Hong Kong is betting free alcohol and longer shopping hours can revive the territor’s once-bustling nightlife.

The government has been in discussions with major property groups to encourage them to roll out measures to boost the nighttime economy, including extending mall operating hours, said Allan Zeman, a nightclub baron and adviser to Hong Kong Chief Executive John Lee (李家超).

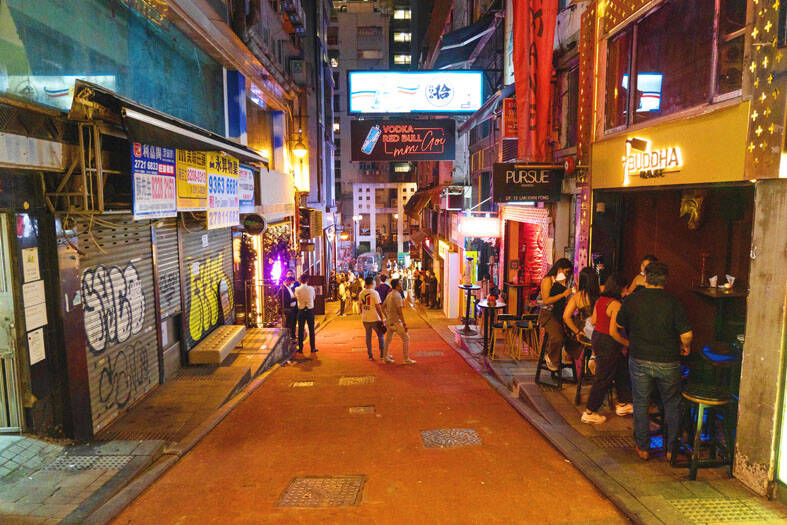

Lan Kwai Fong Holdings Ltd (蘭桂坊集團), which owns the bulk of Hong Kong’s largest party district, plans to offer flash discounts on some weekday evenings next month and set up street performances by DJs, Zeman said.

Photo: Bloomberg

Other property firms say they are going to distribute drink and shopping vouchers, and hold nighttime events in the push to reignite sluggish tourism and consumer sectors hurt by COVID-19.

This year was meant to herald Hong Kong’s grand reopening to the world after final virus curbs were scrapped and cross-border travel with China fully resumed.

However, officials’ “Hello Hong Kong” campaign to entice tourists is falling flat, and instead of throngs of shoppers and club-goers, the territory’s best-known retail and nightlife districts are a shadow of their former selves.

Domestic pressures are also mounting. Harsh COVID-19 controls and the National Security Law have sparked a wave of emigration since 2020, and residents are flocking to holiday hotspots such as Thailand and Japan or splashing their cash on day trips to Shenzhen.

“The vanished night economy is a symptom of a deeper problem that Hong Kong is facing,” Natixis SA senior economist Gary Ng (吳卓殷) said.

While “regional peers focused on improving tourism quality in the past two years, Hong Kong was busy thinking and spending resources on how to restrict mobility,” meaning the territory might find it hard to regain its competitiveness, he said.

Hong Kong’s tourist arrivals in the first half of this year were about 37 percent of pre-COVID-19 levels, compared with 57 percent for the neighboring casino hub of Macau, official statistics showed.

Yet there are signs of an uptick, with Hong Kong hitting 53 percent of 2019 levels in June and Macau reaching 71 percent.

Still, about 80 percent of Hong Kong’s arrivals come from China and those visitors are grappling with a worsening economic outlook and a weak yuan that is eroding their consumer confidence, according to Michael Cheng (鄭煥然), China and Hong Kong consumer markets leader for PwC Asia Pacific.

Some venues are managing to weather the downturn.

Zeman said his group’s business, which is largely concentrated on bars and restaurants in tourist areas of Hong Kong, has been recovering well, and some tenants are seeing year-to-date sales that exceed pre-COVID-19 levels by as much as 20 percent.

Yet many others, particularly those operating outside of the central areas popular with visitors, are struggling. Castelo Concepts shut nine of its 14 Hong Kong restaurants in July as it entered liquidation.

Louie Chung (鍾思朗), owner of Lubuds, which operates more than 40 restaurants across Hong Kong including in more residential neighborhoods, said that revenue last month registered a double-digit drop from a year earlier.

“The evening business in July and August is the quietest in my 17 years in the food and drinks industry,” Chung said.

For the territory as a whole, sales from restaurants’ evening dine-in operations last month and this month plunged an average of 30 percent year-on-year, partly due to more residents heading to Chinese cities for weekend visits or even just after-work shopping and eating, Hong Kong Federation of Restaurants and Related Trades president Simon Wong (黃家和) said.

That is spurring the effort to get people into bars, restaurants and shopping malls. Chinachem Group (華懋集團) is hosting a three-day music festival at Central Market, a historic building near the heart of the financial district that was reopened in 2021 as a cultural and retail hub. The venue, which usually closes at 10pm, is to ask bars to stay open until midnight for the event.

Meanwhile, Robert Ng’s (黃志祥) Sino Land Co (信和置業) is planning to distribute 10,000 vouchers for free drinks for people who spend a certain amount of money at its malls after 8pm. Henry Cheng’s (鄭家純) New World Development Co (新世界發展) is also considering extending its malls’ operating hours and hosting events at night to attract customers, while Lee Shau-Kee’s (李兆基) Henderson Land Development Co (恆基地產) plans to give out shopping vouchers.

However, those efforts, however, are unlikely to be enough to address the core hurdle Hong Kong’s retail and food and beverage industries face, Ng said.

“The night economy is demand-driven,” he said. “If there is no demand, no measure the government is taking right now can boost it.”

Greek tourism student Katerina quit within a month of starting work at a five-star hotel in Halkidiki, one of the country’s top destinations, because she said conditions were so dire. Beyond the bad pay, the 22-year-old said that her working and living conditions were “miserable and unacceptable.” Millions holiday in Greece every year, but its vital tourism industry is finding it harder and harder to recruit Greeks to look after them. “I was asked to work in any department of the hotel where there was a need, from service to cleaning,” said Katerina, a tourism and marketing student, who would

i Gasoline and diesel prices at fuel stations are this week to rise NT$0.1 per liter, as tensions in the Middle East pushed crude oil prices higher last week, CPC Corp, Taiwan (台灣中油) and Formosa Petrochemical Corp (台塑石化) said yesterday. International crude oil prices last week rose for the third consecutive week due to an escalating conflict between Israel and Iran, as the market is concerned that the situation in the Middle East might affect crude oil supply, CPC and Formosa said in separate statements. Front-month Brent crude oil futures — the international oil benchmark — rose 3.75 percent to settle at US$77.01

Merida Industry Co (美利達) has seen signs of recovery in the US and European markets this year, as customers are gradually depleting their inventories, the bicycle maker told shareholders yesterday. Given robust growth in new orders at its Taiwanese factory, coupled with its subsidiaries’ improving performance, Merida said it remains confident about the bicycle market’s prospects and expects steady growth in its core business this year. CAUTION ON CHINA However, the company must handle the Chinese market with great caution, as sales of road bikes there have declined significantly, affecting its revenue and profitability, Merida said in a statement, adding that it would

UNCERTAINTIES: The world’s biggest chip packager and tester is closely monitoring the US’ tariff policy before making any capacity adjustments, a company official said ASE Technology Holding Inc (日月光投控), the world’s biggest chip packager and tester, yesterday said it is cautiously evaluating new advanced packaging capacity expansion in the US in response to customers’ requests amid uncertainties about the US’ tariff policy. Compared with its semiconductor peers, ASE has been relatively prudent about building new capacity in the US. However, the company is adjusting its global manufacturing footprint expansion after US President Donald Trump announced “reciprocal” tariffs in April, and new import duties targeting semiconductors and other items that are vital to national security. ASE subsidiary Siliconware Precision Industries Co (SPIL, 矽品精密) is participating in Nvidia