The nation’s initial public offering (IPO) activity would remain buoyant in the second half of the year, after a rapid pickup in the first half, judging by the number of deals and money raised, consultancy firm Ernst & Young Taiwan (EY Taiwan) said in a semi-annual report released on Thursday.

The first six months saw 27 IPO deals at the Taiwan Stock Exchange (TWSE) and Taipei Exchange (TPEX) markets and together they raised NT$18.4 billion (US$568.78 million), EY Taiwan said, adding that the amount raised more than doubled compared with the same period last year.

The robust showings came even though the global number of IPOs shrank 15 percent from a year earlier to 532 and the money they raised fell 17 percent to US$51.7 billion, EY Taiwan said in the report.

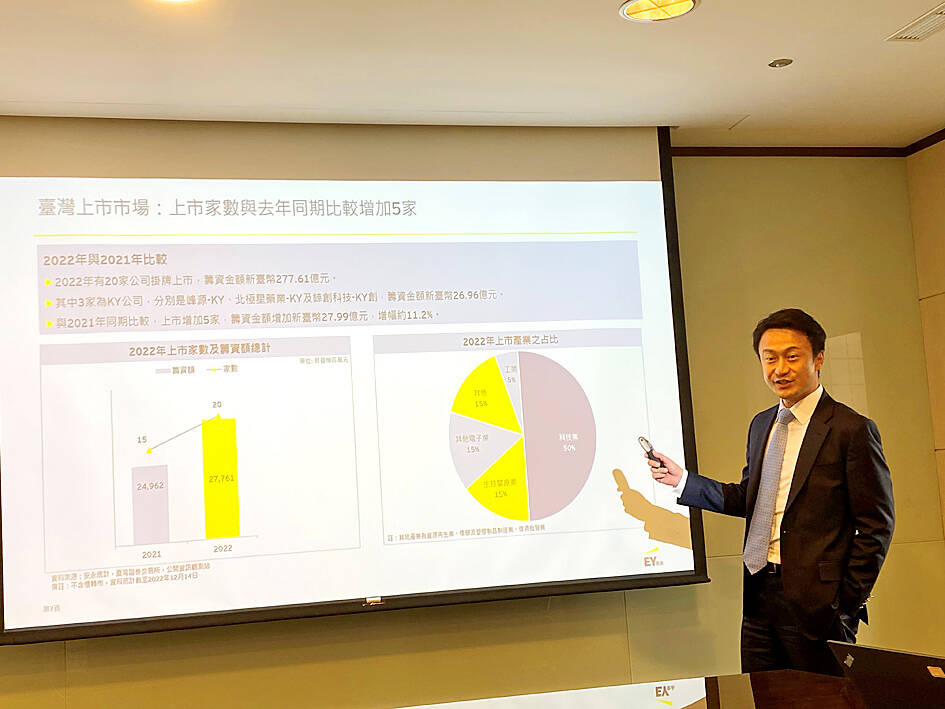

Photo: Clare Cheng, Taipei Times

The markets for Hong Kong and China’s A-shares fared worse, as they reported only 72 IPOs, which raised US$6.2 billion, it showed.

The data represented a decline of 64 percent and 81 percent by measure of deals and funding respectively.

Biotechnology and tech companies underpinned Taiwan’s capital markets and would continue to lend support in the second half, EY Taiwan said.

The mainboard gained 16 new listings that raised a total of NT$12.22 billion, or an increase of seven deals and NT$5.74 billion from a year earlier, it said.

Taichung-based sports shoemaker Lai Yih Group (來億) had the largest IPO with NT$3.3 billion, accounting for 27 percent of the overall amount, it said.

Yunlin-based SuperAlloy Industrial Co (巧新), which supplies forged wheels for major automobile manufacturers including Tesla, Ford and Toyota, was second, raising NT$1.72 billion, or a 14.08 percent share, it added.

The Taipei Exchange added 11 listings, which bagged NT$6.19 billion combined, a drastic increase of 252.33 percent from a year earlier, it said.

Among them, drug maker Alar Pharmaceuticals Inc (昱展) raised the most money at NT$1.68 billion, followed by Jiu Han System Technology Co’s (巨漢) NT$.102 billion, it said.

Additionally, there were 28 emerging stock listings, dominated by firms from biotechnology, information services and industry sectors, it said.

Taiwan’s IPO activity had to do with eager capital inflows to local shares, EY Taiwan said, adding that foreign fund inflows amounted to NT$379 billion last month alone, as investors at home and abroad sought to take part in the artificial intelligence boom.

That explains why the TAIEX has repeatedly made records in recent months, EY Taiwan said.

Investor zeal would be sustained given that 20 firms have filed to list in the TWSE or the TPEX, the consultancy said.

Nvidia Corp chief executive officer Jensen Huang (黃仁勳) on Monday introduced the company’s latest supercomputer platform, featuring six new chips made by Taiwan Semiconductor Manufacturing Co (TSMC, 台積電), saying that it is now “in full production.” “If Vera Rubin is going to be in time for this year, it must be in production by now, and so, today I can tell you that Vera Rubin is in full production,” Huang said during his keynote speech at CES in Las Vegas. The rollout of six concurrent chips for Vera Rubin — the company’s next-generation artificial intelligence (AI) computing platform — marks a strategic

REVENUE PERFORMANCE: Cloud and network products, and electronic components saw strong increases, while smart consumer electronics and computing products fell Hon Hai Precision Industry Co (鴻海精密) yesterday posted 26.51 percent quarterly growth in revenue for last quarter to NT$2.6 trillion (US$82.44 billion), the strongest on record for the period and above expectations, but the company forecast a slight revenue dip this quarter due to seasonal factors. On an annual basis, revenue last quarter grew 22.07 percent, the company said. Analysts on average estimated about NT$2.4 trillion increase. Hon Hai, which assembles servers for Nvidia Corp and iPhones for Apple Inc, is expanding its capacity in the US, adding artificial intelligence (AI) server production in Wisconsin and Texas, where it operates established campuses. This

US President Donald Trump on Friday blocked US photonics firm HieFo Corp’s US$3 million acquisition of assets in New Jersey-based aerospace and defense specialist Emcore Corp, citing national security and China-related concerns. In an order released by the White House, Trump said HieFo was “controlled by a citizen of the People’s Republic of China” and that its 2024 acquisition of Emcore’s businesses led the US president to believe that it might “take action that threatens to impair the national security of the United States.” The order did not name the person or detail Trump’s concerns. “The Transaction is hereby prohibited,”

Garment maker Makalot Industrial Co (聚陽) yesterday reported lower-than-expected fourth-quarter revenue of NT$7.93 billion (US$251.44 million), down 9.48 percent from NT$8.76 billion a year earlier. On a quarterly basis, revenue fell 10.83 percent from NT$8.89 billion, company data showed. The figure was also lower than market expectations of NT$8.05 billion, according to data compiled by Yuanta Securities Investment and Consulting Co (元大投顧), which had projected NT$8.22 billion. Makalot’s revenue this quarter would likely increase by a mid-teens percentage as the industry is entering its high season, Yuanta said. Overall, Makalot’s revenue last year totaled NT$34.43 billion, down 3.08 percent from its record NT$35.52