Nanya Technology Corp (南亞科技) yesterday reduced its capital expenditure by about 19 percent for this year after posting its third straight quarterly loss last quarter, as chip prices dipped for the fifth quarter in a row due to oversupply and flagging demand.

The New Taipei City-based DRAM chipmaker expects its average selling price to drop slightly this quarter from last quarter, following a low single-digit percent decline last quarter.

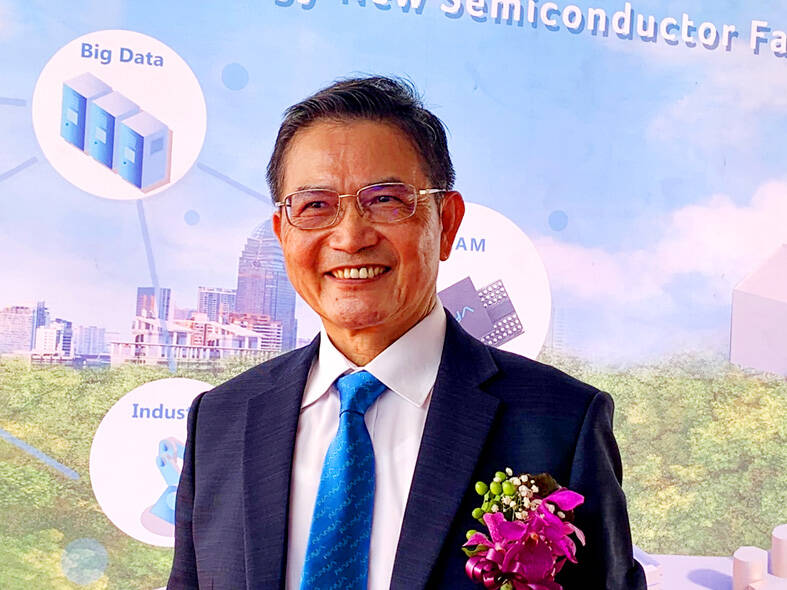

“We have a mixed picture for the third quarter. Prices for some products are picking up mildly, while some are declining,” Nanya Technology president Lee Pei-ing (李培瑛) told a virtual media briefing.

Photo: Grace Hung, Taipei Times

The DRAM industry is bottoming out judging by positive signs such as slower price declines and slight increases in chip demand, Lee said.

Overall DRAM supply and demand would begin to balance out in the fourth quarter after all suppliers have adjusted their output and capital spending downward, he said.

The company would be flexible about its factory utilization in the second half of this year if customer demand worsens, given the escalating US-China technology dispute and macroeconomic uncertainty, Lee said.

However, Nanya Technology said that it did not expect China’s curb on germanium exports to have a major impact, considering the small portion of the metal it consumes and because there are alternative suppliers outside of China.

The company yesterday reduced its capital spending for this year to NT$15 billion, compared with the NT$18.5 billion it projected at the beginning of this year.

That represents an annual contraction of 28 percent from the NT$20.7 billion it spent last year.

The bulk of this year’s budget would be spent on next-generation DRAM technology, with half of the amount earmarked for the construction of facilities, the company said.

Nanya Technology’s second-quarter losses narrowed to NT$771 million, compared with losses of NT$1.69 billion in the first quarter, thanks mainly to foreign-exchange gains of NT$258 million and NT$722 million in tax rebates, it said.

Operating losses widened to NT$3.19 billion last quarter from NT$2.89 billion the previous quarter, the chipmaker said.

Gross margin worsened to minus-11.2 percent last quarter from minus-8.6 percent in the first quarter. Nanya Technology attributed the deterioration to a low single-digit percent quarterly decline in its average selling price, costs from lower utilization and inventory write-offs.

Gross margin this quarter would continue to face pressure, Lee said.

Nanya Technology has continued to upgrade its technology profile despite the DRAM slump, as it is on track to make its new DRAM DDR5 product available to customers in the middle of next year, Lee said.

The new product would be made using the company’s second generation, 10-nanometer-class, or 1B, technology, he said.

SEMICONDUCTORS: The German laser and plasma generator company will expand its local services as its specialized offerings support Taiwan’s semiconductor industries Trumpf SE + Co KG, a global leader in supplying laser technology and plasma generators used in chip production, is expanding its investments in Taiwan in an effort to deeply integrate into the global semiconductor supply chain in the pursuit of growth. The company, headquartered in Ditzingen, Germany, has invested significantly in a newly inaugurated regional technical center for plasma generators in Taoyuan, its latest expansion in Taiwan after being engaged in various industries for more than 25 years. The center, the first of its kind Trumpf built outside Germany, aims to serve customers from Taiwan, Japan, Southeast Asia and South Korea,

Nvidia Corp chief executive officer Jensen Huang (黃仁勳) on Monday introduced the company’s latest supercomputer platform, featuring six new chips made by Taiwan Semiconductor Manufacturing Co (TSMC, 台積電), saying that it is now “in full production.” “If Vera Rubin is going to be in time for this year, it must be in production by now, and so, today I can tell you that Vera Rubin is in full production,” Huang said during his keynote speech at CES in Las Vegas. The rollout of six concurrent chips for Vera Rubin — the company’s next-generation artificial intelligence (AI) computing platform — marks a strategic

Gasoline and diesel prices at domestic fuel stations are to fall NT$0.2 per liter this week, down for a second consecutive week, CPC Corp, Taiwan (台灣中油) and Formosa Petrochemical Corp (台塑石化) announced yesterday. Effective today, gasoline prices at CPC and Formosa stations are to drop to NT$26.4, NT$27.9 and NT$29.9 per liter for 92, 95 and 98-octane unleaded gasoline respectively, the companies said in separate statements. The price of premium diesel is to fall to NT$24.8 per liter at CPC stations and NT$24.6 at Formosa pumps, they said. The price adjustments came even as international crude oil prices rose last week, as traders

Taiwan Semiconductor Manufacturing Co (TSMC, 台積電), which supplies advanced chips to Nvidia Corp and Apple Inc, yesterday reported NT$1.046 trillion (US$33.1 billion) in revenue for last quarter, driven by constantly strong demand for artificial intelligence (AI) chips, falling in the upper end of its forecast. Based on TSMC’s financial guidance, revenue would expand about 22 percent sequentially to the range from US$32.2 billion to US$33.4 billion during the final quarter of 2024, it told investors in October last year. Last year in total, revenue jumped 31.61 percent to NT$3.81 trillion, compared with NT$2.89 trillion generated in the year before, according to