US DRAM maker Micron Technology Inc is set to install the industry’s most cutting-edge technology — extreme ultraviolet (EUV) lithography equipment — in its facility in Taichung this year, the company said yesterday.

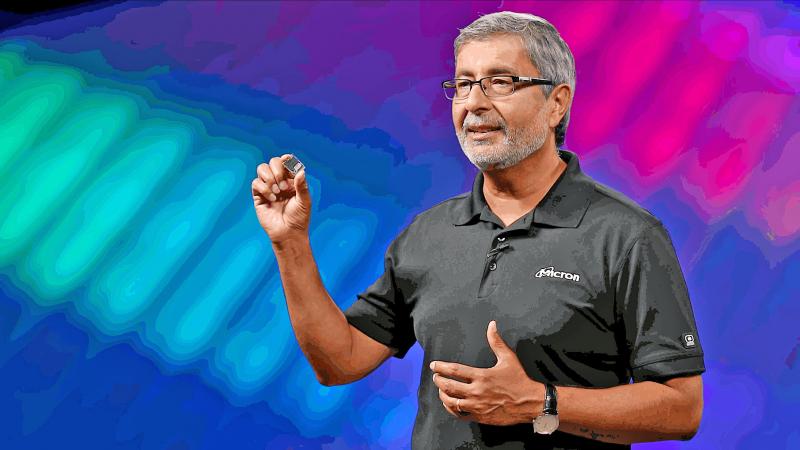

In early preparation for the volume production of 1-gamma nanometer node DRAM, “we plan to introduce EUV tools to our Taichung fab later this year,” Micron president and chief executive officer Sanjay Mehrotra said via video at the Computex trade show in Taipei.

Gamma refers to the dimension of half the distance between cells in a DRAM chip.

Photo courtesy of Micron Technology Inc via CNA

Micron is also looking forward to beginning mass production of its next-generation DRAM products manufactured using the 1-beta nanometer node process in Taiwan next year, Mehrotra said.

“These two installations are another milestone in our continued growth and commitment to Taiwan,” he said.

Micron last year unveiled its 1-alpha nanometer node DRAM, which the company said has 40 percent more memory density than its 1z nanometer node DRAM.

Micron’s Taiwan fabs have begun volume production of 1-alpha nanomerter node DRAM, starting with DDR4 memory for computer customers and consumer PC DRAM products for its Crucial brand, the company said in a news release in January last year.

The largest foreign employer and foreign direct investor in Taiwan with more than 10,000 employees in its fabs in Taichung and Taoyuan, Micron would continue to expand its recruitment of highly skilled personnel in the years ahead, it said.

Digitimes Asia yesterday reported that Micron has placed orders for EUV equipment and plans to transition to EUV technology to manufacture its 1-gamma nanometer node DRAM starting in 2024.

HORMUZ ISSUE: The US president said he expected crude prices to drop at the end of the war, which he called a ‘minor excursion’ that could continue ‘for a little while’ The United Arab Emirates (UAE) and Kuwait started reducing oil production, as the near-closure of the crucial Strait of Hormuz ripples through energy markets and affects global supply. Abu Dhabi National Oil Co (ADNOC) is “managing offshore production levels to address storage requirements,” the company said in a statement, without giving details. Kuwait Petroleum Corp said it was lowering production at its oil fields and refineries after “Iranian threats against safe passage of ships through the Strait of Hormuz.” The war in the Middle East has all but closed Hormuz, the narrow waterway linking the Persian Gulf to the open seas,

Nanya Technology Corp (南亞科技) yesterday said the DRAM supply crunch could extend through 2028, as the artificial intelligence (AI) boom has led the world’s major memory makers to dramatically reduce production of standard DRAM and allocate a significant portion of their capacity for high-bandwidth memory (HBM) chips. The most severe supply constraints would stretch to the first half of next year due to “very limited” increases in new DRAM capacity worldwide, Nanya Technology president Lee Pei-ing (李培瑛) told a news briefing. The company plans to increase monthly 12-inch wafer capacity to 20,000 in the first half of 2028 after a

Taiwan has enough crude oil reserves for more than 100 days and sufficient natural gas reserves for more than 11 days, both above the regulatory safety requirement, Minister of Economic Affairs Kung Ming-hsin (龔明鑫) said yesterday, adding that the government would prioritize domestic price stability as conflicts in the Middle East continue. Overall, energy supply for this month is secure, and the government is continuing efforts to ensure sufficient supply for next month, Kung told reporters after meeting with representatives from business groups at the ministry in Taipei. The ministry has been holding daily cross-ministry meetings at the Executive Yuan to ensure

RATIONING: The proposal would give the Trump administration ample leverage to negotiate investments in the US as it decides how many chips to give each country US officials are debating a new regulatory framework for exporting artificial intelligence (AI) chips and are considering requiring foreign nations to invest in US AI data centers or security guarantees as a condition for granting exports of 200,000 chips or more, according to a document seen by Reuters. The rules are not yet final and could change. They would be the first attempt to regulate the flow of AI chips to US allies and partners since US President Donald Trump’s administration said it rescinded its predecessor’s so-called AI diffusion rules. Those rules sought to keep a significant amount of AI