Nvidia Corp’s negotiations to invest as much as US$100 billion in OpenAI have broken down, the Wall Street Journal (WSJ) reported, exposing a potential rift between two of the most powerful companies in the artificial intelligence (AI) industry.

The discussions stalled after some inside Nvidia expressed concerns about the transaction, the WSJ reported, citing unidentified people familiar with the deliberations.

OpenAI makes the popular chatbot ChatGPT, while Nvidia dominates the market for AI processors that help develop such software.

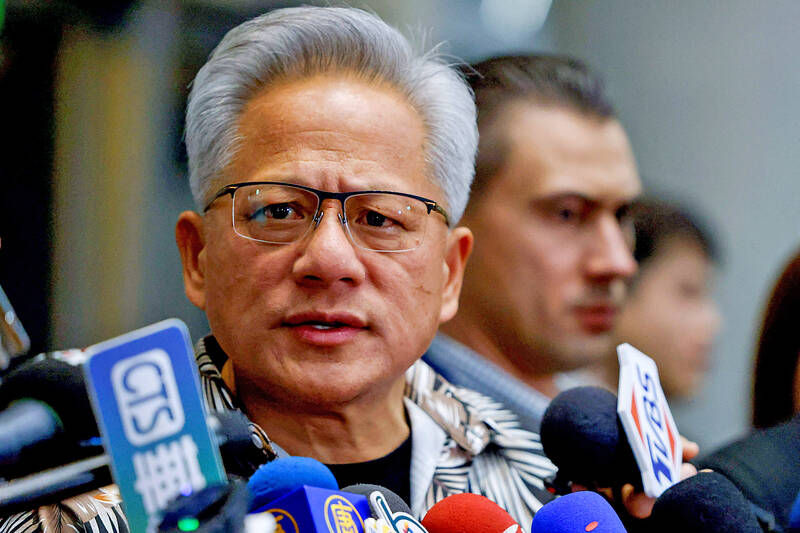

Photo: Ann Wang, Reuters

The companies announced the agreement in September last year, saying at the time that they had signed a letter of intent for a strategic deal.

The US$100 billion was meant to support new data centers and other AI infrastructure, built with Nvidia components.

“We have been OpenAI’s preferred partner for the last 10 years,” Nvidia said in a statement to Bloomberg News on Friday. “We look forward to continuing to work together.”

The company did not discuss the state of negotiations.

A representative for OpenAI did not immediately respond to a request for comment.

The two sides are now rethinking the partnership, the WSJ said.

In one scenario, Nvidia might invest tens of billions of dollars as part of OpenAI’s current funding round, the newspaper reported.

OpenAI has been seeking to raise as much as US$100 billion in that round.

Amazon.com Inc. is in talks to invest as much as US$50 billion and expand an agreement that involves selling computer power to the AI start-up, Bloomberg reported on Thursday.

Nvidia has made other high-profile investments in AI companies. Earlier this week, it announced plans to put an additional US$2 billion into CoreWeave Inc, a cloud computing provider that is also a customer.

These sorts of circular deals — where a company invests in a business that buys its product — have fueled concern about the sustainability of the AI boom.

Nvidia chief executive officer Jensen Huang (黃仁勳) has brushed off the criticism.

After the CoreWeave deal, Huang said that such investments represent a small portion of the total amount that companies will need to raise.

“So the idea that it is circular is — it’s ridiculous,” he said.

European Central Bank (ECB) President Christine Lagarde is expected to step down from her role before her eight-year term ends in October next year, the Financial Times reported. Lagarde wants to leave before the French presidential election in April next year, which would allow French President Emmanuel Macron and German Chancellor Friedrich Merz to find her replacement together, the report said, citing an unidentified person familiar with her thoughts on the matter. It is not clear yet when she might exit, the report said. “President Lagarde is totally focused on her mission and has not taken any decision regarding the end of

French President Emmanuel Macron told a global artificial intelligence (AI) summit in India yesterday he was determined to ensure safe oversight of the fast-evolving technology. The EU has led the way for global regulation with its Artificial Intelligence Act, which was adopted in 2024 and is coming into force in phases. “We are determined to continue to shape the rules of the game... with our allies such as India,” Macron said in New Delhi. “Europe is not blindly focused on regulation — Europe is a space for innovation and investment, but it is a safe space.” The AI Impact Summit is the fourth

AUSPICIOUS TIMING: Ostensibly looking to spike the guns of domestic rivals, ByteDance launched the upgrade to coincide with the Lunar New Year China’s ByteDance Ltd (字節跳動) has rolled out its Doubao 2.0 model, an upgrade of the country’s most widely used artificial-intelligence (AI) app, the company announced on Saturday. ByteDance is one of several Chinese firms hoping to generate overseas and domestic buzz around its new AI models during the Lunar New Year holiday, which began yesterday, when hundreds of millions of Chinese partake in family gatherings in their hometowns. The company, like rival Alibaba Group Holding Ltd (阿里巴巴), was caught off-guard by DeepSeek’s (深度求索) meteoric rise to global fame during last year’s Spring Festival, when Silicon Valley and investors worldwide were

Advanced Micro Devices Inc (AMD) is partnering with Tata Consultancy Services Ltd (TCS) to deploy the US chipmaker’s latest artificial intelligence (AI) data center technology in India, challenging Nvidia Corp in one of the world’s fastest-growing markets. AMD is to offer its Helios data center blueprint and work with TCS to support up to 200 megawatts of AI infrastructure capacity in India, the companies said in a statement on Monday. “AI adoption is accelerating from pilots to large-scale deployments, and that shift requires a new blueprint for compute infrastructure,” AMD chief executive officer Lisa Su (蘇姿丰) said in the statement. “Together with