Wall Street ended lower on Friday after escalating tensions in Ukraine and US warnings of a potential Russian invasion prompted investors to dump risky assets in the run-up to a long weekend.

The NASDAQ Composite fell sharply, pulled down by declines in high-growth stocks, including Apple Inc, Amazon.com Inc and Microsoft Corp, each down around.

Russian-backed separatists packed civilians onto buses out of breakaway regions in east Ukraine, another development in a conflict the West believes Moscow plans to use as justification for all-out invasion of its neighbor.

Photo: Reuters

Russia has said it has no intention to attack Ukraine, accusing the West of fear-mongering.

Speculation about the US Federal Reserve’s next move also weighed on equities.

New York Fed President John Williams said earlier in the day that it would be appropriate to hike interest rates next month, without mentioning the magnitude.

“This is a confused market, confused about Ukraine, confused about how aggressive the Fed is going to be, and pretty much ignoring very strong earnings results from the fourth quarter,” said Tim Ghriskey, senior portfolio strategist at Ingalls & Snyder in New York.

Expiration of monthly options contracts was also seen adding to the volatility ahead of the US market holiday tomorrow for Presidents’ Day.

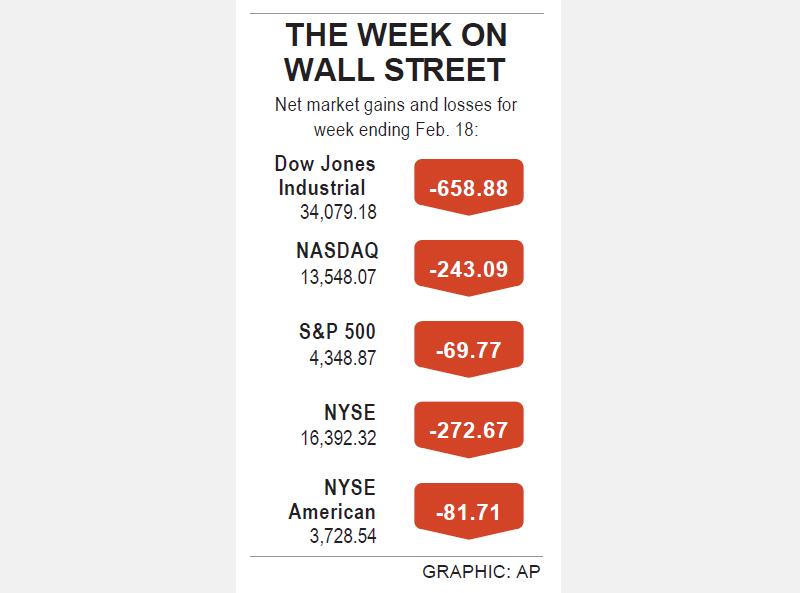

The Dow Jones Industrial Average on Friday fell 0.68 percent to end at 34,079.18 points, while the S&P 500 lost 0.72 percent to 4,348.87.

The NASDAQ Composite dropped 1.23 percent to 13,548.07.

The indices logged weekly declines for the second straight week, buffeted by rising tensions between Moscow and the West over Ukraine. For the week, the S&P 500 fell 1.6 percent, the Dow lost 1.9 percent and the NASDAQ declined 1.8 percent.

Intel Corp tumbled 5.3 percent to its lowest since 2020 after the chipmaker’s turnaround pitch failed to impress investors worried about its loss of market share.

About 78 percent of the 417 S&P 500 companies have in this reporting season posted quarterly earnings above analyst estimates as per Refinitiv data.

Roku Inc slumped 22 percent after the streaming platform’s disappointing quarterly revenue and first-quarter outlook.

DraftKings Inc also fell 22 percent after the sports-betting company forecast a bigger-than anticipated loss for this year.

Declining issues outnumbered advancing ones on the New York Stock Exchange by a 1.84-to-1 ratio; on NASDAQ, a 2.10-to-1 ratio favored decliners.

The S&P 500 posted eight new 52-week highs and 28 new lows; the NASDAQ Composite recorded 19 new highs and 395 new lows.

Volume on US exchanges was 11.3 billion shares, compared with the 12.3 billion average over the past 20 trading days.

European Central Bank (ECB) President Christine Lagarde is expected to step down from her role before her eight-year term ends in October next year, the Financial Times reported. Lagarde wants to leave before the French presidential election in April next year, which would allow French President Emmanuel Macron and German Chancellor Friedrich Merz to find her replacement together, the report said, citing an unidentified person familiar with her thoughts on the matter. It is not clear yet when she might exit, the report said. “President Lagarde is totally focused on her mission and has not taken any decision regarding the end of

French President Emmanuel Macron told a global artificial intelligence (AI) summit in India yesterday he was determined to ensure safe oversight of the fast-evolving technology. The EU has led the way for global regulation with its Artificial Intelligence Act, which was adopted in 2024 and is coming into force in phases. “We are determined to continue to shape the rules of the game... with our allies such as India,” Macron said in New Delhi. “Europe is not blindly focused on regulation — Europe is a space for innovation and investment, but it is a safe space.” The AI Impact Summit is the fourth

CONFUSION: Taiwan, Japan and other big exporters are cautiously monitoring the situation, while analysts said more Trump responses ate likely after his loss in court US trading partners in Asia started weighing fresh uncertainties yesterday after President Donald Trump vowed to impose a new tariff on imports, hours after the Supreme Court struck down many of the sweeping levies he used to launch a global trade war. The court’s ruling invalidated a number of tariffs that the Trump administration had imposed on Asian export powerhouses from China and South Korea to Japan and Taiwan, the world’s largest chip maker and a key player in tech supply chains. Within hours, Trump said he would impose a new 10 percent duty on US imports from all countries starting on

STRATEGIC ALLIANCE: The initiative is aimed at protecting semiconductor supply chain resilience to reduce dependence on China-dominated manufacturing hubs India yesterday joined a US-led initiative to strengthen technology cooperation among strategic allies in a move that underscores the nations’ warming ties after a brief strain over New Delhi’s unabated purchase of discounted Russian oil. The decision aligns India closely with Washington’s efforts to build secure supply chains for semiconductors, advanced manufacturing and critical technologies at a time when geopolitical competition with China is intensifying. It also signals a reset in relations following friction over energy trade and tariffs. Nations that have joined the Pax Silica framework include Japan, South Korea, the UK and Israel. “Pax Silica will be a group of nations