ASML Holding NV’s new advanced chip machines have a daunting price tag, said Taiwan Semiconductor Manufacturing Co (TSMC, 台積電), one of the Dutch company’s biggest clients.

“The cost is very high,” TSMC senior vice president Kevin Zhang (張曉強) said at a technology symposium in Amsterdam on Tuesday, referring to ASML’s latest system known as high-NA extreme ultraviolet (EUV).

“I like the high-NA EUV’s capability, but I don’t like the sticker price,” Zhang said.

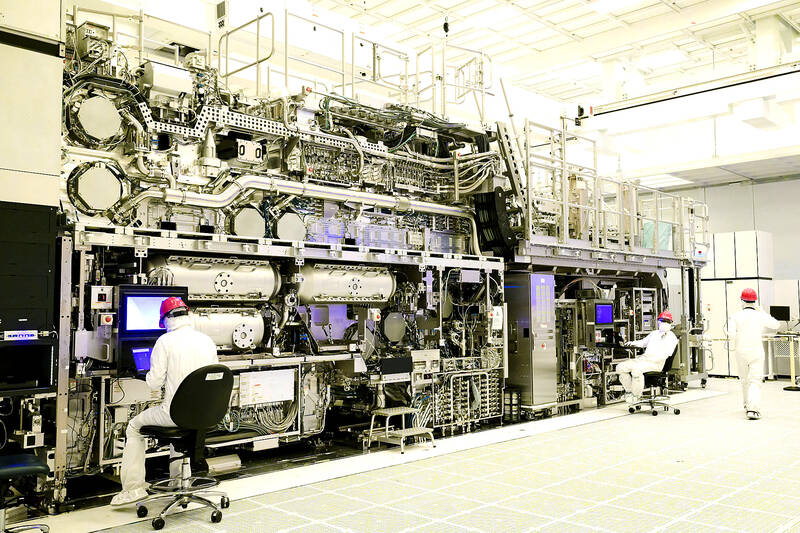

Photo: Intel Corp via Reuters

ASML’s new chip machine can imprint semiconductors with lines that are just 8 nanometers thick — 1.7 times smaller than the previous generation.

The machines cost 350 million euros (US$378 million) apiece and weigh as much as two Airbus A320s.

ASML is the only company that produces equipment needed to make the most sophisticated semiconductors, and demand for its products is a bellwether for the industry’s health.

Intel Corp has already placed orders for the latest high-NA EUV machine and got the first one shipped to a factory in Oregon in late December last year, but it is not yet clear when TSMC would start buying the equipment.

Zhang said TSMC’s so-called A16 node technology, which is due in late 2026, would not need to use ASML’s high-NA EUV machines and can continue to rely on TSMC’s older EUV equipment.

“I think at this point, our existing EUV capability should be able to support that,” he said.

Using the new ASML technology would depend on where it makes the most economic sense and “the technical balancing we can achieve,” Zhang said.

He declined to comment on when the firm would start ordering high-NA EUV machines from ASML.

Rising costs and technical complexity are making the most advanced chipmaking more difficult. Intel faces particular challenges as it tries to regain its once-unshakable technological edge.

It is also pushing into the foundry market — selling outsourced chip manufacturing — an area where TSMC dominates.

Intel on Monday announced a new general manager for its foundry services, already the third chief of the unit since it was founded in 2021.

Zhang said the costs of running a factory, including construction, tools, electricity and raw materials, “keep going up.”

“It’s a collective challenge for the whole industry,” he said.

South Korea’s equity benchmark yesterday crossed a new milestone just a month after surpassing the once-unthinkable 5,000 mark as surging global memory demand powers the country’s biggest chipmakers. The KOSPI advanced as much as 2.6 percent to a record 6,123, with Samsung Electronics Co and SK Hynix Inc each gaining more than 2 percent. With the benchmark now up 45 percent this year, South Korea’s stock market capitalization has also moved past France’s, following last month’s overtaking of Germany’s. Long overlooked by foreign funds, despite being undervalued, South Korean stocks have now emerged as clear winners in the global market. The so-called “artificial intelligence

NEW IDENTITY: Known for its software, India has expanded into hardware, with its semiconductor industry growing from US$38bn in 2023 to US$45bn to US$50bn India on Saturday inaugurated its first semiconductor assembly and test facility, a milestone in the government’s push to reduce dependence on foreign chipmakers and stake a claim in a sector dominated by China. Indian Prime Minister Narendra Modi opened US firm Micron Technology Inc’s semiconductor assembly, test and packaging unit in his home state of Gujarat, hailing the “dawn of a new era” for India’s technology ambitions. “When young Indians look back in the future, they will see this decade as the turning point in our tech future,” Modi told the event, which was broadcast on his YouTube channel. The plant would convert

‘SEISMIC SHIFT’: The researcher forecast there would be about 1.1 billion mobile shipments this year, down from 1.26 billion the prior year and erasing years of gains The global smartphone market is expected to contract 12.9 percent this year due to the unprecedented memorychip shortage, marking “a crisis like no other,” researcher International Data Corp (IDC) said. The new forecast, a dramatic revision down from earlier estimates, gives the latest accounting of the ongoing memory crunch that is affecting every corner of the electronics industry. The demand for advanced memory to power artificial intelligence (AI) tasks has drained global supply until well into next year and jeopardizes the business model of many smartphone makers. IDC forecast about 1.1 billion mobile shipments this year, down from 1.26 billion the prior

People stand in a Pokemon store in Tokyo on Thursday. One of the world highest-grossing franchises is celebrated its 30th anniversary yesterday.