The manufacturing purchasing managers’ index (PMI) last month shed 0.6 points to 47.2, remaining in the contraction zone for two straight months, as inventory digestion stalled amid inflation and economic uncertainty, the Chung-Hua Institution for Economic Research (CIER, 中華經濟研究院) said yesterday.

The rate of contraction is the deepest in two years, and the coming release of the latest iPhone model is unlikely to make it rise, the Taipei-based think tank said.

“Major economies have released disappointing data, which is bound to affect Taiwan’s exports, with the blow becoming evident in the fourth quarter,” the high season for technology products, CIER president Chang Chuang-chang (張傳章) said.

Photo: Ann Wang, Reuters

The PMI gauges the health of the manufacturing industry, with scores above 50 indicating expansion and values below the threshold suggesting contraction.

The US is heading toward recession, and China is not faring well due to strict COVID-19 controls, the economist said, adding that the two countries account for more than 50 percent of Taiwanese exports.

Only food manufacturers last month saw business expand due to seasonal demand during the Ghost Festival, the institute said.

Business decline is not industry-wide, but it is mainly limited to downstream supplers, namely finished goods vendors, researcher Chen Shin-hui (陳馨蕙) said.

The inventory glut is so unfavorable that Apple Inc’s new product launches next week are not likely to reverse the course, Chen said.

The US technology titan is slated to unveil the next-generation iPhone series and Apple Watch on Thursday next week, benefiting local firms in their supply chain.

The forthcoming product launch helped the critical sub-index on new business orders gain five points, although it remained in contraction territory at 41.6, Chen said.

Meanwhile, the measure of industrial production increased by 0.6 points to 44.4.

Companies overall turned conservative and cut headcounts, pushing the employment reading down by 2.7 points to 48.8, the institute’s monthly survey found.

Delivery time lost a further 3.7 points to 45.6, while raw material prices weakened 5.4 points to 43.9, indicating smoother shipping and eased inflationary pressures.

However, the inventory reading remained high at 55.7, and customers’ inventory held firm at 59.2, stemming from previous overbooking and current tepid demand.

Consequently, the six-month business outlook dropped by 1.8 points to 28.3, with all sectors sharing a pessimistic sentiment, it said.

Sectors reliant on domestic demand fared better, with the non-manufacturing purchasing managers’ index standing at 53.8, although it lost 2.9 points, CIER said.

Chang said he doubted that the expansion mode for service providers would be sustainable if exporters continue to suffer.

Wholesale operators, as well as logistics and warehousing service providers, reported a business decline because of their heavy dependence on exporters, the economist said, adding that firms were generally not optimistic about business for the near future.

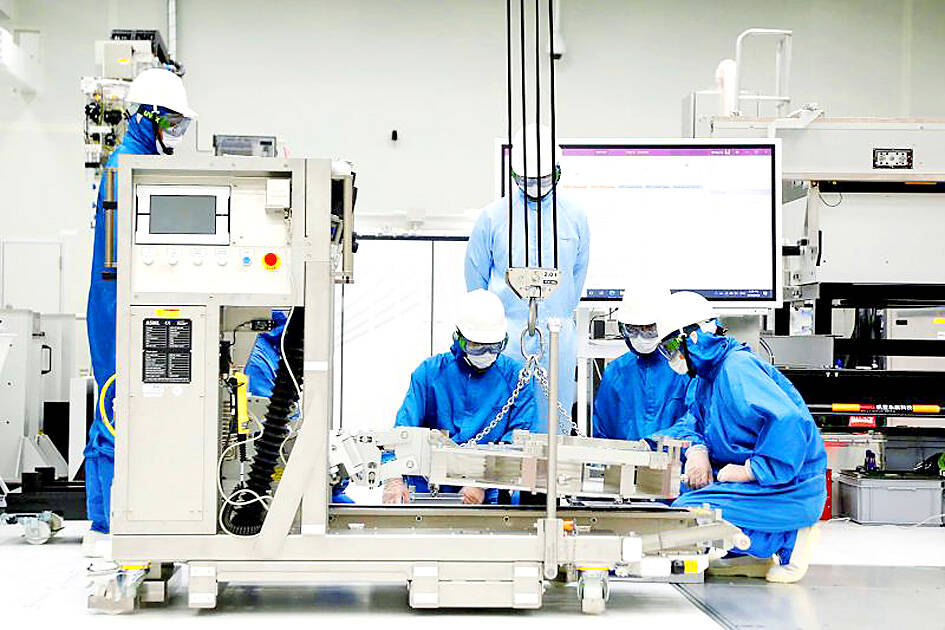

SEMICONDUCTORS: The German laser and plasma generator company will expand its local services as its specialized offerings support Taiwan’s semiconductor industries Trumpf SE + Co KG, a global leader in supplying laser technology and plasma generators used in chip production, is expanding its investments in Taiwan in an effort to deeply integrate into the global semiconductor supply chain in the pursuit of growth. The company, headquartered in Ditzingen, Germany, has invested significantly in a newly inaugurated regional technical center for plasma generators in Taoyuan, its latest expansion in Taiwan after being engaged in various industries for more than 25 years. The center, the first of its kind Trumpf built outside Germany, aims to serve customers from Taiwan, Japan, Southeast Asia and South Korea,

Gasoline and diesel prices at domestic fuel stations are to fall NT$0.2 per liter this week, down for a second consecutive week, CPC Corp, Taiwan (台灣中油) and Formosa Petrochemical Corp (台塑石化) announced yesterday. Effective today, gasoline prices at CPC and Formosa stations are to drop to NT$26.4, NT$27.9 and NT$29.9 per liter for 92, 95 and 98-octane unleaded gasoline respectively, the companies said in separate statements. The price of premium diesel is to fall to NT$24.8 per liter at CPC stations and NT$24.6 at Formosa pumps, they said. The price adjustments came even as international crude oil prices rose last week, as traders

Taiwan Semiconductor Manufacturing Co (TSMC, 台積電), which supplies advanced chips to Nvidia Corp and Apple Inc, yesterday reported NT$1.046 trillion (US$33.1 billion) in revenue for last quarter, driven by constantly strong demand for artificial intelligence (AI) chips, falling in the upper end of its forecast. Based on TSMC’s financial guidance, revenue would expand about 22 percent sequentially to the range from US$32.2 billion to US$33.4 billion during the final quarter of 2024, it told investors in October last year. Last year in total, revenue jumped 31.61 percent to NT$3.81 trillion, compared with NT$2.89 trillion generated in the year before, according to

PRECEDENTED TIMES: In news that surely does not shock, AI and tech exports drove a banner for exports last year as Taiwan’s economic growth experienced a flood tide Taiwan’s exports delivered a blockbuster finish to last year with last month’s shipments rising at the second-highest pace on record as demand for artificial intelligence (AI) hardware and advanced computing remained strong, the Ministry of Finance said yesterday. Exports surged 43.4 percent from a year earlier to US$62.48 billion last month, extending growth to 26 consecutive months. Imports climbed 14.9 percent to US$43.04 billion, the second-highest monthly level historically, resulting in a trade surplus of US$19.43 billion — more than double that of the year before. Department of Statistics Director-General Beatrice Tsai (蔡美娜) described the performance as “surprisingly outstanding,” forecasting export growth