European stocks posted their worst session in more than year on Friday, as reports of a newly identified and possibly vaccine-resistant SARS-CoV-2 variant stoked fears of a fresh hit to global economy and drove investors out of riskier assets.

The benchmark STOXX 600 fell 3.7 percent. It had slid as much as 3.6 percent in early trading, while the volatility gauge for the main stock market hit its highest in nearly 10 months. For the week, it plunged 4.53 percent.

Little is known of the variant detected in South Africa, Botswana and Hong Kong, but scientists said it has an unusual combination of mutations and might evade immune responses or make it more transmissible.

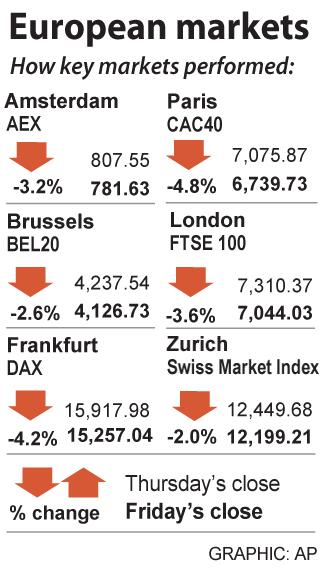

France’s CAC 40 shed 4.75 percent, leading regional markets lower as shares in plane maker Airbus SE, shopping center operator Unibail SE and Safran SA fell 10 to 11 percent each.

UK’s FTSE 100 dropped 3.64 percent, while Germany’s DAX fell 4.15 percent and Spain’s IBEX lost 4.96 percent.

Cyclical-heavy European stock markets have already been under stress this week as a resurgence in COVID-19 cases prompted new restrictions in several countries.

“While COVID still has an impact on market sentiment, it is not the dominant driver it was a year ago. Political and economic agendas have more breadth,” Hargreaves Lansdown head of investment analysis Emma Wall said. “That said, should we have a difficult winter with returned restrictions expect to see those stock sectors which were most vulnerable before wobble — retail, leisure, entertainment and travel.”

Travel and leisure stocks were down 3.9 percent after falling as much as 7 percent after the UK announced a temporary ban on flights from South Africa and several neighboring countries from Friday. The EU is also planning similar moves.

Shares in British Airways owner IAG and EasyJet Holdings PLC, cruise operator Carnival Corp PLC and travel company TUI Group fell 9 to 10 percent.

Oil and gas producers dropped 4.3 percent, while miners tumbled 3.5 percent as oil and metal prices lost ground as reports of the new virus variant fueled economic slowdown worries.

Tracking falls in bond yields, the banking index dropped 4.4 percent, while some stay-at-home stocks, including Delivery Hero SE and Just Eat Takeaway.com NV rose about 3 percent.

The virus scare prompted eurozone money markets to scale back bets of a rate hike from the European Central Bank next year. Odds of a 10 basis point rate hike in December next year almost halved from a full 100 percent earlier this week.

European Central Bank (ECB) President Christine Lagarde is expected to step down from her role before her eight-year term ends in October next year, the Financial Times reported. Lagarde wants to leave before the French presidential election in April next year, which would allow French President Emmanuel Macron and German Chancellor Friedrich Merz to find her replacement together, the report said, citing an unidentified person familiar with her thoughts on the matter. It is not clear yet when she might exit, the report said. “President Lagarde is totally focused on her mission and has not taken any decision regarding the end of

French President Emmanuel Macron told a global artificial intelligence (AI) summit in India yesterday he was determined to ensure safe oversight of the fast-evolving technology. The EU has led the way for global regulation with its Artificial Intelligence Act, which was adopted in 2024 and is coming into force in phases. “We are determined to continue to shape the rules of the game... with our allies such as India,” Macron said in New Delhi. “Europe is not blindly focused on regulation — Europe is a space for innovation and investment, but it is a safe space.” The AI Impact Summit is the fourth

CONFUSION: Taiwan, Japan and other big exporters are cautiously monitoring the situation, while analysts said more Trump responses ate likely after his loss in court US trading partners in Asia started weighing fresh uncertainties yesterday after President Donald Trump vowed to impose a new tariff on imports, hours after the Supreme Court struck down many of the sweeping levies he used to launch a global trade war. The court’s ruling invalidated a number of tariffs that the Trump administration had imposed on Asian export powerhouses from China and South Korea to Japan and Taiwan, the world’s largest chip maker and a key player in tech supply chains. Within hours, Trump said he would impose a new 10 percent duty on US imports from all countries starting on

STRATEGIC ALLIANCE: The initiative is aimed at protecting semiconductor supply chain resilience to reduce dependence on China-dominated manufacturing hubs India yesterday joined a US-led initiative to strengthen technology cooperation among strategic allies in a move that underscores the nations’ warming ties after a brief strain over New Delhi’s unabated purchase of discounted Russian oil. The decision aligns India closely with Washington’s efforts to build secure supply chains for semiconductors, advanced manufacturing and critical technologies at a time when geopolitical competition with China is intensifying. It also signals a reset in relations following friction over energy trade and tariffs. Nations that have joined the Pax Silica framework include Japan, South Korea, the UK and Israel. “Pax Silica will be a group of nations