Ministerial-level talks last week between the EU and Taiwan under a new trade and investment framework reflected the EU’s urgency in gaining more stable access to the global semiconductor supply chain, economists said.

The talks between Minister of Economic Affairs Wang Mei-hua (王美花) and EU Director-General for Trade Sabine Weyand on Thursday were the first under the new EU-Taiwan Trade and Investment Dialogue.

After the talks, the Bureau of Foreign Trade said in a statement that the dialogue was aimed at creating a platform to further promote bilateral trade and cooperation, most notably in the semiconductor sector.

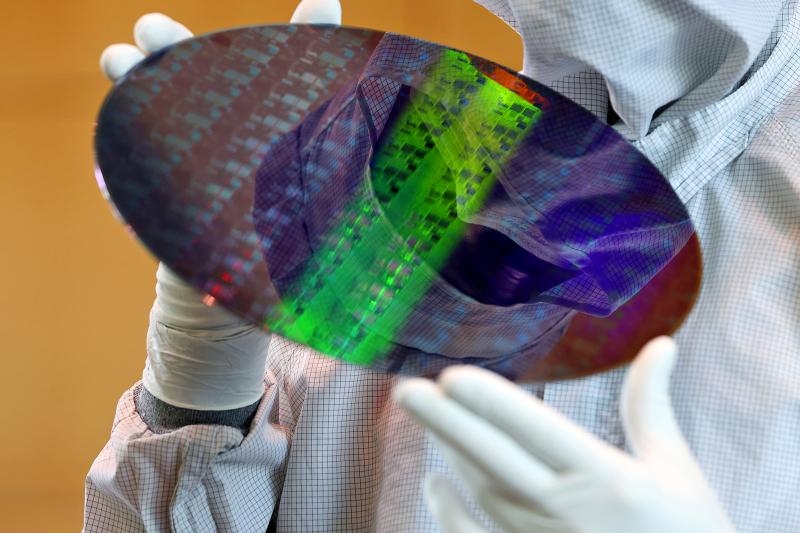

Photo: Bloomberg

Yen Huai-shing (顏慧欣), deputy executive director of the Taiwan WTO & RTA Center at the Chung-Hua Institution for Economic Research (中華經濟研究院), said the talks came at a time when the EU has felt vulnerable because it has little control over semiconductor manufacturing and design.

Russia’s invasion of Ukraine and interruptions in logistics amid the COVID-19 pandemic, which sent ripples through the global semiconductor industry, have only increased the EU’s urgency on supply chain resilience, Yen said.

“The ongoing geopolitical crisis has made the EU sense the importance of stable semiconductor supplies,” Yen said. “Even weapons need chips ... so a shortage in semiconductor supplies has become an issue of national security.”

She said the EU has immediate, medium-term and long-term goals, with its current priority being securing a stable supply of chips.

In the medium term, it hopes to build an information-sharing mechanism with Taiwan similar to the one between Taiwan and the US, in which the EU would provide information on shortages of key materials and orders placed with Taiwan throughout the supply chain.

The EU hopes Taiwan’s semiconductor companies make further investments in Europe, Yen said.

It was not clear how receptive Taiwan would be to those goals, but in the bureau statement, Wang was cited as saying that Taiwan was willing to continue its role as a reliable partner in the global semiconductor industry and maintain its efforts to enhance the resilience of the chip supply chain.

Darson Chiu (邱達生), an economist at the Taiwan Institute of Economic Research (台灣經濟研究院), said he expects the EU to use cooperation on semiconductors as a first step in solidifying economic ties with Taiwan before moving on to old-economy sectors, such as the textile, machinery and petrochemical sectors, to lower its trade deficit with Taiwan.

The EU is also expected to work more closely in clean energy development with Taiwan, Chiu said.

At the same time, Taiwan expects that with the EU being a close ally of the US, trade tensions between Washington and Beijing could help Taiwan gain a bigger share of EU markets, he said.

According to the bureau, the EU is Taiwan’s fifth-largest trade partner, with bilateral trade reaching US$68.7 billion last year, an increase of 32.45 percent over 2020.

In terms of investment, the EU is Taiwan’s largest source of foreign capital. Taiwan’s investments in the EU have also grown significantly, totaling US$5.42 billion since 2016, which accounts for 66.8 percent of Taiwan’s all-time investment in the EU.

Among the rows of vibrators, rubber torsos and leather harnesses at a Chinese sex toys exhibition in Shanghai this weekend, the beginnings of an artificial intelligence (AI)-driven shift in the industry quietly pulsed. China manufactures about 70 percent of the world’s sex toys, most of it the “hardware” on display at the fair — whether that be technicolor tentacled dildos or hyper-realistic personalized silicone dolls. Yet smart toys have been rising in popularity for some time. Many major European and US brands already offer tech-enhanced products that can enable long-distance love, monitor well-being and even bring people one step closer to

Malaysia’s leader yesterday announced plans to build a massive semiconductor design park, aiming to boost the Southeast Asian nation’s role in the global chip industry. A prominent player in the semiconductor industry for decades, Malaysia accounts for an estimated 13 percent of global back-end manufacturing, according to German tech giant Bosch. Now it wants to go beyond production and emerge as a chip design powerhouse too, Malaysian Prime Minister Anwar Ibrahim said. “I am pleased to announce the largest IC (integrated circuit) Design Park in Southeast Asia, that will house world-class anchor tenants and collaborate with global companies such as Arm [Holdings PLC],”

Thousands of parents in Singapore are furious after a Cordlife Group Ltd (康盛人生集團), a major operator of cord blood banks in Asia, irreparably damaged their children’s samples through improper handling, with some now pursuing legal action. The ongoing case, one of the worst to hit the largely untested industry, has renewed concerns over companies marketing themselves to anxious parents with mostly unproven assurances. This has implications across the region, given Cordlife’s operations in Hong Kong, Macau, Indonesia, the Philippines and India. The parents paid for years to have their infants’ cord blood stored, with the understanding that the stem cells they contained

Sales in the retail, and food and beverage sectors last month continued to rise, increasing 0.7 percent and 13.6 percent respectively from a year earlier, setting record highs for the month of March, the Ministry of Economic Affairs said yesterday. Sales in the wholesale sector also grew last month by 4.6 annually, mainly due to the business opportunities for emerging applications related to artificial intelligence (AI) and high-performance computing technologies, the ministry said in a report. The ministry forecast that retail, and food and beverage sales this month would retain their growth momentum as the former would benefit from Tomb Sweeping Day