Tech companies are raising hundreds of millions of US dollars, including backing from agriculture heavyweights such as Bayer AG, for developing farm products that use living things such as microbes and seaweed to nourish crops and lessen the need for synthetic fertilizer.

Microbes, including fungi and viruses, have been available for decades as treatments to protect plants from insects and disease, with mixed results.

However, developers are increasingly deploying them as natural ways to nurture crops, while maintaining crop production levels.

Photo: Reuters

Such products could help farmers lessen applications of nitrogen that can pollute waterways and generate nitrous oxide, at a time when farm emissions face greater scrutiny. Canada wants to cut fertilizer emissions by 2030, while the EU aims to reduce fertilizer usage.

Tech companies are attracting funding as commercial nitrogen and potash fertilizers are in tight supply, inflating the costs of food production.

Investment bank Rabobank expects the US$3 billion biostimulants industry to grow 12 to 15 percent annually over the next five years.

Global investments in crop biostimulant and control products more than doubled last year from a year earlier, to US$777 million, preliminary data from venture capital firm AgFunder showed.

Yet microbial fertilizers are largely unregulated, with few studies on how effective they are at boosting crop yields. Only a handful of US states require companies to supply data on the products’ efficacy.

The EU aims to impose its first efficacy requirement for biostimulants in July, and the US Environmental Protection Agency has issued draft guidance for public review.

“Unfortunately, there is an element of buyer beware out there,” said Jon Treloar, agronomist at Denmark-based Novozymes, one of the biggest sellers of biological agriculture products.

One contains a fungus that grows alongside plant roots and releases phosphate — a crop nutrient — from the soil.

Unlike some companies, Novozymes shares field testing results with farmers, Treloar said.

“If growers have a bad experience, it can really tar the entire industry,” he said.

Still, Iowa farmer Jeff Taylor likes what he has seen from biostimulants.

Taylor applied a new product from start-up Pivot Bio and a reduced fertilizer application on a cornfield last year, while applying a full rate of fertilizer on another field.

He said that the field with Pivot’s product yielded slightly more corn per hectare.

“I was skeptical that there was a biological product that would help the crop,” Taylor said. “This is one that I personally feel is working for me.”

Pivot, a private company whose investors include oilseed crusher Bunge Ltd, launched commercial sales of its microbial fertilizer in 2019, and said that farmers use it on more than 404,685 hectares of land.

It raised US$430 million last year from DCVC and Singapore investment company Temasek.

The microbes in Pivot’s Proven 40 consume the sugar found in the roots of a corn, wheat or sorghum plant, producing an enzyme that converts nitrogen found in the air to ammonia, a crop nutrient.

“Microbes that can fix nitrogen in the air into ammonia have been the holy grail of agriculture for 100 years,” Pivot chief executive officer Karsten Temme said.

Pivot’s products do not generate the high emissions associated with manufacturing nitrogen fertilizer, nor the nitrous oxide emissions created when synthetic fertilizer degrades over time, Temme said.

Joyn Bio, a joint venture of Bayer and biotech company Ginkgo Bioworks, expects commercial sales of a microbial seed treatment in three to four years, chief executive officer Mike Miille said.

Joyn engineers microbes in its Boston lab that fix nitrogen from the air and deliver it to corn plants in a form that they can use.

Midwest field trials of the treatment, which aims to allow farmers to cut use of conventional fertilizer by 50 percent while maintaining yields, began last year.

Privately held Locus Agricultural Solutions said its microbial soil treatments help crops absorb more nutrients and less water and captures and stores more climate-warming carbon underground, generating carbon credits.

The credits, generated when carbon capture claims are verified, can be sold to buyers looking to offset their emissions.

The company, which sells its products in the US and is expanding into Europe, has seen revenues jump 50 percent or more year-on-year, a growth rate that Locus chief executive officer Chad Pawlak said is expected to continue for the next two to three years due to soaring farm input costs.

“When you see the double-digit percentage increases in [fertilizer] costs, the conversation around microbes is changing significantly,” Pawlak said. “We’re able to unlock some of those nutrients that were bound up in the soil over the decades.”

Fertilizer and seed companies are getting onboard.

Nutrien Ltd sells biostimulants in its farm supply stores and Yara International produces biosimulants based on seaweed and humic substances.

Seed company Corteva is launching a biological product this spring that captures nitrogen from the atmosphere and converts it into ammonium, a fertilizer that plants can use, a company spokesperson said.

Bayer’s venture investment unit, Leaps by Bayer, has funded microbe-focused start-ups Andes and Sound Agriculture.

However, not everyone is convinced biostimulants work.

University of Minnesota soil scientist Daniel Kaiser tested Pivot’s Proven product on six sites over the past two seasons with less-than-optimal nitrogen fertilizer applications and only one site showed an improved yield.

“With a lot of these [biostimulant products] the scientific principles are sound, but taking them from a concept to something that will work in the field, that’s where they tend to fall apart,” he said.

Europe accounts for half the global market, according to the European Biostimulants Industry Council.

Farmers there initially used them mainly for organic production and on high-value fruit and vegetable crops, but now increasingly deploy them in conventional crops in response to the EU’s drive to make agricultural production more sustainable.

Plants can also support crop growth. Acadian Plant Health harvests seaweed from the Atlantic Ocean and uses extracts of its active molecules in products to improve crop use of nutrients.

The global focus on curbing emissions and consumer attention to how food is produced have given the biostimulant sector momentum, Acadian senior vice president James Maude said.

“It had bad connotations of being snake oil. [Now] it’s like the stars are aligned,” he added.

Greek tourism student Katerina quit within a month of starting work at a five-star hotel in Halkidiki, one of the country’s top destinations, because she said conditions were so dire. Beyond the bad pay, the 22-year-old said that her working and living conditions were “miserable and unacceptable.” Millions holiday in Greece every year, but its vital tourism industry is finding it harder and harder to recruit Greeks to look after them. “I was asked to work in any department of the hotel where there was a need, from service to cleaning,” said Katerina, a tourism and marketing student, who would

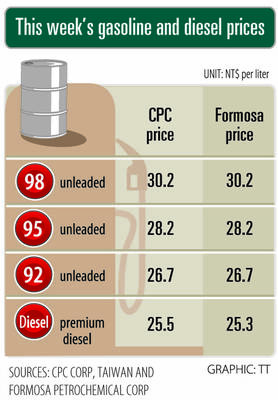

i Gasoline and diesel prices at fuel stations are this week to rise NT$0.1 per liter, as tensions in the Middle East pushed crude oil prices higher last week, CPC Corp, Taiwan (台灣中油) and Formosa Petrochemical Corp (台塑石化) said yesterday. International crude oil prices last week rose for the third consecutive week due to an escalating conflict between Israel and Iran, as the market is concerned that the situation in the Middle East might affect crude oil supply, CPC and Formosa said in separate statements. Front-month Brent crude oil futures — the international oil benchmark — rose 3.75 percent to settle at US$77.01

Merida Industry Co (美利達) has seen signs of recovery in the US and European markets this year, as customers are gradually depleting their inventories, the bicycle maker told shareholders yesterday. Given robust growth in new orders at its Taiwanese factory, coupled with its subsidiaries’ improving performance, Merida said it remains confident about the bicycle market’s prospects and expects steady growth in its core business this year. CAUTION ON CHINA However, the company must handle the Chinese market with great caution, as sales of road bikes there have declined significantly, affecting its revenue and profitability, Merida said in a statement, adding that it would

UNCERTAINTIES: The world’s biggest chip packager and tester is closely monitoring the US’ tariff policy before making any capacity adjustments, a company official said ASE Technology Holding Inc (日月光投控), the world’s biggest chip packager and tester, yesterday said it is cautiously evaluating new advanced packaging capacity expansion in the US in response to customers’ requests amid uncertainties about the US’ tariff policy. Compared with its semiconductor peers, ASE has been relatively prudent about building new capacity in the US. However, the company is adjusting its global manufacturing footprint expansion after US President Donald Trump announced “reciprocal” tariffs in April, and new import duties targeting semiconductors and other items that are vital to national security. ASE subsidiary Siliconware Precision Industries Co (SPIL, 矽品精密) is participating in Nvidia