Nvidia Corp on Wednesday told investors that demand remains strong for its artificial intelligence (AI) and data-center chips, even as the company continues to struggle with a slowdown in the PC market.

While revenue declined 17 percent to US$5.93 billion in the fiscal third quarter, that handily beat the US$5.79 billion average estimate.

Nvidia’s data center unit posted a 31 percent sales increase, also beating projections.

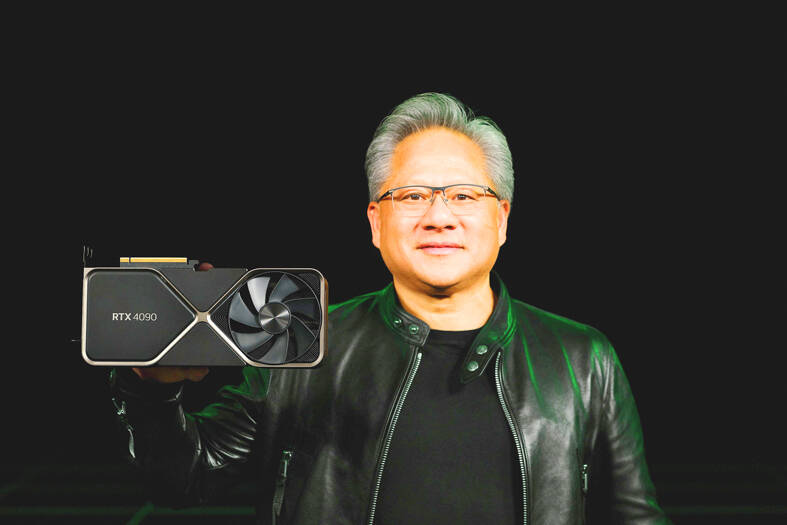

Photo: Reuters

That helped make up for a 51 percent drop in the company’s gaming business — a market tied to PC sales.

Although Nvidia’s outlook for this quarter missed some estimates, the forecast was solid enough to satisfy analysts, or at least remove concerns that its business is rapidly deteriorating.

Fundamentally strong demand for machines that run AI software would help the company weather a difficult economic environment, particularly in China, Nvidia chief executive officer Jensen Huang (黃仁勳) said in an interview.

After excessive inventory is cleared, this quarter would show sequential growth, helped by the debut of new products, the company said.

However, even while adding a dose of optimism, Huang said that the economy and COVID-19 restrictions in China would continue to take a toll.

“The macro environment is still difficult,” he said. “Inflation is real. COVID lockdowns in China still exist.”

Data center sales were helped last quarter by orders from US cloud service providers, with demand weakening in China, Nvidia said.

The division generated US$3.83 billion in revenue in the third quarter, compared with a US$3.79 billion estimate.

The firm earlier on Wednesday announced further inroads into the data-center market, when it said that Microsoft Corp would use its graphics chips, networking products and software for a new AI offering.

Santa Clara, California-based Nvidia expects fourth-quarter revenue to be about US$6 billion, plus or minus 2 percent. That compares with an estimate of US$6.09 billion.

Third-quarter profit was US$0.58 per share, excluding some items, short of the US$0.7 projection.

The company is caught up in the worsening standoff between China and the US. Washington is increasingly trying to cut China off from advanced chip technology, threatening Nvidia’s access to the market.

The company’s best AI offerings are now subject to licensing requirements for export to China, a hurdle that the company said might cost it hundred of millions of dollars in lost revenue.

Nvidia recently debuted a new offering for the China market that it says is compliant with the restrictions.

Nvidia’s outlook was more upbeat than that of Micron Technology Inc earlier on Wednesday.

Micron warned that it was cutting production because next year would be worse than previously feared.

It is reducing production of DRAM and NAND wafers by about 20 percent compared with the fiscal fourth quarter “in response to market conditions,” Micron said in a statement.

Year-on-year DRAM bit supply would need to shrink and NAND bit supply growth would need to be significantly lower than previous estimates, the company said.

The leading US maker of memory semiconductors said it is also working toward additional capital spending cuts.

In September, it said it would cut spending by 30 percent in its fiscal year.

DIVIDED VIEWS: Although the Fed agreed on holding rates steady, some officials see no rate cuts for this year, while 10 policymakers foresee two or more cuts There are a lot of unknowns about the outlook for the economy and interest rates, but US Federal Reserve Chair Jerome Powell signaled at least one thing seems certain: Higher prices are coming. Fed policymakers voted unanimously to hold interest rates steady at a range of 4.25 percent to 4.50 percent for a fourth straight meeting on Wednesday, as they await clarity on whether tariffs would leave a one-time or more lasting mark on inflation. Powell said it is still unclear how much of the bill would fall on the shoulders of consumers, but he expects to learn more about tariffs

Meta Platforms Inc offered US$100 million bonuses to OpenAI employees in an unsuccessful bid to poach the ChatGPT maker’s talent and strengthen its own generative artificial intelligence (AI) teams, OpenAI CEO Sam Altman has said. Facebook’s parent company — a competitor of OpenAI — also offered “giant” annual salaries exceeding US$100 million to OpenAI staffers, Altman said in an interview on the Uncapped with Jack Altman podcast released on Tuesday. “It is crazy,” Sam Altman told his brother Jack in the interview. “I’m really happy that at least so far none of our best people have decided to take them

PLANS: MSI is also planning to upgrade its service center in the Netherlands Micro-Star International Co (MSI, 微星) yesterday said it plans to set up a server assembly line at its Poland service center this year at the earliest. The computer and peripherals manufacturer expects that the new server assembly line would shorten transportation times in shipments to European countries, a company spokesperson told the Taipei Times by telephone. MSI manufactures motherboards, graphics cards, notebook computers, servers, optical storage devices and communication devices. The company operates plants in Taiwan and China, and runs a global network of service centers. The company is also considering upgrading its service center in the Netherlands into a

NOT JUSTIFIED: The bank’s governor said there would only be a rate cut if inflation falls below 1.5% and economic conditions deteriorate, which have not been detected The central bank yesterday kept its key interest rates unchanged for a fifth consecutive quarter, aligning with market expectations, while slightly lowering its inflation outlook amid signs of cooling price pressures. The move came after the US Federal Reserve held rates steady overnight, despite pressure from US President Donald Trump to cut borrowing costs. Central bank board members unanimously voted to maintain the discount rate at 2 percent, the secured loan rate at 2.375 percent and the overnight lending rate at 4.25 percent. “We consider the policy decision appropriate, although it suggests tightening leaning after factoring in slackening inflation and stable GDP growth,”