Counterfeit products — mainly clothes — cost the European economy 16 billion euros (US$17.42 billion) a year and result in nearly 200,000 lost jobs, the EU Intellectual Property Office said yesterday.

The findings, based on data from 2018 to 2021, show that fakes take the biggest toll on the clothing sector, costing 12 billion euros annually, or 5.2 percent of its overall revenues, the agency said.

Fake cosmetics account for 3 billion euros of losses, while toys represent 1 billion euros, although the office added that “counterfeiting, like any illegal activity, cannot be accurately measured.”

Photo: AFP

It based its findings on the number of items seized by police as well as the percentage of Europeans who admitted to buying counterfeit products in each country in the bloc.

A study from June last year found that one-third of Europeans deemed it acceptable to buy fake goods if the price of the authentic item was deemed too high — a percentage that rose to half of all youth respondents.

The bulk of the counterfeiting occurred in just five EU member states, with Germany, France, Italy, Spain and Austria accounting for half the yearly losses.

Based on the findings, Germany was losing 40,000 jobs a year, Italy 24,000, and France and Spain 15,000 jobs each, the agency said.

Separately, Uniqlo, part of Fast Retailing Co, sued Chinese retailer Shein in Japan, accusing it of copying its popular Round Mini Shoulder Bag.

The entities that operate the Shein brand must immediately cease sales of “imitation products” and compensate for damages, Fast Retailing said in a statement yesterday.

The bag, sold for about ¥1,500 (US$10.23) in Japan, has become a global hit, with Uniqlo warning consumers about counterfeits and similar products being sold online.

Fast Retailing joins rival Hennes & Mauritz AB in suing Shein for copyright infringement in Hong Kong, where litigation aimed at mitigating the threat posed by the Chinese rival has been under way since 2021.

Uniqlo filed the lawsuit against Roadget Business Pte, Fashion Choice Pte and Shein Japan Co on Dec. 28 at the Tokyo District Court.

“The company filed this complaint because it has determined that the form of the imitation products sold by Shein closely resembles that of its own product,” Fast Retailing said in the statement. “The sale of the imitation products by Shein significantly undermines the high level of customer confidence in the quality of the Uniqlo brand and its products.”

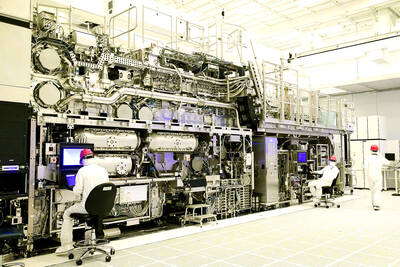

ASML Holding NV’s new advanced chip machines have a daunting price tag, said Taiwan Semiconductor Manufacturing Co (TSMC, 台積電), one of the Dutch company’s biggest clients. “The cost is very high,” TSMC senior vice president Kevin Zhang (張曉強) said at a technology symposium in Amsterdam on Tuesday, referring to ASML’s latest system known as high-NA extreme ultraviolet (EUV). “I like the high-NA EUV’s capability, but I don’t like the sticker price,” Zhang said. ASML’s new chip machine can imprint semiconductors with lines that are just 8 nanometers thick — 1.7 times smaller than the previous generation. The machines cost 350 million euros (US$378 million)

Apple Inc has closed in on an agreement with OpenAI to use the start-up’s technology on the iPhone, part of a broader push to bring artificial intelligence (AI) features to its devices, people familiar with the matter said. The two sides have been finalizing terms for a pact to use ChatGPT features in Apple’s iOS 18, the next iPhone operating system, said the people, who asked not to be identified because the situation is private. Apple also has held talks with Alphabet Inc’s Google about licensing its Gemini chatbot. Those discussions have not led to an agreement, but are ongoing. An OpenAI

INSATIABLE: Almost all AI innovators are working with the chipmaker to address the rapidly growing AI-related demand for energy-efficient computing power, the CEO said Taiwan Semiconductor Manufacturing Co (TSMC, 台積電) yesterday reported about 60 percent annual growth in revenue for last month, benefiting from rapidly growing demand for artificial intelligence (AI) and high-performance computing applications. Revenue last month expanded to NT$236.02 billion (US$7.28 billion), compared with NT$147.9 billion in April last year, the second-highest level in company history, TSMC said in a statement. On a monthly basis, revenue surged 20.9 percent, from NT$195.21 billion in March. As AI-related applications continue to show strong growth, TSMC expects revenue to expand about 27.6 percent year-on-year during the current quarter to between US$19.6 billion and US$20.4 billion. That would

‘FULL SUPPORT’: Kumamoto Governor Takashi Kimura said he hopes more companies would settle in the prefecture to create an area similar to Taiwan’s Hsinchu Science Park The newly elected governor of Japan’s Kumamoto Prefecture said he is ready to ensure wide-ranging support to woo Taiwan Semiconductor Manufacturing Co (TSMC, 台積電) to build its third Japanese chip factory there. Concerns of groundwater shortages when TSMC’s two plants begin operations in the prefecture’s Kikuyo have spurred discussions about the possibility of tapping unused dam water, Kumamoto Governor Takashi Kimura said in an interview on Saturday. While Kimura said talks about a third plant have yet to occur, Bloomberg had reported TSMC is already considering its third Japanese fab — also in Kumamoto — which would make more advanced chips. “We are