China’s factory activity last month shrank to its lowest level in six months, fueling expectations that the Chinese government might have to act soon to add impetus to the economy.

The official manufacturing purchasing managers’ index (PMI) declined to 49, the Chinese National Bureau of Statistics (NBS) said in a statement yesterday.

That was weaker than the median forecast of 49.6 by economists in a Bloomberg survey, and matched the reading seen in June.

Photo: Reuters

A gauge of non-manufacturing activity rose to 50.4 from 50.2 in November, boosted by expansion in the construction sector as government-led infrastructure investment accelerated in recent months.

On the other hand, services activity continued to contract with an underlying measure staying at 49.3.

Any reading above the 50 mark suggests an expansion from the previous month, while a figure below that denotes a contraction.

The PMI figures provided more signs of weakness in China’s economic recovery in the final months of last year. They are also likely to add pressure on fiscal and monetary policymakers to act urgently, after leaders vowed to maintain a pro-growth stance this year.

“The weaker-than-expected PMI data showed growth momentum has declined further amid a low season and the cold weather,” Australia and New Zealand Banking Group Ltd senior strategist Xing Zhaopeng (邢兆鵬) said. “We can’t rule out the possibility that the [Chinese] central bank may cut rates in early January.”

Bureau analyst Zhao Qinghe (趙清河) said in a separate statement that “falling overseas orders coupled with insufficient effective domestic demand” was the biggest trouble reported by some companies in the official PMI survey.

The textile and non-metal mineral product sectors were unable to make use of their full capacity due to subdued demand, Zhao added.

Weak demand and sluggish confidence have also been reflected in deepening consumer price deflation and shrinking imports. The worst property downturn in modern China is expected to persist, which could further curb demand for goods from furniture to home appliances.

A subindex for factories’ new orders fell to 48.7 as demand weakened, while a gauge measuring new export orders contracted to 45.8.

For non-manufacturing sectors, a gauge of construction activity climbed to 56.9 from 55 in November, the NBS said. Some analysts had expected construction momentum to remain robust as Beijing stepped up its efforts to build more infrastructure projects with extra bond issuances.

Some services industries, such as air transport, and lodging and household services lost steam as consumers reduced travel due to cold weather, Zhao said.

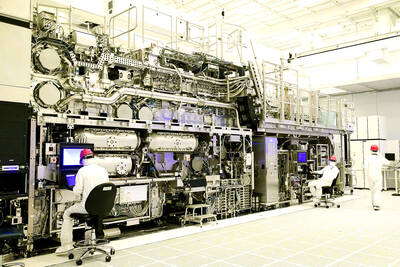

ASML Holding NV’s new advanced chip machines have a daunting price tag, said Taiwan Semiconductor Manufacturing Co (TSMC, 台積電), one of the Dutch company’s biggest clients. “The cost is very high,” TSMC senior vice president Kevin Zhang (張曉強) said at a technology symposium in Amsterdam on Tuesday, referring to ASML’s latest system known as high-NA extreme ultraviolet (EUV). “I like the high-NA EUV’s capability, but I don’t like the sticker price,” Zhang said. ASML’s new chip machine can imprint semiconductors with lines that are just 8 nanometers thick — 1.7 times smaller than the previous generation. The machines cost 350 million euros (US$378 million)

Apple Inc has closed in on an agreement with OpenAI to use the start-up’s technology on the iPhone, part of a broader push to bring artificial intelligence (AI) features to its devices, people familiar with the matter said. The two sides have been finalizing terms for a pact to use ChatGPT features in Apple’s iOS 18, the next iPhone operating system, said the people, who asked not to be identified because the situation is private. Apple also has held talks with Alphabet Inc’s Google about licensing its Gemini chatbot. Those discussions have not led to an agreement, but are ongoing. An OpenAI

INSATIABLE: Almost all AI innovators are working with the chipmaker to address the rapidly growing AI-related demand for energy-efficient computing power, the CEO said Taiwan Semiconductor Manufacturing Co (TSMC, 台積電) yesterday reported about 60 percent annual growth in revenue for last month, benefiting from rapidly growing demand for artificial intelligence (AI) and high-performance computing applications. Revenue last month expanded to NT$236.02 billion (US$7.28 billion), compared with NT$147.9 billion in April last year, the second-highest level in company history, TSMC said in a statement. On a monthly basis, revenue surged 20.9 percent, from NT$195.21 billion in March. As AI-related applications continue to show strong growth, TSMC expects revenue to expand about 27.6 percent year-on-year during the current quarter to between US$19.6 billion and US$20.4 billion. That would

‘FULL SUPPORT’: Kumamoto Governor Takashi Kimura said he hopes more companies would settle in the prefecture to create an area similar to Taiwan’s Hsinchu Science Park The newly elected governor of Japan’s Kumamoto Prefecture said he is ready to ensure wide-ranging support to woo Taiwan Semiconductor Manufacturing Co (TSMC, 台積電) to build its third Japanese chip factory there. Concerns of groundwater shortages when TSMC’s two plants begin operations in the prefecture’s Kikuyo have spurred discussions about the possibility of tapping unused dam water, Kumamoto Governor Takashi Kimura said in an interview on Saturday. While Kimura said talks about a third plant have yet to occur, Bloomberg had reported TSMC is already considering its third Japanese fab — also in Kumamoto — which would make more advanced chips. “We are