The Dow on Friday closed lower dragged down by financial stocks as investors were disappointed by fourth quarter results from big US banks, which cast a shadow over the beginning of the earnings season.

The NASDAQ and the S&P regained lost ground in afternoon trading to close higher.

Consumer discretionary stocks put pressure on the indices throughout the session, after morning data showed a decline in retail sales and a souring of consumer sentiment last month.

JPMorgan Chase & Co tumbled after reporting weaker performance at its trading arm.

The bellwether lender also said that soaring inflation, the looming threat of the Omicron variant of SARS-CoV-2 and trading revenues would challenge industry growth in coming months.

Along with JPMorgan, big decliners putting pressure on the Dow included financial stocks Goldman Sachs Group Inc, American Express Co and home improvement retailer Home Depot Inc.

Photo: AFP

Citigroup Inc shares fell after it reported a 26 percent drop in fourth-quarter profit, while asset manager BlackRock Inc fell 2.2 percent after missing quarterly revenue expectations.

The S&P 500 bank subsector, which hit an intraday high in the previous session, closed down 1.7 percent. The sector has recently been outperforming the S&P as investors bet the US Federal Reserve’s expected interest rate hikes would boost bank profits.

“The bar was very high going into [JPMorgan] results. On the surface it was good but, under the hood, not so much,” said Michael James, managing director of equity trading at Wedbush Securities Inc in Los Angeles.

In the interest rate hiking cycle expected this year “positioning was very crowded on the long side” going into the earnings season, he said.

For consumer stock weakness, James pointed to “clearly disappointing” retail sales, which dropped 1.9 percent last month due to shortages of goods and an explosion of COVID-19 infections. Separate data showed that soaring inflation hit US consumer sentiment this month, pushing it to its second-lowest level in a decade.

Retail sales and bank loan growth raised doubts about the economic outlook for this quarter and this year for Keith Buchanan, portfolio manager at Globalt Inc in Atlanta.

“The question is, does the economy have enough strength to get through the risk Omicron brings as fiscal and monetary stimulus is rolling off,” Buchanan said.

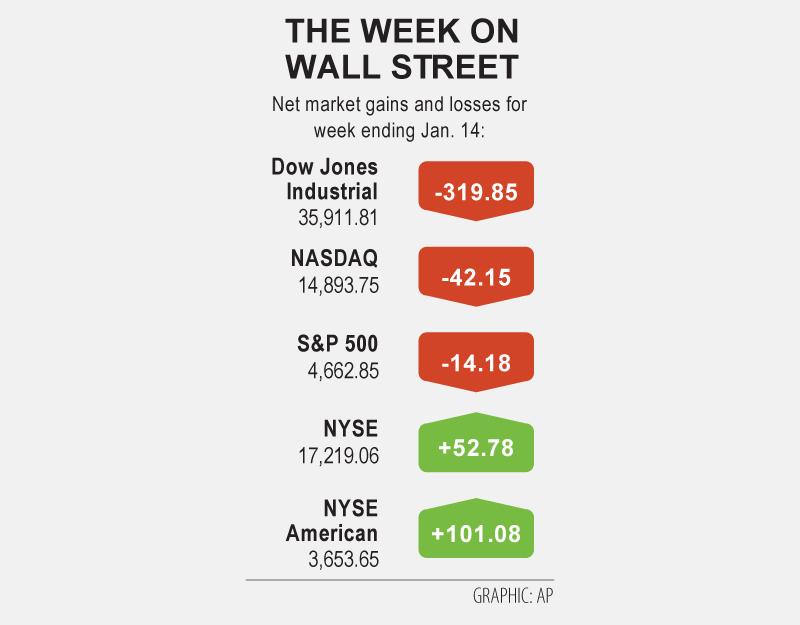

The Dow Jones Industrial Average fell 201.81 points, or 0.56 percent, to 35,911.81, the S&P 500 gained 3.82 points, or 0.08 percent, to 4,662.85 and the NASDAQ Composite added 86.94 points, or 0.59 percent, to 14,893.75.

For the week, the S&P 500 fell 0.3 percent while the Dow fell 0.88 percent and the NASDAQ fell 0.28 percent.

At the end of the session, four out of 11 S&P sectors rose with energy leading gains.

An afternoon rally pushed the NASDAQ and the S&P to closing gains with help from rate-sensitive growth sectors, with technology closing up 0.89 percent and communications services adding 0.53 percent.

“There’s clearly some bargain hunting going on in technology today,” James said.

Analysts see S&P 500 companies earnings rising 23.1 percent in the fourth quarter, Institutional Brokers’ Estimate System data from Refinitiv showed.

However, one bright spot in the bank sector on Friday was Wells Fargo & Co, which rallied after posting a bigger-than-expected rise in fourth-quarter profit.

European Central Bank (ECB) President Christine Lagarde is expected to step down from her role before her eight-year term ends in October next year, the Financial Times reported. Lagarde wants to leave before the French presidential election in April next year, which would allow French President Emmanuel Macron and German Chancellor Friedrich Merz to find her replacement together, the report said, citing an unidentified person familiar with her thoughts on the matter. It is not clear yet when she might exit, the report said. “President Lagarde is totally focused on her mission and has not taken any decision regarding the end of

French President Emmanuel Macron told a global artificial intelligence (AI) summit in India yesterday he was determined to ensure safe oversight of the fast-evolving technology. The EU has led the way for global regulation with its Artificial Intelligence Act, which was adopted in 2024 and is coming into force in phases. “We are determined to continue to shape the rules of the game... with our allies such as India,” Macron said in New Delhi. “Europe is not blindly focused on regulation — Europe is a space for innovation and investment, but it is a safe space.” The AI Impact Summit is the fourth

CONFUSION: Taiwan, Japan and other big exporters are cautiously monitoring the situation, while analysts said more Trump responses ate likely after his loss in court US trading partners in Asia started weighing fresh uncertainties yesterday after President Donald Trump vowed to impose a new tariff on imports, hours after the Supreme Court struck down many of the sweeping levies he used to launch a global trade war. The court’s ruling invalidated a number of tariffs that the Trump administration had imposed on Asian export powerhouses from China and South Korea to Japan and Taiwan, the world’s largest chip maker and a key player in tech supply chains. Within hours, Trump said he would impose a new 10 percent duty on US imports from all countries starting on

STRATEGIC ALLIANCE: The initiative is aimed at protecting semiconductor supply chain resilience to reduce dependence on China-dominated manufacturing hubs India yesterday joined a US-led initiative to strengthen technology cooperation among strategic allies in a move that underscores the nations’ warming ties after a brief strain over New Delhi’s unabated purchase of discounted Russian oil. The decision aligns India closely with Washington’s efforts to build secure supply chains for semiconductors, advanced manufacturing and critical technologies at a time when geopolitical competition with China is intensifying. It also signals a reset in relations following friction over energy trade and tariffs. Nations that have joined the Pax Silica framework include Japan, South Korea, the UK and Israel. “Pax Silica will be a group of nations