The European luxury sector is welcoming the end of pandemic lockdowns in China, as the return of big-spending Chinese tourists could sustain further growth.

Prior to the pandemic, Chinese tourists visiting Europe were a major source of sales for luxury houses. The Chinese accounted for “a third of luxury purchases in the world and two-thirds of those purchases were made outside China”, said Joelle de Montgolfier, head of the luxury division at management consulting firm Bain & Co.

Their return has led RBC Bank to revise up its growth forecast for the sector this year to 11 percent, from 7 percent previously.

Photo: Reuters

“China reopening is one of the key ‘mega-themes’ for the luxury sector in 2023,” RBC Bank said in a recent note to clients.

After a drop in 2020, the luxury sector managed to surpass its pre-pandemic sales in 2021.

“The Chinese consumed, but only in China,” Bain’s De Montgolfier said.

Photo: Bloomberg

“In 2022, it was much more complicated with unexpected confinements in the country,” she added.

Nevertheless, that did not hold the sector back from making an estimated 22 percent jump to 353 billion euros (US$384 billion), according to a November forecast issued by Bain & Co.

That growth was supported by the wave of post-lockdown US tourists visiting Europe armed with a strong US dollar, as well as South Korean and Southeast Asian tourists.

Another pleasant surprise was Europeans “who had been ignored for decades ... and were more interested in luxury goods than expected,” said Erwan Rambourg, a luxury industry insider turned analyst and author of the book Future Luxe: What’s Ahead for the Business of Luxury.

With the lifting of travel restrictions in China “there will be a considerable return of Chinese tourists, but that will be more likely in the second quarter,” said Arnaud Cadart, a portfolio manager at asset manager Flornoy & Associates.

“The pandemic is still very active in China and it will affect lots of people,” Cadart said.

Chinese tourists may be needed if the flow of US tourists slows.

“European boutiques need this rebound in Chinese clientele to replace its American clientele which could buy locally,” Cadart said.

They also need to readapt to Chinese customers, who tend to travel in groups, and will join a large number of US tourists.

“There are already lines in front of the boutiques even without Chinese clients ... they need more staff,” De Montgolfier said. Otherwise, they risk a “degradation of the experience” of shopping in a luxury boutique.

Another concern: the volume of merchandise that Chinese customers will want to buy is unclear. The sector likes to keep volumes low and does not discount to ensure exclusivity.

DIVIDED VIEWS: Although the Fed agreed on holding rates steady, some officials see no rate cuts for this year, while 10 policymakers foresee two or more cuts There are a lot of unknowns about the outlook for the economy and interest rates, but US Federal Reserve Chair Jerome Powell signaled at least one thing seems certain: Higher prices are coming. Fed policymakers voted unanimously to hold interest rates steady at a range of 4.25 percent to 4.50 percent for a fourth straight meeting on Wednesday, as they await clarity on whether tariffs would leave a one-time or more lasting mark on inflation. Powell said it is still unclear how much of the bill would fall on the shoulders of consumers, but he expects to learn more about tariffs

Meta Platforms Inc offered US$100 million bonuses to OpenAI employees in an unsuccessful bid to poach the ChatGPT maker’s talent and strengthen its own generative artificial intelligence (AI) teams, OpenAI CEO Sam Altman has said. Facebook’s parent company — a competitor of OpenAI — also offered “giant” annual salaries exceeding US$100 million to OpenAI staffers, Altman said in an interview on the Uncapped with Jack Altman podcast released on Tuesday. “It is crazy,” Sam Altman told his brother Jack in the interview. “I’m really happy that at least so far none of our best people have decided to take them

PLANS: MSI is also planning to upgrade its service center in the Netherlands Micro-Star International Co (MSI, 微星) yesterday said it plans to set up a server assembly line at its Poland service center this year at the earliest. The computer and peripherals manufacturer expects that the new server assembly line would shorten transportation times in shipments to European countries, a company spokesperson told the Taipei Times by telephone. MSI manufactures motherboards, graphics cards, notebook computers, servers, optical storage devices and communication devices. The company operates plants in Taiwan and China, and runs a global network of service centers. The company is also considering upgrading its service center in the Netherlands into a

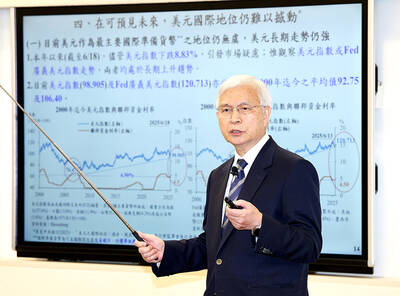

NOT JUSTIFIED: The bank’s governor said there would only be a rate cut if inflation falls below 1.5% and economic conditions deteriorate, which have not been detected The central bank yesterday kept its key interest rates unchanged for a fifth consecutive quarter, aligning with market expectations, while slightly lowering its inflation outlook amid signs of cooling price pressures. The move came after the US Federal Reserve held rates steady overnight, despite pressure from US President Donald Trump to cut borrowing costs. Central bank board members unanimously voted to maintain the discount rate at 2 percent, the secured loan rate at 2.375 percent and the overnight lending rate at 4.25 percent. “We consider the policy decision appropriate, although it suggests tightening leaning after factoring in slackening inflation and stable GDP growth,”