Micron Technology Inc, the largest US maker of memory chips, said the worst industry glut in more than a decade would make it difficult to return to profitability next year.

The company on Wednesday announced a host of cost-cutting measures, including a 10 percent workforce reduction, aimed at helping it weather a rapid drop in revenue.

Micron also projected a steep sales decline and a wider loss than analysts had estimated for the current quarter.

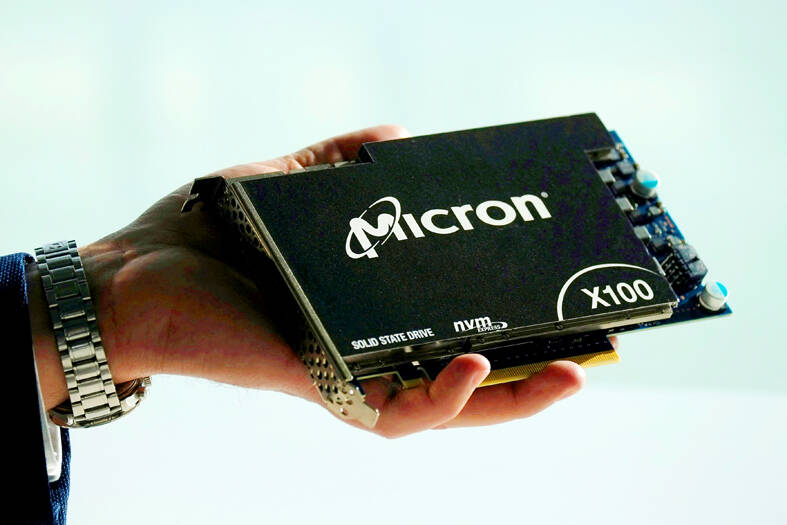

Photo: Reuters

The industry is experiencing its worst imbalance between supply and demand in 13 years, Micron chief executive officer Sanjay Mehrotra said.

Inventory should peak in the current period, then decline, he said.

Customers would move to more healthy inventory levels by about the middle of next year, and the chipmaker’s revenue would improve in the second half of the year, Mehrotra said.

“Profitability will be challenged throughout 2023 because of the oversupply that exists in the industry,” he said in an interview. “The rate and pace of the recovery in terms of profitability depends on how fast supply is brought into line.”

Mehrotra said a unique convergence of circumstances — the war in Ukraine, a surge in inflation, COVID-19 and supply disruptions — has thrust the memorychip industry into a repeat of past cycles when prices plummeted and wiped out profits. Micron has responded aggressively to try to quickly get through the difficult period.

Once the downturn is over, the industry would resume profitable growth helped by demand for artificial intelligence computing and automation of various industries, he said.

Micron, which last month said that it was cutting production by about 20 percent, is cutting its budget for new plants and equipment, and now expects to spend from US$7 billion to US$7.5 billion for the fiscal year, a decline from an earlier target of as much as US$12 billion.

The company is slowing the introduction of more advanced manufacturing techniques and predicts that spending on new production will fall throughout the industry.

Micron’s pledge to reduce output from its factories and slow expansion projects would not ease the glut of chips available unless rivals, including Samsung Electronics Co and SK Hynix Inc, follow suit. That step can help support prices, but comes with the penalty of running expensive plants at less than full capacity, something that can weigh heavily on profitability.

In addition to its planned workforce reductions, the company has suspended share repurchases, is cutting executive salaries and would skip company-wide bonus payments, executives said on a conference call after its results were released.

Micron said sales would be about US$3.8 billion in the fiscal second quarter. That compares with analysts’ average estimate of US$3.88 billion, according to data compiled by Bloomberg.

The company projected a loss of about US$0.62 a share, excluding certain items, in the period ending in February, compared with a loss of US$0.29 expected by analysts.

In the three months ended Dec. 1, Micron’s revenue declined 47 percent to US$4.09 billion. The company had a loss of US$0.04 a share, excluding certain items. That compares with an average estimate of a loss of US$0.01 a share on sales of US$4.13 billion.

Micron’s shares declined about 2 percent in extended trading after closing at US$51.19 in New York.

The stock has dropped 45 percent this year, a worst decline than most chip-related equities. The Philadelphia Stock Exchange Semiconductor Index is down 33 percent this year.

NEW IDENTITY: Known for its software, India has expanded into hardware, with its semiconductor industry growing from US$38bn in 2023 to US$45bn to US$50bn India on Saturday inaugurated its first semiconductor assembly and test facility, a milestone in the government’s push to reduce dependence on foreign chipmakers and stake a claim in a sector dominated by China. Indian Prime Minister Narendra Modi opened US firm Micron Technology Inc’s semiconductor assembly, test and packaging unit in his home state of Gujarat, hailing the “dawn of a new era” for India’s technology ambitions. “When young Indians look back in the future, they will see this decade as the turning point in our tech future,” Modi told the event, which was broadcast on his YouTube channel. The plant would convert

Nanya Technology Corp (南亞科技) yesterday said the DRAM supply crunch could extend through 2028, as the artificial intelligence (AI) boom has led the world’s major memory makers to dramatically reduce production of standard DRAM and allocate a significant portion of their capacity for high-bandwidth memory (HBM) chips. The most severe supply constraints would stretch to the first half of next year due to “very limited” increases in new DRAM capacity worldwide, Nanya Technology president Lee Pei-ing (李培瑛) told a news briefing. The company plans to increase monthly 12-inch wafer capacity to 20,000 in the first half of 2028 after a

Property transactions in the nation’s six special municipalities plunged last month, as a lengthy Lunar New Year holiday combined with ongoing credit tightening dampened housing market activity, data compiled by local land administration offices released on Monday showed. The six cities recorded a total of 10,480 property transfers last month, down 42.5 percent from January and marking the second-lowest monthly level on record, the data showed. “The sharp drop largely reflected seasonal factors and tighter credit conditions,” Evertrust Rehouse Co (永慶房屋) deputy research manager Chen Chin-ping (陳金萍) said. The nine-day Lunar New Year holiday fell in February this year, reducing

New vehicle sales in Taiwan plunged about 37 percent sequentially last month as the long Lunar New Year holiday and 228 Peace Memorial Day holiday cut short the number of working days, along with the lingering uncertainty over import tax cuts on US vehicles, market researcher U-Car said in a report yesterday. New car sales last month totaled 22,043, slumping from 35,073 units in January and down 19.89 percent from 37,515 in February last year, U-Car data showed. Sales of imported luxury cars, led by Mercedes-Benz, plummeted about 45 percent to 3,109 units last month from 5,663 units in the previous month,