CPC Corp, Taiwan (CPC, 台灣中油) and Formosa Petrochemical Corp (台塑石化) yesterday said they would continue to keep gasoline and diesel prices unchanged this week for a second consecutive week.

This is despite a seventh weekly rise in global crude oil prices amid tensions in Ukraine and a tight supply in the US.

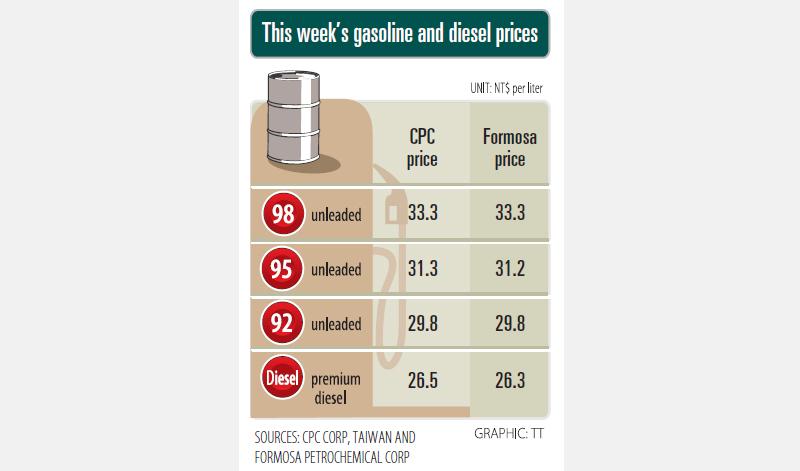

Gasoline prices at CPC stations are to remain at NT$29.8, NT$31.3 and NT$33.3 per liter for 92, 95 and 98-octane unleaded gasoline respectively, while the price of premium diesel fuel is to stay at NT$26.5 per liter, the state-run refiner said in a statement.

Formosa Petrochemical’s prices for 92, 95 and 98-octane unleaded gasoline are to remain at NT$29.8, NT$31.2 and NT$33.3 per liter respectively, while premium diesel is to stay at NT$26.3 per liter, the company said.

Global crude oil prices continued to climb last week on a combination of factors that included a cold snap in Texas and rising concerns about the state’s shale oil production.

Military tensions between Ukraine and Russia were another factor, after the US sent troops to aid European allies, CPC said.

The refiner said its crude oil costs last week rose 2.1 percent, following an increase of 1.23 percent the previous week, based on its floating oil price formula.

To comply with government policy, CPC said that it would not raise fuel prices so that consumer costs would remain stable through the Lunar New Year holiday.

It is to resume its price adjustments on Monday next week, the statement said.

In Italy’s storied gold-making hubs, jewelers are reworking their designs to trim gold content as they race to blunt the effect of record prices and appeal to shoppers watching their budgets. Gold prices hit a record high on Thursday, surging near US$5,600 an ounce, more than double a year ago as geopolitical concerns and jitters over trade pushed investors toward the safe-haven asset. The rally is putting undue pressure on small artisans as they face mounting demands from customers, including international brands, to produce cheaper items, from signature pieces to wedding rings, according to interviews with four independent jewelers in Italy’s main

Macronix International Co (旺宏), the world’s biggest NOR flash memory supplier, yesterday said it would spend NT$22 billion (US$699.1 million) on capacity expansion this year to increase its production of mid-to-low-density memory chips as the world’s major memorychip suppliers are phasing out the market. The company said its planned capital expenditures are about 11 times higher than the NT$1.8 billion it spent on new facilities and equipment last year. A majority of this year’s outlay would be allocated to step up capacity of multi-level cell (MLC) NAND flash memory chips, which are used in embedded multimedia cards (eMMC), a managed

Japanese Prime Minister Sanae Takaichi has talked up the benefits of a weaker yen in a campaign speech, adopting a tone at odds with her finance ministry, which has refused to rule out any options to counter excessive foreign exchange volatility. Takaichi later softened her stance, saying she did not have a preference for the yen’s direction. “People say the weak yen is bad right now, but for export industries, it’s a major opportunity,” Takaichi said on Saturday at a rally for Liberal Democratic Party candidate Daishiro Yamagiwa in Kanagawa Prefecture ahead of a snap election on Sunday. “Whether it’s selling food or

In the wake of strong global demand for AI applications, Taiwan’s export-oriented economy accelerated with the composite index of economic indicators flashing the first “red” light in December for one year, indicating the economy is in booming mode, the National Development Council (NDC) said yesterday. Moreover, the index of leading indicators, which gauges the potential state of the economy over the next six months, also moved higher in December amid growing optimism over the outlook, the NDC said. In December, the index of economic indicators rose one point from a month earlier to 38, at the lower end of the “red” light.