The Web site of Hon Hai Technology Group’s (鴻海科技集團) semiconductor parts manufacturing affiliate Foxsemicon Integrated Technology Inc (京鼎精密) yesterday appeared to have been hijacked by a ransomware group, displaying a message threatening to release the personal information of the company’s customers and employees.

It is the first time a major local business has been targeted in a Web site defacement attack.

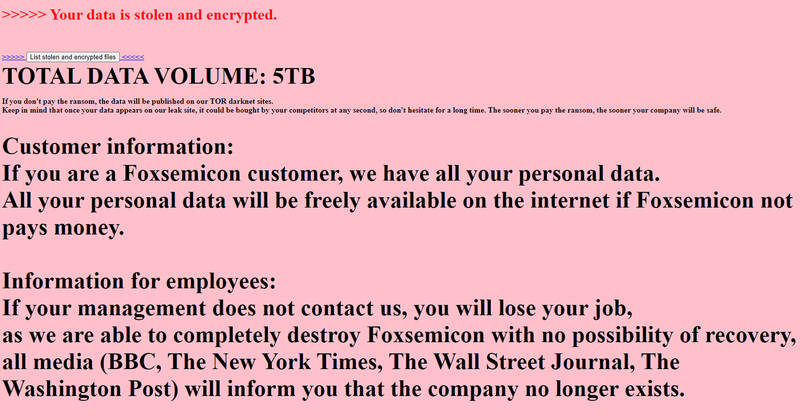

“Your data is stolen and encrypted,” a message at the top of Foxsemicon’s Web site stated, adding that it held 5 terabytes of the company’s information and would publish it online if a ransom was not paid.

Photo: screen grab from Foxsemicon Integrated Technology Inc’s Web site

“If you are a Foxsemicon customer, we have all your personal data,” it said. “All your personal data will be freely available on the Internet if Foxsemicon not pays [sic] money.”

It also included a threatening message for employees of the semiconductor equipment company.

“If your management does not contact us, you will lose your job, as we are able to completely destroy Foxsemicon with no possibility of recovery,” it said.

Photo: CNA

In a company statement submitted to the Taiwan Stock Exchange, Foxsemicon said it recovered its Web site in the afternoon, soon after detecting the attack, adding that it was working with security experts.

However, as of press time last night, the firm’s English-language Web site remained inaccessible, displaying the ransomware message, while many portions of its Mandarin-language site, including corporate information and financial statements, also appeared to be inaccessible.

The company’s preliminary assessment showed that the incident should not significantly affect its operations, Foxsemicon said in the statement.

The company did not disclose any information about the ransom demanded by the hackers. It also did not state whether any personal information of its customers or employees was leaked.

Foxsemicon is about 15.22 percent owned by Hon Hai through its subsidiaries. Applied Materials Taiwan (台灣應用材料) holds an 8.36 percent share in the company.

Global weekly cyberattacks rose 3 percent annually during the first three quarters of last year, a report released by Check Point Research showed.

Taiwan was the most hacked area with an average of 1,509 attacks per week.

Nvidia Corp chief executive officer Jensen Huang (黃仁勳) on Monday introduced the company’s latest supercomputer platform, featuring six new chips made by Taiwan Semiconductor Manufacturing Co (TSMC, 台積電), saying that it is now “in full production.” “If Vera Rubin is going to be in time for this year, it must be in production by now, and so, today I can tell you that Vera Rubin is in full production,” Huang said during his keynote speech at CES in Las Vegas. The rollout of six concurrent chips for Vera Rubin — the company’s next-generation artificial intelligence (AI) computing platform — marks a strategic

REVENUE PERFORMANCE: Cloud and network products, and electronic components saw strong increases, while smart consumer electronics and computing products fell Hon Hai Precision Industry Co (鴻海精密) yesterday posted 26.51 percent quarterly growth in revenue for last quarter to NT$2.6 trillion (US$82.44 billion), the strongest on record for the period and above expectations, but the company forecast a slight revenue dip this quarter due to seasonal factors. On an annual basis, revenue last quarter grew 22.07 percent, the company said. Analysts on average estimated about NT$2.4 trillion increase. Hon Hai, which assembles servers for Nvidia Corp and iPhones for Apple Inc, is expanding its capacity in the US, adding artificial intelligence (AI) server production in Wisconsin and Texas, where it operates established campuses. This

US President Donald Trump on Friday blocked US photonics firm HieFo Corp’s US$3 million acquisition of assets in New Jersey-based aerospace and defense specialist Emcore Corp, citing national security and China-related concerns. In an order released by the White House, Trump said HieFo was “controlled by a citizen of the People’s Republic of China” and that its 2024 acquisition of Emcore’s businesses led the US president to believe that it might “take action that threatens to impair the national security of the United States.” The order did not name the person or detail Trump’s concerns. “The Transaction is hereby prohibited,”

Garment maker Makalot Industrial Co (聚陽) yesterday reported lower-than-expected fourth-quarter revenue of NT$7.93 billion (US$251.44 million), down 9.48 percent from NT$8.76 billion a year earlier. On a quarterly basis, revenue fell 10.83 percent from NT$8.89 billion, company data showed. The figure was also lower than market expectations of NT$8.05 billion, according to data compiled by Yuanta Securities Investment and Consulting Co (元大投顧), which had projected NT$8.22 billion. Makalot’s revenue this quarter would likely increase by a mid-teens percentage as the industry is entering its high season, Yuanta said. Overall, Makalot’s revenue last year totaled NT$34.43 billion, down 3.08 percent from its record NT$35.52