The Ministry of Economic Affairs (MOEA) yesterday said reports of global tech firms cutting dependence on Taiwan-made chips were inaccurate, after chip designer MediaTek Inc (聯發科) issued a clarification emphasizing it would expand its business based on Taiwan’s semiconductor supply chain.

“The recent reports on the global supply chain shifting away from Taiwan are inaccurate and MediaTek Inc has pointed out the mistake in a filing,” the ministry said, responding to news reports that global tech firms would require their chip suppliers to have multiple sources to cut dependence on Taiwan amid rising US-China trade tensions.

The reports cited MediaTek chief executive officer Rick Tsai (蔡力行).

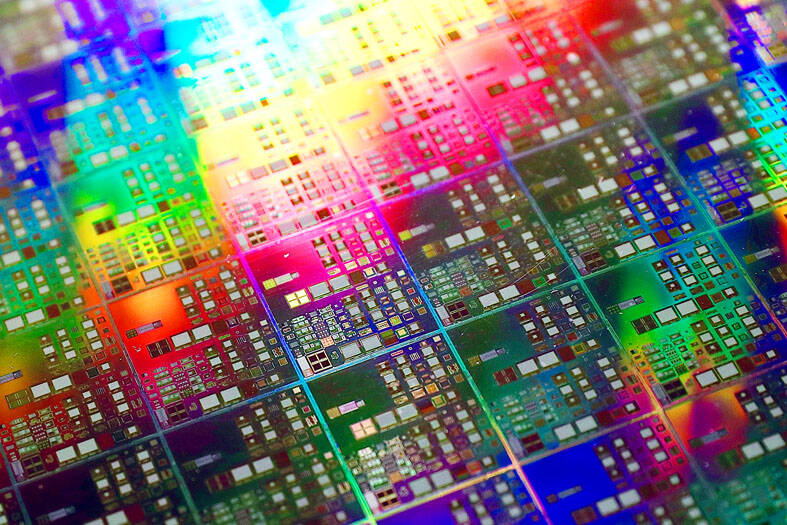

Photo: Ritchie B. Tongo, EPA-EFE

The Hsinchu-based company, which designs chips used in smartphones, laptops and other technology applications, said in the filing that it has no intention of moving away from Taiwan in any way, but would continue to invest in the nation and work with existing partners in its bid to expand in overseas markets.

As the world’s fourth-largest chip company, MediaTek always has multiple suppliers to serve a global clientele, it said, adding that its investment and procurement spending in Taiwan amounts to NT$300 billion (US$9.64 billion) a year.

MediaTek would seek to gain customers and business globally based on Taiwan’s robust semiconductor supply chain, it said.

The ministry said that Taiwan has a well-established and irreplaceable semiconductor ecosystem that encompasses upstream, midstream and downstream players, and has cultivated semiconductor talent for more than 40 years.

The investment environment in Taiwan is safe and built upon a democratic legal system that would continue to attract companies from global semiconductor supply chains, the ministry said.

Taiwan Semiconductor Manufacturing Co (台積電), the world’s largest chipmaker, whose clients include Apple Inc, MediaTek, Advanced Micro Devices Inc, Nvidia Corp and Intel Corp, has reiterated its commitment to keeping advanced manufacturing technologies in Taiwan after announcing plans to add capacity in Hsinchu and Kaohsiung, the ministry said.

International firms have followed suit.

US semiconductor equipment manufacturer Applied Materials Inc in 2019 set up a manufacturing center and a research lab in the Southern Taiwan Science Park (南部科學園區), while Dutch semiconductor equipment manufacturer ASML Holding NV in 2020 launched a global extreme ultraviolet training center for engineers in the same park, the ministry said.

Entegris Inc, a supplier of advanced materials and process solutions for the semiconductor industry and other high-tech sectors, is expanding its investment in a new advanced manufacturing facility in Kaohsiung to about US$500 million in three years, while German science and technology company Merck Group has unveiled plans to spend US$600 million expanding its manufacturing and research investment in Taiwan over the next five to seven years, the ministry said.

NEW IDENTITY: Known for its software, India has expanded into hardware, with its semiconductor industry growing from US$38bn in 2023 to US$45bn to US$50bn India on Saturday inaugurated its first semiconductor assembly and test facility, a milestone in the government’s push to reduce dependence on foreign chipmakers and stake a claim in a sector dominated by China. Indian Prime Minister Narendra Modi opened US firm Micron Technology Inc’s semiconductor assembly, test and packaging unit in his home state of Gujarat, hailing the “dawn of a new era” for India’s technology ambitions. “When young Indians look back in the future, they will see this decade as the turning point in our tech future,” Modi told the event, which was broadcast on his YouTube channel. The plant would convert

‘SEISMIC SHIFT’: The researcher forecast there would be about 1.1 billion mobile shipments this year, down from 1.26 billion the prior year and erasing years of gains The global smartphone market is expected to contract 12.9 percent this year due to the unprecedented memorychip shortage, marking “a crisis like no other,” researcher International Data Corp (IDC) said. The new forecast, a dramatic revision down from earlier estimates, gives the latest accounting of the ongoing memory crunch that is affecting every corner of the electronics industry. The demand for advanced memory to power artificial intelligence (AI) tasks has drained global supply until well into next year and jeopardizes the business model of many smartphone makers. IDC forecast about 1.1 billion mobile shipments this year, down from 1.26 billion the prior

People stand in a Pokemon store in Tokyo on Thursday. One of the world highest-grossing franchises is celebrated its 30th anniversary yesterday.

Zimbabwe’s ban on raw lithium exports is forcing Chinese miners to rethink their strategy, speeding up plans to process the metal locally instead of shipping it to China’s vast rechargeable battery industry. The country is Africa’s largest lithium producer and has one of the world’s largest reserves, according to the US Geological Survey (USGS). Zimbabwe already banned the export of lithium ore in 2022 and last year announced it would halt exports of lithium concentrates from January next year. However, on Wednesday it imposed the ban with immediate effect, leaving unclear what the lithium mining sector would do in the