A Chinese fast-fashion company without a global network of physical stores is seeking a valuation that could be more than the combined worth of high-street staples Hennes & Mauritz AB and Inditex SA’s Zara.

Shein, an online-only retailer of inexpensive clothes, beauty and lifestyle products that pumps out more than 6,000 new items daily, is in talks with potential investors including General Atlantic for a funding round that could value the company at about US$100 billion, media reported on Sunday.

Should Shein succeed with the round, it would make the decade-old brand about twice as valuable as Tokyo-based Fast Retailing Co — the owner of Uniqlo — which last year had more than 2,300 outlets in 25 countries and regions. It would also make Shein the world’s most valuable start-up after ByteDance Ltd (字節跳動) and SpaceX, data provider CB Insights said.

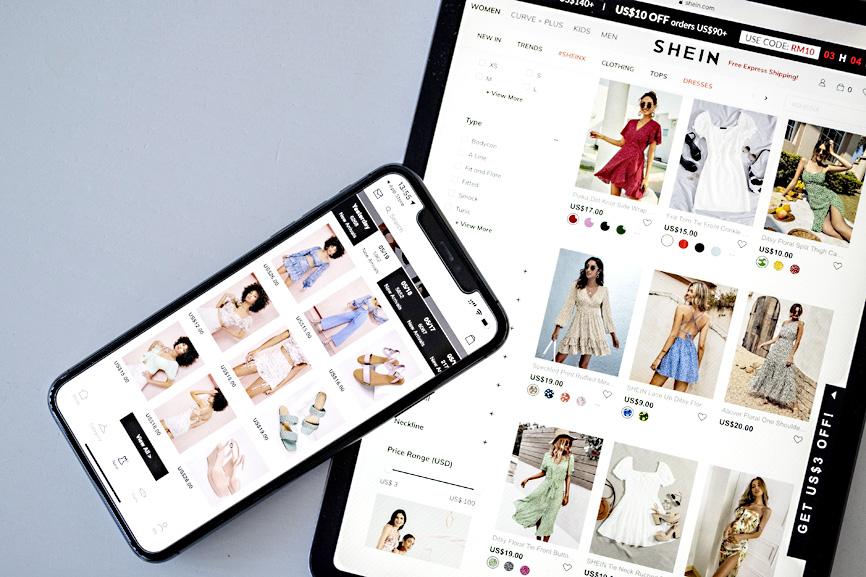

Photo: Bloomberg

While funding rounds indicate the value of a business broadly, initial public offerings offer a sharper peek into whether a wider base of investors shares the same enthusiasm, especially after the books are thrown open to the public for scrutiny.

Shein has not unveiled any public offering plans.

Since its launch in 2012, Shein has developed an extensive network of low-cost suppliers in southern China. During the COVID-19 pandemic, it worked with celebrities such as Lil Nas X and Katy Perry to boost its profile among Gen Z shoppers outside China.

Early in the pandemic, Shein benefited from changes in consumer behavior, as shoppers made even more of their purchases on cellphones or computers. Sales more than tripled in 2020 to US$10 billion, making Shein the biggest Web-only fashion brand.

The new investment round would reflect the impact of a surge in sales for Shein. At the time of a funding round in August 2020, Shein had a valuation of US$15 billion, PitchBook data showed.

Shein’s potentially astonishing valuation also masks some of the adverse effects the fast-fashion industry has on the environment. Although the closely held company has not commented on its carbon footprint, the sector is often blamed for its heavy reliance on petrochemicals derived from oil.

Fashion accounts for up to 10 percent of global carbon dioxide output, the United Nations Environment Programme said.

It also accounts for one-fifth of the about 300 million tonnes of plastic produced globally each year — a product that is the backbone of polyester, which has overtaken cotton as the primary material in textile production.

In its sustainability and social impact report, Shein said that fashion has an undeniable impact on the planet’s health, and it is striving for zero waste and would announce its goal by the end of the year.

In December last year, it announced a US$10 million fund to support global nonprofit organizations focused on empowering entrepreneurs, supporting underserved communities, ensuring animal health and welfare, and promoting recycling.

The Chinese brand is also facing headwinds in the US, with lawmakers in Washington considering legislation that could hinder its sales in the world’s No. 1 economy.

The US House of Representatives in February approved the America COMPETES Act, which includes language that would prevent Chinese companies from using an exemption for tariff-free imports of packages worth less than US$800.

The Senate passed a bill without that change, and lawmakers have yet to reveal the terms of the final version.

Taiwanese suppliers to Taiwan Semiconductor Manufacturing Co. (TSMC, 台積電) are expected to follow the contract chipmaker’s step to invest in the US, but their relocation may be seven to eight years away, Minister of Economic Affairs J.W. Kuo (郭智輝) said yesterday. When asked by opposition Chinese Nationalist Party (KMT) Legislator Niu Hsu-ting (牛煦庭) in the legislature about growing concerns that TSMC’s huge investments in the US will prompt its suppliers to follow suit, Kuo said based on the chipmaker’s current limited production volume, it is unlikely to lead its supply chain to go there for now. “Unless TSMC completes its planned six

Intel Corp has named Tasha Chuang (莊蓓瑜) to lead Intel Taiwan in a bid to reinforce relations between the company and its Taiwanese partners. The appointment of Chuang as general manager for Intel Taiwan takes effect on Thursday, the firm said in a statement yesterday. Chuang is to lead her team in Taiwan to pursue product development and sales growth in an effort to reinforce the company’s ties with its partners and clients, Intel said. Chuang was previously in charge of managing Intel’s ties with leading Taiwanese PC brand Asustek Computer Inc (華碩), which included helping Asustek strengthen its global businesses, the company

Power supply and electronic components maker Delta Electronics Inc (台達電) yesterday said second-quarter revenue is expected to surpass the first quarter, which rose 30 percent year-on-year to NT$118.92 billion (US$3.71 billion). Revenue this quarter is likely to grow, as US clients have front-loaded orders ahead of US President Donald Trump’s planned tariffs on Taiwanese goods, Delta chairman Ping Cheng (鄭平) said at an earnings conference in Taipei, referring to the 90-day pause in tariff implementation Trump announced on April 9. While situations in the third and fourth quarters remain unclear, “We will not halt our long-term deployments and do not plan to

The New Taiwan dollar and Taiwanese stocks surged on signs that trade tensions between the world’s top two economies might start easing and as US tech earnings boosted the outlook of the nation’s semiconductor exports. The NT dollar strengthened as much as 3.8 percent versus the US dollar to 30.815, the biggest intraday gain since January 2011, closing at NT$31.064. The benchmark TAIEX jumped 2.73 percent to outperform the region’s equity gauges. Outlook for global trade improved after China said it is assessing possible trade talks with the US, providing a boost for the nation’s currency and shares. As the NT dollar