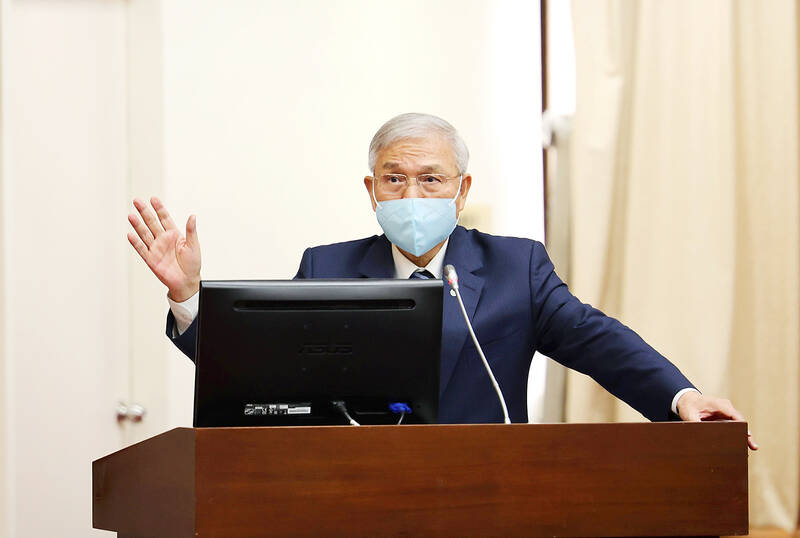

Central bank Governor Yang Chin-long (楊金龍) yesterday said the bank would not impose foreign-exchange controls to curb capital outflows before his tenure ends in February next year.

Yang made the announcement during a question-and-answer session at the legislature after his comments on foreign capital management on Tuesday sparked fears that the bank could take drastic measures to limit capital outflows.

The bank has not adopted capital controls since 1997, when the Asian financial crisis broke out.

Photo: CNA

Foreign investors have remitted NT$40 billion to NT$50 billion (US$1.26 billion to US$1.57 billion) after unloading their local stock holdings, Yang told Chinese Nationalist Party (KMT) Legislator Lin Te-fu (林德福) during the session.

“It is impossible to resist floods. Dredging would work better [to reduce flooding],” Yang said, referring to foreign capital flows. “When you face headwinds, you have to make use of your strength.”

Asked by KMT Legislator Lai Shyh-bao (賴士葆) whether the bank would impose capital controls, Yang said: “Not during my tenure.”

The bank would not impose capital controls in the near term, given Taiwan’s healthy financial fundamentals, including strong foreign-currency liquidity totaling US$691.4 billion, a healthy trade surplus, low foreign debt and high foreign-currency deposits of US$270 billion, Yang said.

He attributed the capital outflows to repeated rate hikes by the US Federal Reserve, saying foreign investors are adjusting their asset portfolios for better returns.

The fund outflows have caused the New Taiwan dollar to fall sharply against the US dollar, as demand for the greenback soared.

The situation is manageable, as the bank had about NT$549 billion in foreign-exchange reserves as of June 30, more than sufficient to prevent the NT dollar overshooting and avoid a financial crisis, Yang said.

Taiwan’s central bank spent NT$8.25 billion to prop up the local currency in the first six months of this year, Yang said.

The NT dollar has plunged more than 15 percent since the beginning of this year. It closed at NT$31.847 against the greenback yesterday.

The central bank is closely monitoring foreign capital movements and overseas fund managers are required to report large remittances to the bank beforehand, Yang said.

However, they are still free to move their funds, he said.

Taiwan weathered the Third Taiwan Strait Crisis in 1995 and the global financial crisis in 2008 without capital controls, Yang said.

No similar measures were taken when China launched military drills around Taiwan last month, he added.

Asked when the central bank would stop raising key interest rates, Yang said that it depends on the inflation rate.

If the consumer price index improves to a manageable level of 2.95 percent this year and falls below 2 percent next year or below the 1.88 percent forecast by the central bank, it might “consider pausing” rates hikes, Yang said.

As there are greater macroeconomic uncertainties, the bank is closely monitoring all economic data and collecting information for its directors to make a decision in their next policy meeting in December, he said.

Quanta Computer Inc (廣達) chairman Barry Lam (林百里) is expected to share his views about the artificial intelligence (AI) industry’s prospects during his speech at the company’s 37th anniversary ceremony, as AI servers have become a new growth engine for the equipment manufacturing service provider. Lam’s speech is much anticipated, as Quanta has risen as one of the world’s major AI server suppliers. The company reported a 30 percent year-on-year growth in consolidated revenue to NT$1.41 trillion (US$43.35 billion) last year, thanks to fast-growing demand for servers, especially those with AI capabilities. The company told investors in November last year that

Intel Corp has named Tasha Chuang (莊蓓瑜) to lead Intel Taiwan in a bid to reinforce relations between the company and its Taiwanese partners. The appointment of Chuang as general manager for Intel Taiwan takes effect on Thursday, the firm said in a statement yesterday. Chuang is to lead her team in Taiwan to pursue product development and sales growth in an effort to reinforce the company’s ties with its partners and clients, Intel said. Chuang was previously in charge of managing Intel’s ties with leading Taiwanese PC brand Asustek Computer Inc (華碩), which included helping Asustek strengthen its global businesses, the company

Taiwanese suppliers to Taiwan Semiconductor Manufacturing Co. (TSMC, 台積電) are expected to follow the contract chipmaker’s step to invest in the US, but their relocation may be seven to eight years away, Minister of Economic Affairs J.W. Kuo (郭智輝) said yesterday. When asked by opposition Chinese Nationalist Party (KMT) Legislator Niu Hsu-ting (牛煦庭) in the legislature about growing concerns that TSMC’s huge investments in the US will prompt its suppliers to follow suit, Kuo said based on the chipmaker’s current limited production volume, it is unlikely to lead its supply chain to go there for now. “Unless TSMC completes its planned six

Power supply and electronic components maker Delta Electronics Inc (台達電) yesterday said it plans to ship its new 1 megawatt charging systems for electric trucks and buses in the first half of next year at the earliest. The new charging piles, which deliver up to 1 megawatt of charging power, are designed for heavy-duty electric vehicles, and support a maximum current of 1,500 amperes and output of 1,250 volts, Delta said in a news release. “If everything goes smoothly, we could begin shipping those new charging systems as early as in the first half of next year,” a company official said. The new