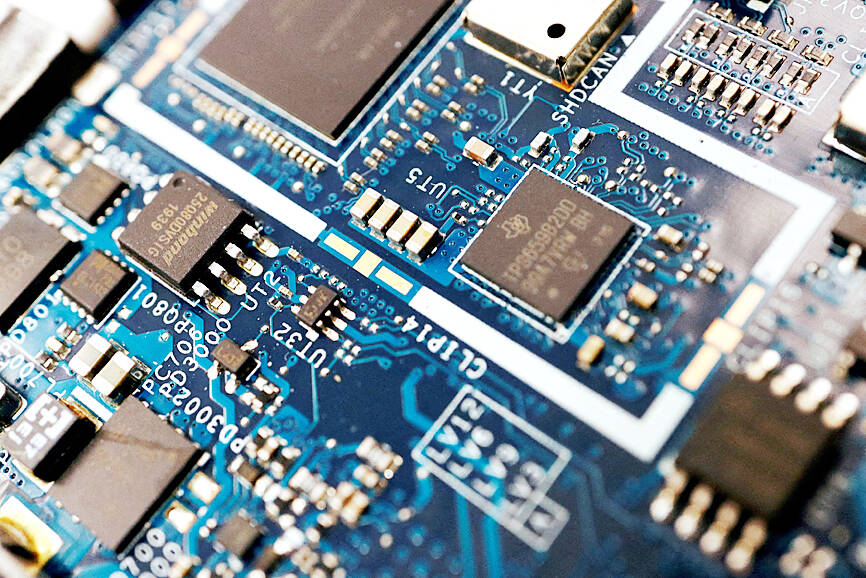

Taiwan was the largest supplier of semiconductors and electric bicycles to the EU in the first nine months of this year, indicating that these two Taiwanese products have become very competitive in the EU market, the Ministry of Economic Affairs said on Tuesday.

According to data compiled by the Department of Statistics, Taiwan’s semiconductor exporters had a 20.8 percent share of the EU market over the nine-month period, beating Malaysia’s 18.5 percent and China’s 13.4 percent, the ministry said.

Taiwan’s semiconductor market share in the EU increased 2.1 percentage points from 18.7 percent for the whole of last year, driven by growing demand for automotive electronics and high-performance computing devices, the data showed.

Photo: Reuters

Israel places fourth with a 9.5 percent share of the EU semiconductor market, followed by the US, which had a 7.9 percent share, the ministry said.

The COVID-19 pandemic and a growing awareness of the need to protect the environment, along with government subsidies, have prompted more people in the EU to change their commuting habits, pushing up demand for electric bikes, the ministry said.

In the first nine months of this year, Taiwan’s electric bike suppliers had a 53.1 percent share of the EU market, the ministry said, adding that Switzerland was a distant second with a 15.6 percent share, ahead of Vietnam’s 12.3 percent and China’s 9 percent.

In the first 11 months of this year, Taiwan’s exports to the EU totaled US$32.2 billion, up 11.6 percent from a year earlier, making the EU the fourth-largest buyer of goods from Taiwan, it said.

Taiwan’s exports to the EU fell 4.9 percent from US$24.1 billion to US$22.9 billion from 2019 to 2020, reversing a 9.8 percent year-on-year increase in 2018, due to the bloc’s protection measures against steel imports, escalating tensions between the US and China and concerns about the COVID-19 pandemic.

However, when COVID-19 fears eased last year and demand for tech gadgets grew, Taiwan’s exports to the EU jumped 38.9 percent from a year earlier to US$31.8 billion, the ministry said.

The annual drop in growth for Taiwan’s exports to the EU in the first 11 months of this year was due to a high comparison base during the same period last year, geopolitical tensions caused by Russia’s invasion of Ukraine and high inflation, which caused demand from end users to decline, it said.

During the 11-month period, Germany bought US$8.17 billion worth of goods from Taiwan, accounting for 25.3 percent of Taiwan’s exports to the EU and making it the largest buyer from the bloc, ahead of the Netherlands with a 25.1 percent share and Italy with a 8.4 percent share, the ministry said.

SEMICONDUCTORS: The German laser and plasma generator company will expand its local services as its specialized offerings support Taiwan’s semiconductor industries Trumpf SE + Co KG, a global leader in supplying laser technology and plasma generators used in chip production, is expanding its investments in Taiwan in an effort to deeply integrate into the global semiconductor supply chain in the pursuit of growth. The company, headquartered in Ditzingen, Germany, has invested significantly in a newly inaugurated regional technical center for plasma generators in Taoyuan, its latest expansion in Taiwan after being engaged in various industries for more than 25 years. The center, the first of its kind Trumpf built outside Germany, aims to serve customers from Taiwan, Japan, Southeast Asia and South Korea,

Gasoline and diesel prices at domestic fuel stations are to fall NT$0.2 per liter this week, down for a second consecutive week, CPC Corp, Taiwan (台灣中油) and Formosa Petrochemical Corp (台塑石化) announced yesterday. Effective today, gasoline prices at CPC and Formosa stations are to drop to NT$26.4, NT$27.9 and NT$29.9 per liter for 92, 95 and 98-octane unleaded gasoline respectively, the companies said in separate statements. The price of premium diesel is to fall to NT$24.8 per liter at CPC stations and NT$24.6 at Formosa pumps, they said. The price adjustments came even as international crude oil prices rose last week, as traders

Taiwan Semiconductor Manufacturing Co (TSMC, 台積電), which supplies advanced chips to Nvidia Corp and Apple Inc, yesterday reported NT$1.046 trillion (US$33.1 billion) in revenue for last quarter, driven by constantly strong demand for artificial intelligence (AI) chips, falling in the upper end of its forecast. Based on TSMC’s financial guidance, revenue would expand about 22 percent sequentially to the range from US$32.2 billion to US$33.4 billion during the final quarter of 2024, it told investors in October last year. Last year in total, revenue jumped 31.61 percent to NT$3.81 trillion, compared with NT$2.89 trillion generated in the year before, according to

PRECEDENTED TIMES: In news that surely does not shock, AI and tech exports drove a banner for exports last year as Taiwan’s economic growth experienced a flood tide Taiwan’s exports delivered a blockbuster finish to last year with last month’s shipments rising at the second-highest pace on record as demand for artificial intelligence (AI) hardware and advanced computing remained strong, the Ministry of Finance said yesterday. Exports surged 43.4 percent from a year earlier to US$62.48 billion last month, extending growth to 26 consecutive months. Imports climbed 14.9 percent to US$43.04 billion, the second-highest monthly level historically, resulting in a trade surplus of US$19.43 billion — more than double that of the year before. Department of Statistics Director-General Beatrice Tsai (蔡美娜) described the performance as “surprisingly outstanding,” forecasting export growth