With the gradual easing of COVID-19 control measures and the effects of the government’s stimulus voucher program, domestic retailers along with food and beverage businesses are expected to experience a continued rebound this quarter, the Ministry of Economic Affairs said on Friday.

“The retail industry has gradually stabilized and the consumer traffic at physical store channels has returned, leading retail sales to return to positive annual growth last month,” the ministry said in a statement.

Retail sales grew 1.3 percent year-on-year to NT$325.4 billion (US$11.7 billion) in September, following three consecutive months of annual contraction, the ministry’s data showed on Monday last week.

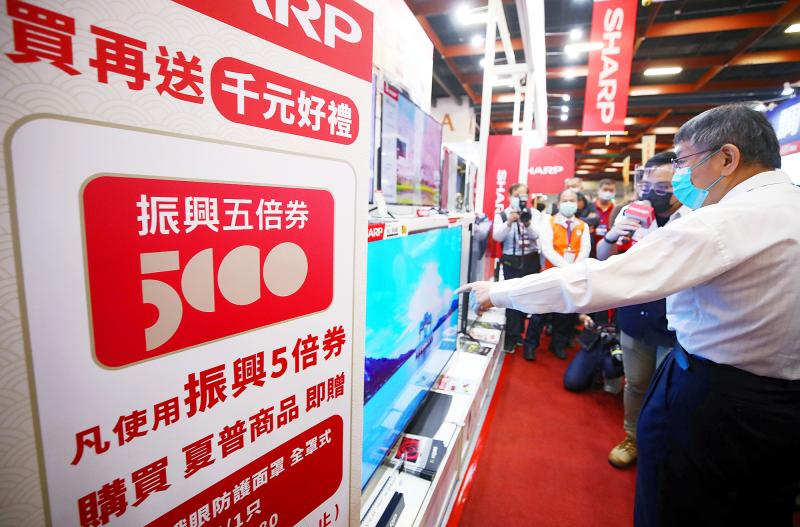

Photo: CNA

The ministry attributed September’s recovery mostly to e-commerce and mail-order sales, which rose 19.5 percent year-on-year to NT$21.5 billion, as firms adopted intensive promotional campaigns for shopping festivals and aggressively marketed on new mobile devices.

Growth in sales of automobiles, motorcycles, auto parts and accessories — increasing 6.1 percent annually to NT$57.6 billion in September, as consumers resumed purchases deferred by a local COVID-19 outbreak in the second quarter — also boosted retail sales in the month, the ministry said.

Other driving forces included fuel products, which reported an annual sales increase of 18 percent to NT$21.8 billion on the back of rising oil prices, and information technology and consumer electronics, which posted an 11.9 percent rise to NT$21.1 billion due to launches of new mobile devices, the data showed.

Food and beverage sales fell 11.2 percent from a year earlier to NT$57.3 billion, a fifth consecutive month of annual contraction despite a steady improvement since May, the ministry said.

“The food and beverage sector registered an annual sales decrease in September as business and banquet activities had not fully recovered,” the ministry said. “It is also because the base period of the previous year was relatively high.”

The pace of slowdown had improved from declines of 25.7 percent in August and 38.8 percent in July, after a level 3 COVID-19 alert was downgraded to level 2 in late July, resulting in relaxed restrictions on on-site dining and drinking, along with eased social distancing measures, providing a small sales boost over previous months.

In the first nine months of this year, retail sales increased 2.2 percent year-on-year to NT$2.86 trillion, the highest for the period on record, while food and beverage sales declined 10.2 percent annually to NT$516.1 billion, the ministry’s data showed.

A survey by the ministry found that companies in the retail and food and beverage sectors were optimistic about business last month compared with September, especially after the distribution of the NT$5,000-valued Quintuple Stimulus Vouchers in September.

Sales in the wholesale sector increased 11.5 percent year-on-year to NT$1.07 trillion last month, a record high, the ministry said.

That came as growing demand for new technology applications and rising raw material prices pushed up wholesale machinery equipment sales by 18.5 percent in September, construction materials by 32.1 percent and chemical materials by 20.7 percent, it said, adding that pharmaceutical and cosmetic product sales rose 4.9 percent as hospitals and pharmacies increased their stocks.

In the first nine months of the year, total wholesale sales reached NT$8.93 trillion, an increase of 16.5 percent from the same period last year, the report said.

European Central Bank (ECB) President Christine Lagarde is expected to step down from her role before her eight-year term ends in October next year, the Financial Times reported. Lagarde wants to leave before the French presidential election in April next year, which would allow French President Emmanuel Macron and German Chancellor Friedrich Merz to find her replacement together, the report said, citing an unidentified person familiar with her thoughts on the matter. It is not clear yet when she might exit, the report said. “President Lagarde is totally focused on her mission and has not taken any decision regarding the end of

French President Emmanuel Macron told a global artificial intelligence (AI) summit in India yesterday he was determined to ensure safe oversight of the fast-evolving technology. The EU has led the way for global regulation with its Artificial Intelligence Act, which was adopted in 2024 and is coming into force in phases. “We are determined to continue to shape the rules of the game... with our allies such as India,” Macron said in New Delhi. “Europe is not blindly focused on regulation — Europe is a space for innovation and investment, but it is a safe space.” The AI Impact Summit is the fourth

CONFUSION: Taiwan, Japan and other big exporters are cautiously monitoring the situation, while analysts said more Trump responses ate likely after his loss in court US trading partners in Asia started weighing fresh uncertainties yesterday after President Donald Trump vowed to impose a new tariff on imports, hours after the Supreme Court struck down many of the sweeping levies he used to launch a global trade war. The court’s ruling invalidated a number of tariffs that the Trump administration had imposed on Asian export powerhouses from China and South Korea to Japan and Taiwan, the world’s largest chip maker and a key player in tech supply chains. Within hours, Trump said he would impose a new 10 percent duty on US imports from all countries starting on

STRATEGIC ALLIANCE: The initiative is aimed at protecting semiconductor supply chain resilience to reduce dependence on China-dominated manufacturing hubs India yesterday joined a US-led initiative to strengthen technology cooperation among strategic allies in a move that underscores the nations’ warming ties after a brief strain over New Delhi’s unabated purchase of discounted Russian oil. The decision aligns India closely with Washington’s efforts to build secure supply chains for semiconductors, advanced manufacturing and critical technologies at a time when geopolitical competition with China is intensifying. It also signals a reset in relations following friction over energy trade and tariffs. Nations that have joined the Pax Silica framework include Japan, South Korea, the UK and Israel. “Pax Silica will be a group of nations