European stocks rallied on Friday after US jobs data backed bets that the US Federal Reserve would deliver smaller rate hikes, with hopes of easing COVID-19 curbs in China boosting mining and luxury stocks.

The STOXX 600 closed 1.81 percent higher at 416.98, with basic resources, personal and household goods and automakers leading a broad rally.

Thanks to a largely better-than-expected earnings season and hopes that central banks would slow their pace of monetary policy tightening, the benchmark index marked its fourth straight weekly gain with a 1.51 percent rise.

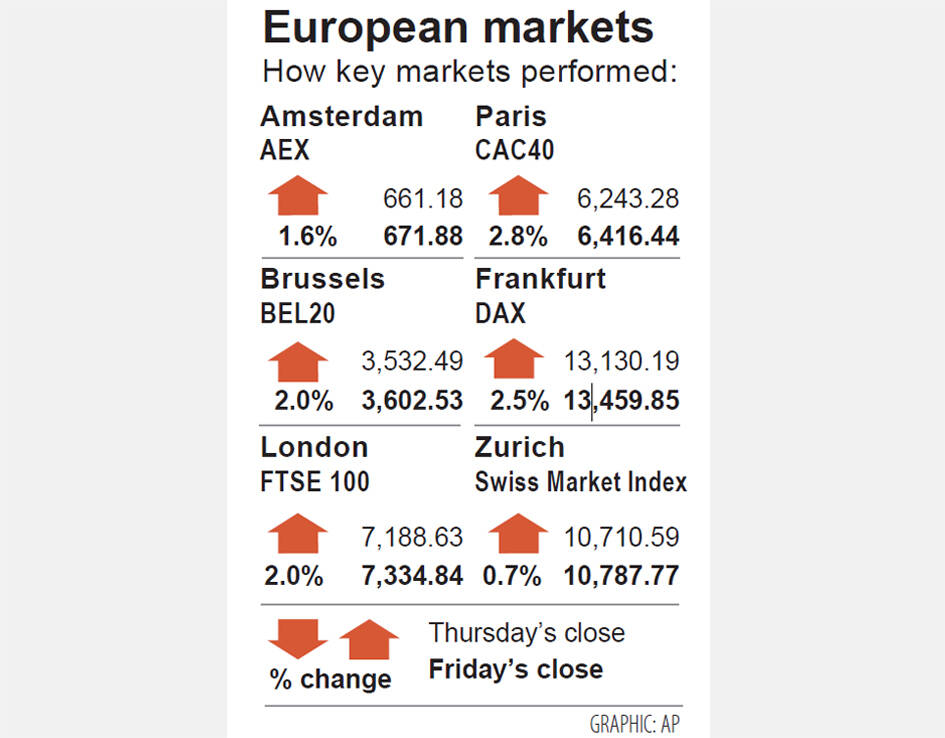

In London, the internationally oriented FTSE 100 index rallied 2.03 percent on the day to 7,334.84, touching its highest level in seven weeks. Its weekly rise of 4.07 percent was its best since January last year.

Wall Street’s main indices held steady as a slowing pace of US job growth and rising unemployment rate suggested some loosening in labor market conditions, supporting hopes of a shift toward smaller rate hikes from next month.

“We definitely believe that the Fed will continue with its hiking cycle, although not with the jumbo hikes that we have seen during the last meetings,” Rabobank senior market economist Teeuwe Mevissen said.

Furthermore, China is expected to make substantial changes to its COVID-19 policy in coming months and further shorten quarantine requirements for inbound travelers.

Luxury giants, including LVMH Moet Hennessy Louis Vuitton SE, Kering, Pernod Ricard and Hermes International SCA, which have a large exposure to China, climbed 3.7 to 7.1 percent.

Miners rose 5.3 percent to post their best day in almost four months as metal prices jumped on speculation over easing COVID-19 curbs in top metal consumer China.

The Euro STOXX volatility index dropped to an 11-week low, reflecting easing anxiety among investors.

Data so far indicates that the eurozone is heading toward a winter recession.

A survey showed that eurozone business activity contracted last month at the fastest pace since late 2020 as high inflation and fears of an intensifying energy crisis hit demand.

In Italy’s storied gold-making hubs, jewelers are reworking their designs to trim gold content as they race to blunt the effect of record prices and appeal to shoppers watching their budgets. Gold prices hit a record high on Thursday, surging near US$5,600 an ounce, more than double a year ago as geopolitical concerns and jitters over trade pushed investors toward the safe-haven asset. The rally is putting undue pressure on small artisans as they face mounting demands from customers, including international brands, to produce cheaper items, from signature pieces to wedding rings, according to interviews with four independent jewelers in Italy’s main

Japanese Prime Minister Sanae Takaichi has talked up the benefits of a weaker yen in a campaign speech, adopting a tone at odds with her finance ministry, which has refused to rule out any options to counter excessive foreign exchange volatility. Takaichi later softened her stance, saying she did not have a preference for the yen’s direction. “People say the weak yen is bad right now, but for export industries, it’s a major opportunity,” Takaichi said on Saturday at a rally for Liberal Democratic Party candidate Daishiro Yamagiwa in Kanagawa Prefecture ahead of a snap election on Sunday. “Whether it’s selling food or

CONCERNS: Tech companies investing in AI businesses that purchase their products have raised questions among investors that they are artificially propping up demand Nvidia Corp chief executive officer Jensen Huang (黃仁勳) on Saturday said that the company would be participating in OpenAI’s latest funding round, describing it as potentially “the largest investment we’ve ever made.” “We will invest a great deal of money,” Huang told reporters while visiting Taipei. “I believe in OpenAI. The work that they do is incredible. They’re one of the most consequential companies of our time.” Huang did not say exactly how much Nvidia might contribute, but described the investment as “huge.” “Let Sam announce how much he’s going to raise — it’s for him to decide,” Huang said, referring to OpenAI

Nvidia Corp’s negotiations to invest as much as US$100 billion in OpenAI have broken down, the Wall Street Journal (WSJ) reported, exposing a potential rift between two of the most powerful companies in the artificial intelligence (AI) industry. The discussions stalled after some inside Nvidia expressed concerns about the transaction, the WSJ reported, citing unidentified people familiar with the deliberations. OpenAI makes the popular chatbot ChatGPT, while Nvidia dominates the market for AI processors that help develop such software. The companies announced the agreement in September last year, saying at the time that they had signed a letter of intent for a strategic