Nvidia Corp is using Arm Holdings PLC technology to develop chips that would challenge Intel Corp processors in PCs, ratcheting up competition between the two semiconductor makers, people familiar with the situation said.

Nvidia, whose artificial intelligence (AI) accelerator chips already dominate that market, is attempting to make central processing units (CPUs) for PCs, said the people, who asked not to be identified because the matter is private.

The CPUs would support Microsoft Corp’s Windows operating system and go on sale as soon as 2025.

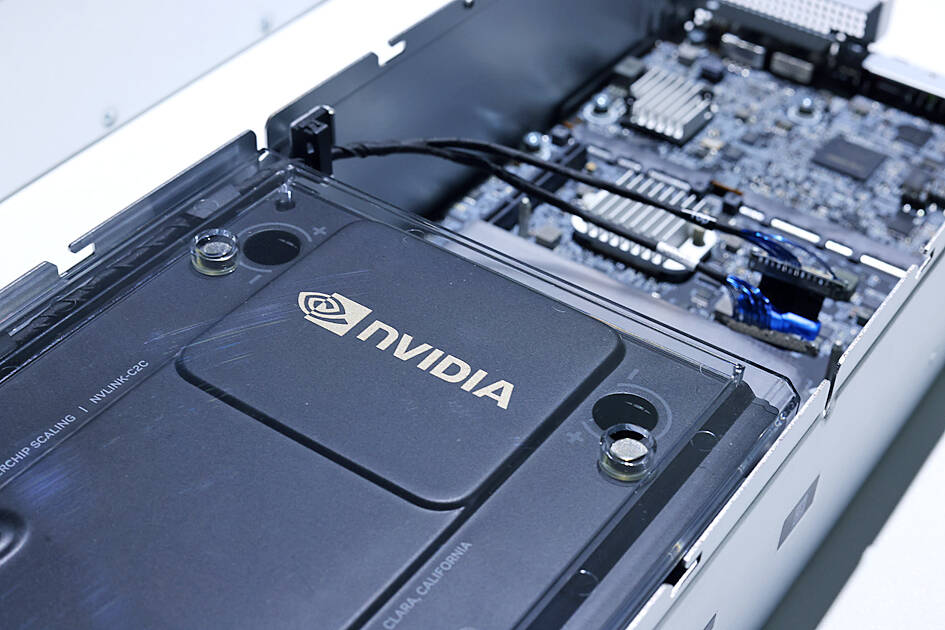

Photo: Ritchie B. Tongo, EPA-EFE

Intel’s main rival in PCs, Advanced Micro Devices Inc (AMD), is also working on Arm-based processors, according to the people. AMD currently licenses Intel’s technology.

It is not the first attempt to use Arm technology — common on smartphones — to crack the PC processor industry. A number of companies have made a run at traditional PC processors over the years with little impact.

Windows RT, which Microsoft announced in 2011 at CES, formerly known as the Consumer Electronics Show, was designed to run on Arm designs. The first of Microsoft’s Surface devices was based on that operating system and used an Nvidia Tegra chip, but the those early models did not catch on with consumers.

Apple Inc has provided a more recent model for how to replace Intel technology. The company switched from using Intel processors in its Mac computers with in-house designs that are based on Arm’s standards. It has credited the change with boosting Mac sales.

Qualcomm Inc, the biggest maker of phone chips, is the only other maker of Arm-based chips for Windows-based PCs.

Representatives of AMD, Arm and Nvidia declined to comment.

CHIP RACE: Three years of overbroad export controls drove foreign competitors to pursue their own AI chips, and ‘cost US taxpayers billions of dollars,’ Nvidia said China has figured out the US strategy for allowing it to buy Nvidia Corp’s H200s and is rejecting the artificial intelligence (AI) chip in favor of domestically developed semiconductors, White House AI adviser David Sacks said, citing news reports. US President Donald Trump on Monday said that he would allow shipments of Nvidia’s H200 chips to China, part of an administration effort backed by Sacks to challenge Chinese tech champions such as Huawei Technologies Co (華為) by bringing US competition to their home market. On Friday, Sacks signaled that he was uncertain about whether that approach would work. “They’re rejecting our chips,” Sacks

Taiwan’s exports soared 56 percent year-on-year to an all-time high of US$64.05 billion last month, propelled by surging global demand for artificial intelligence (AI), high-performance computing and cloud service infrastructure, the Ministry of Finance said yesterday. Department of Statistics Director-General Beatrice Tsai (蔡美娜) called the figure an unexpected upside surprise, citing a wave of technology orders from overseas customers alongside the usual year-end shopping season for technology products. Growth is likely to remain strong this month, she said, projecting a 40 percent to 45 percent expansion on an annual basis. The outperformance could prompt the Directorate-General of Budget, Accounting and

NATIONAL SECURITY: Intel’s testing of ACM tools despite US government control ‘highlights egregious gaps in US technology protection policies,’ a former official said Chipmaker Intel Corp has tested chipmaking tools this year from a toolmaker with deep roots in China and two overseas units that were targeted by US sanctions, according to two sources with direct knowledge of the matter. Intel, which fended off calls for its CEO’s resignation from US President Donald Trump in August over his alleged ties to China, got the tools from ACM Research Inc, a Fremont, California-based producer of chipmaking equipment. Two of ACM’s units, based in Shanghai and South Korea, were among a number of firms barred last year from receiving US technology over claims they have

BARRIERS: Gudeng’s chairman said it was unlikely that the US could replicate Taiwan’s science parks in Arizona, given its strict immigration policies and cultural differences Gudeng Precision Industrial Co (家登), which supplies wafer pods to the world’s major semiconductor firms, yesterday said it is in no rush to set up production in the US due to high costs. The company supplies its customers through a warehouse in Arizona jointly operated by TSS Holdings Ltd (德鑫控股), a joint holding of Gudeng and 17 Taiwanese firms in the semiconductor supply chain, including specialty plastic compounds producer Nytex Composites Co (耐特) and automated material handling system supplier Symtek Automation Asia Co (迅得). While the company has long been exploring the feasibility of setting up production in the US to address