state while California Governor Gavin Newsom of the Democratic Party maneuvers to defeat a levy that he fears would lead to an exodus of wealth. A technology mecca, California has more billionaires than any other US state — a few hundred, by some estimates. About half its personal income tax revenue, a financial backbone in the nearly US$350 billion budget, comes from the top 1 percent of earners. A large healthcare union is attempting to place a proposal before