The yen jumped sharply against its peers yesterday after it slid past ¥160 per US dollar earlier in the session, with traders citing US dollar-selling intervention by Japanese banks.

The Japanese currency increased about 2 percent from the initial level of ¥159 per US dollar in a matter of a few minutes during Asian trading, as some traders said they had seen the selling of US dollars onshore.

The rapid move came just a few hours after the yen tumbled to the weaker side of ¥160 per US dollar for the first time in 34 years.

Photo: Kyodo via REUTERS

“It does look like intervention,” ING Groep NV currency strategist Francesco Pesole said. “The recipe, hitting that mark of 160, then it looks like a big chunk of intervention delivered at 5am (London time) ... it just makes sense at this point.”

“It’s a very busy week for markets. I suspect that they might have intervened today and then hoped that data in the US and the Federal Reserve does not turn too much favor for the [US] dollar,” he added.

The US dollar was last down 1.59 percent at ¥155.83, after falling to an intraday low of ¥154.54 in early European trading.

“I won’t comment now,” Japanese Vice Minister of Finance for International Affairs Masato Kanda, the nation’s top currency diplomat, said when asked if authorities had intervened.

The Bank of Japan (BOJ) also did not comment on such moves.

A weak yen could be a boon for Japan’s giant exporters such as Toyota Motor Corp, by boosting the value of their overseas earnings when converted into the yen. However, a weak currency could hurt the economy in the long run, because it reduces purchasing power and possible wage growth.

Japan imports almost all its energy.

In equity markets, Taiwan’s TAIEX surged 1.86 percent to 20,495.52 and South Korea’s KOSPI rose 1.2 percent to 2,687.44. Sydney’s S&P/ASX 200 increased 0.8 percent to 7,637.40, Hong Kong’s Hang Seng Index edged up 0.5 percent to 17,746.91, while the Shanghai Composite Index went up 0.8 percent to 3,113.04.

Trading was closed in Tokyo for a holiday, Showa Day. Japan has a series of holidays coming up known as the Golden Week, through Monday next week.

Meanwhile, European stocks and US futures rose, as investors looked toward the US Federal Reserve’s latest decision tomorrow and US jobs data on Friday.

The market mood was positive after last week’s Wall Street tech-driven rally, SPI Asset Management managing partner Stephen Innes said.

The recent string of strong corporate earnings has boosted market sentiment, but what could be a risk factor is the declining Japanese yen, Innes said.

“Investors will be closely monitoring the latest developments in the remarkable and volatile decline of the Japanese yen against the US dollar and other major currencies,” Innes added.

The BOJ’s decision to keep interest rates unchanged on Friday was in line with expectations, but what was unexpected was the central bank’s apparent lack of significant concern about the exchange rate, Innes said.

Additional reporting by AP

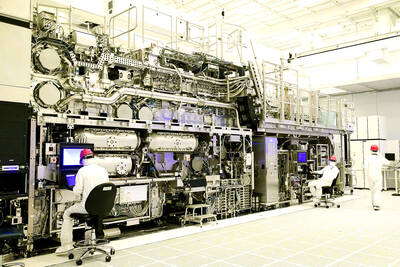

ASML Holding NV’s new advanced chip machines have a daunting price tag, said Taiwan Semiconductor Manufacturing Co (TSMC, 台積電), one of the Dutch company’s biggest clients. “The cost is very high,” TSMC senior vice president Kevin Zhang (張曉強) said at a technology symposium in Amsterdam on Tuesday, referring to ASML’s latest system known as high-NA extreme ultraviolet (EUV). “I like the high-NA EUV’s capability, but I don’t like the sticker price,” Zhang said. ASML’s new chip machine can imprint semiconductors with lines that are just 8 nanometers thick — 1.7 times smaller than the previous generation. The machines cost 350 million euros (US$378 million)

Apple Inc has closed in on an agreement with OpenAI to use the start-up’s technology on the iPhone, part of a broader push to bring artificial intelligence (AI) features to its devices, people familiar with the matter said. The two sides have been finalizing terms for a pact to use ChatGPT features in Apple’s iOS 18, the next iPhone operating system, said the people, who asked not to be identified because the situation is private. Apple also has held talks with Alphabet Inc’s Google about licensing its Gemini chatbot. Those discussions have not led to an agreement, but are ongoing. An OpenAI

INSATIABLE: Almost all AI innovators are working with the chipmaker to address the rapidly growing AI-related demand for energy-efficient computing power, the CEO said Taiwan Semiconductor Manufacturing Co (TSMC, 台積電) yesterday reported about 60 percent annual growth in revenue for last month, benefiting from rapidly growing demand for artificial intelligence (AI) and high-performance computing applications. Revenue last month expanded to NT$236.02 billion (US$7.28 billion), compared with NT$147.9 billion in April last year, the second-highest level in company history, TSMC said in a statement. On a monthly basis, revenue surged 20.9 percent, from NT$195.21 billion in March. As AI-related applications continue to show strong growth, TSMC expects revenue to expand about 27.6 percent year-on-year during the current quarter to between US$19.6 billion and US$20.4 billion. That would

‘FULL SUPPORT’: Kumamoto Governor Takashi Kimura said he hopes more companies would settle in the prefecture to create an area similar to Taiwan’s Hsinchu Science Park The newly elected governor of Japan’s Kumamoto Prefecture said he is ready to ensure wide-ranging support to woo Taiwan Semiconductor Manufacturing Co (TSMC, 台積電) to build its third Japanese chip factory there. Concerns of groundwater shortages when TSMC’s two plants begin operations in the prefecture’s Kikuyo have spurred discussions about the possibility of tapping unused dam water, Kumamoto Governor Takashi Kimura said in an interview on Saturday. While Kimura said talks about a third plant have yet to occur, Bloomberg had reported TSMC is already considering its third Japanese fab — also in Kumamoto — which would make more advanced chips. “We are