Aston Martin Lagonda Global Holdings PLC is tying up with Lucid Group Inc on electric vehicle (EV) technology, uniting the storied British automaker and relative newcomer both backed by Saudi Arabia’s sovereign wealth fund.

Aston Martin is to issue new shares to Lucid and make cash payments totaling US$232 million in exchange for battery-electric powertrain components, the company said in a statement yesterday.

The UK manufacturer also extended a longtime cooperation agreement with Mercedes-Benz Group AG, though it would no longer issue more shares to the German company that already owns an about 9 percent stake.

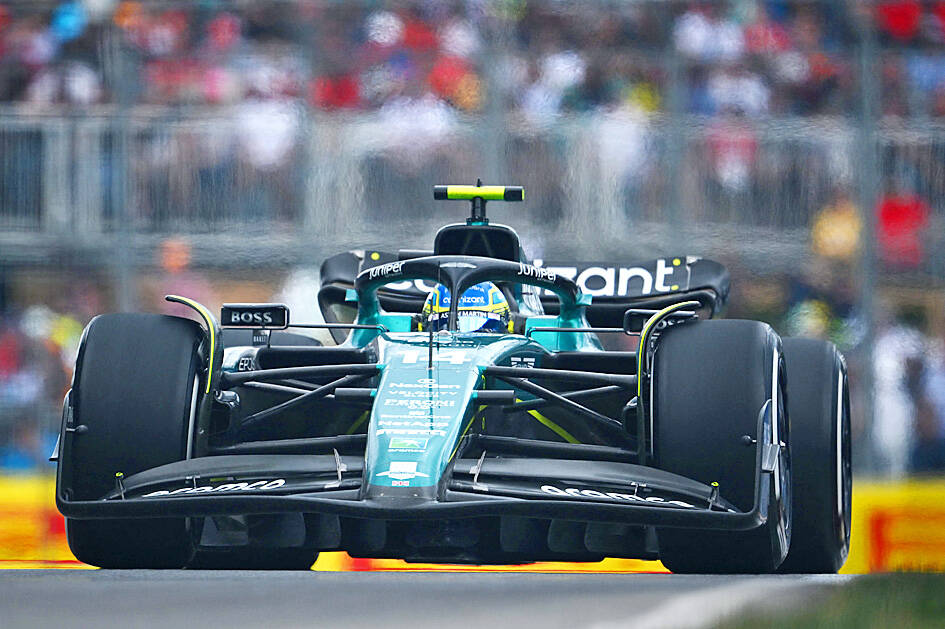

Photo: AFP

The announcements sent Aston Martin shares surging as much as 15 percent, their biggest intraday jump in more than one month.

“The proposed supply agreement with Lucid is a game changer for the future EV-led growth of Aston Martin,” chairman Lawrence Stroll said in a statement. “Based on our strategy and requirements, we selected Lucid, gaining access to the industry’s highest-performance and most innovative technologies for our future BEV products.”

Stroll, 63, is three years into an effort to turn around the British automaker with a long history of financial trouble. Aston Martin has needed several capital raises since he threw the company a lifeline in early 2020, the most recent of which have made China’s Zhejiang Geely Holding Group Co (吉利控股集團) and Saudi Arabia’s Public Investment Fund major shareholders.

The Public Investment Fund owns about 49 percent of Lucid and 18 percent of Aston Martin, according to data compiled by Bloomberg.

Aston Martin’s financial woes have made it increasingly reliant on partners for technology that other automakers consider core to their products. Models including the DBX sport utility vehicle and DB12 sports car are powered by Mercedes engines.

Going forward, Aston Martin is to discuss future access to technology from Mercedes and would pay for it in cash, scrapping plans to issue more shares to its partner over the next year.

The Lucid deal would help Aston Martin toward its ambitious electrification targets. The automaker plans to launch its first plug-in hybrid super car, the Valhalla, early next year and its first battery-electric vehicle in 2025.

Aston Martin is to make phased cash payments to Lucid totaling US$132 million and has committed to spending at least US$225 million on the EV maker’s powertrain components.

The company would also pay another US$10 million to Lucid for integrating its technology into its vehicles.

Greek tourism student Katerina quit within a month of starting work at a five-star hotel in Halkidiki, one of the country’s top destinations, because she said conditions were so dire. Beyond the bad pay, the 22-year-old said that her working and living conditions were “miserable and unacceptable.” Millions holiday in Greece every year, but its vital tourism industry is finding it harder and harder to recruit Greeks to look after them. “I was asked to work in any department of the hotel where there was a need, from service to cleaning,” said Katerina, a tourism and marketing student, who would

i Gasoline and diesel prices at fuel stations are this week to rise NT$0.1 per liter, as tensions in the Middle East pushed crude oil prices higher last week, CPC Corp, Taiwan (台灣中油) and Formosa Petrochemical Corp (台塑石化) said yesterday. International crude oil prices last week rose for the third consecutive week due to an escalating conflict between Israel and Iran, as the market is concerned that the situation in the Middle East might affect crude oil supply, CPC and Formosa said in separate statements. Front-month Brent crude oil futures — the international oil benchmark — rose 3.75 percent to settle at US$77.01

Merida Industry Co (美利達) has seen signs of recovery in the US and European markets this year, as customers are gradually depleting their inventories, the bicycle maker told shareholders yesterday. Given robust growth in new orders at its Taiwanese factory, coupled with its subsidiaries’ improving performance, Merida said it remains confident about the bicycle market’s prospects and expects steady growth in its core business this year. CAUTION ON CHINA However, the company must handle the Chinese market with great caution, as sales of road bikes there have declined significantly, affecting its revenue and profitability, Merida said in a statement, adding that it would

UNCERTAINTIES: The world’s biggest chip packager and tester is closely monitoring the US’ tariff policy before making any capacity adjustments, a company official said ASE Technology Holding Inc (日月光投控), the world’s biggest chip packager and tester, yesterday said it is cautiously evaluating new advanced packaging capacity expansion in the US in response to customers’ requests amid uncertainties about the US’ tariff policy. Compared with its semiconductor peers, ASE has been relatively prudent about building new capacity in the US. However, the company is adjusting its global manufacturing footprint expansion after US President Donald Trump announced “reciprocal” tariffs in April, and new import duties targeting semiconductors and other items that are vital to national security. ASE subsidiary Siliconware Precision Industries Co (SPIL, 矽品精密) is participating in Nvidia