The Dow and S&P 500 on Friday edged higher and ended a turbulent week with slight increases, helped by gains in Tesla Inc and Facebook Inc that offset a tumble by Nike Inc.

Athletic wear company Nike’s shares fell 6.3 percent and were the biggest drag on the Dow and the S&P 500 after it delivered a downbeat sales forecast and warned of delays during the holiday shopping season, blaming a supply chain crunch.

Shares of footwear retailer Foot Locker Retail Inc also fell sharply.

On the flip side, Facebook climbed 2 percent and Tesla rose 2.7 percent.

The S&P communication services sector climbed 0.7 percent and was the second-biggest sector gainer of the day after energy, up 0.8 percent.

Stocks bounced back from a sharp sell-off at the start of the week tied in part to concerns over a default by China Evergrande Group (恆大集團) and its potential risk to global financial markets.

Photo: Reuters

On Friday, Evergrande’s electric vehicle unit said that it faced an uncertain future unless it got a swift injection of cash, the clearest sign yet that the property developer’s liquidity crisis is worsening in other parts of its business.

“You’ve had a good recovery from the lows” this week, said Rick Meckler, a partner at Cherry Lane Investments in New Vernon, New Jersey.

“With rates this low — even if they are going to move up slowly — and with the fiscal stimulus you’ll probably see coming, I think investors still prefer stocks to any other asset class. Stocks remain in a weird way what investors see as the safe place,” Meckler said.

On Wednesday, the US Federal Reserve said it would reduce its monthly bond purchases “soon” and half of the Fed’s policymakers projected that borrowing costs would need to rise next year.

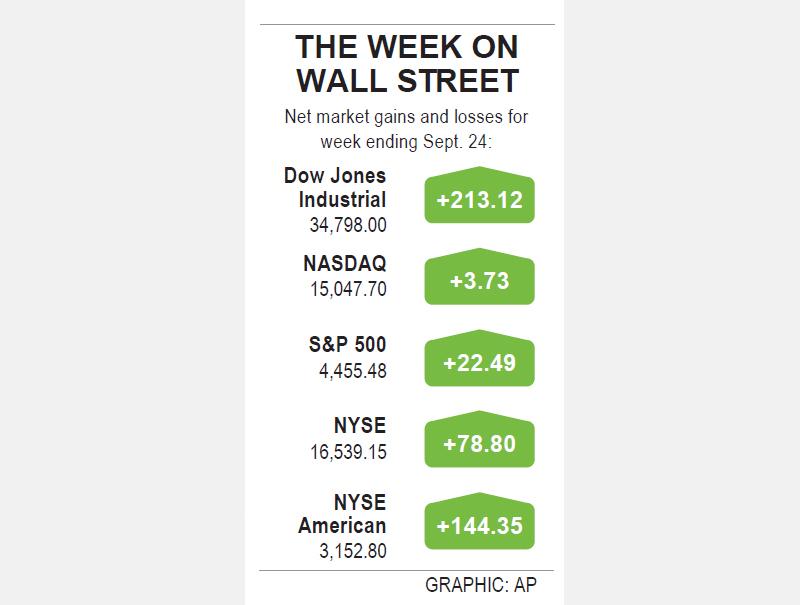

The Dow Jones Industrial Average rose 33.18 points, or 0.1 percent, to 34,798, the S&P 500 gained 6.5 points, or 0.15 percent, to 4,455.48 and the NASDAQ Composite dropped 4.54 points, or 0.03 percent, to 15,047.7.

For the week, the Dow was up 0.62 percent, the S&P 500 gained 0.51 percent and the NASDAQ gained 0.02 percent.

Shares of cryptocurrency-related firms Coinbase Global Inc, MicroStrategy Inc, Riot Blockchain Inc and Marathon Patent Group fell after China’s central bank put a ban on crypto trading and mining.

“It’s been a very volatile week to say the least, so I think going into the last week of September the volatility is likely to continue, especially with the end-of-the-quarter window dressing,” said Peter Cardillo, chief market economist at Spartan Capital Securities LLC in New York.

Investors are also looking for signs of progress on US President Joe Biden’s spending and budget bills.

Declining issues outnumbered advancing ones on the NYSE by a 1.50-to-1 ratio; on the NASDAQ, a 1.40-to-1 ratio favored decliners.

The S&P 500 posted 21 new 52-week highs and six new lows, while the NASDAQ Composite recorded 82 new highs and 73 new lows.

Volume on US exchanges was 9.00 billion shares, compared with the 10.11 billion average for the full session over the past 20 trading days.

European Central Bank (ECB) President Christine Lagarde is expected to step down from her role before her eight-year term ends in October next year, the Financial Times reported. Lagarde wants to leave before the French presidential election in April next year, which would allow French President Emmanuel Macron and German Chancellor Friedrich Merz to find her replacement together, the report said, citing an unidentified person familiar with her thoughts on the matter. It is not clear yet when she might exit, the report said. “President Lagarde is totally focused on her mission and has not taken any decision regarding the end of

French President Emmanuel Macron told a global artificial intelligence (AI) summit in India yesterday he was determined to ensure safe oversight of the fast-evolving technology. The EU has led the way for global regulation with its Artificial Intelligence Act, which was adopted in 2024 and is coming into force in phases. “We are determined to continue to shape the rules of the game... with our allies such as India,” Macron said in New Delhi. “Europe is not blindly focused on regulation — Europe is a space for innovation and investment, but it is a safe space.” The AI Impact Summit is the fourth

CONFUSION: Taiwan, Japan and other big exporters are cautiously monitoring the situation, while analysts said more Trump responses ate likely after his loss in court US trading partners in Asia started weighing fresh uncertainties yesterday after President Donald Trump vowed to impose a new tariff on imports, hours after the Supreme Court struck down many of the sweeping levies he used to launch a global trade war. The court’s ruling invalidated a number of tariffs that the Trump administration had imposed on Asian export powerhouses from China and South Korea to Japan and Taiwan, the world’s largest chip maker and a key player in tech supply chains. Within hours, Trump said he would impose a new 10 percent duty on US imports from all countries starting on

STRATEGIC ALLIANCE: The initiative is aimed at protecting semiconductor supply chain resilience to reduce dependence on China-dominated manufacturing hubs India yesterday joined a US-led initiative to strengthen technology cooperation among strategic allies in a move that underscores the nations’ warming ties after a brief strain over New Delhi’s unabated purchase of discounted Russian oil. The decision aligns India closely with Washington’s efforts to build secure supply chains for semiconductors, advanced manufacturing and critical technologies at a time when geopolitical competition with China is intensifying. It also signals a reset in relations following friction over energy trade and tariffs. Nations that have joined the Pax Silica framework include Japan, South Korea, the UK and Israel. “Pax Silica will be a group of nations