KYMCO (光陽) last week announced a strategic partnership with the nation’s biggest cab-hailing service provider, Taiwan Taxi (台灣大車隊), to electrify the latter’s two-wheeler delivery fleet, GBG Express (全球快遞), using KYMCO’s Ionex battery swapping solution.

GBG Express, a wholly owned delivery arm of Taiwan Taxi, has 26,000 riders with yellow jackets delivering food, clothing, groceries and all sorts of products to people’s doorsteps in Taiwan’s 132 districts.

The firm also focuses on providing business-to-business last-mile delivery services, and has accumulated more than 40,000 corporate clients in more than 100 industries, including Taiwan’s most well-known e-commerce brands, brick-and-mortar stores, convenience store chains and government agencies.

Photo courtesy of KYMCO

To electrify its fleet, GBG Express plans to adopt KYMCO’s electric scooters and Ionex battery swapping network across the nation.

The two firms said that they would jointly design Ionex electric vehicles optimized for making deliveries and promote viable incentive schemes to accelerate the transition of GBG Express to an electric fleet, both at home and, later, as it expands globally.

“KYMCO Ionex is a leading turnkey solution for electric vehicles that empowers businesses and governments to go electric,” KYMCO chairman Allen Ko (柯勝峰) said in a joint statement on Wednesday.

Photo courtesy of KYMCO

“The partnership with Taiwan Taxi marks an important milestone for KYMCO, as the company is committed to leading the world and helping all businesses usher in the electric era,” Ko said.

KYMCO is moving into the global electric scooter market. Over the past few years, the firm has cooperated with Chinese and Southeast Asian express logistics and vehicle-sharing firm through capital investment and technical cooperation. It also exports its Ionex electric scooters and battery swapping platform to overseas markets.

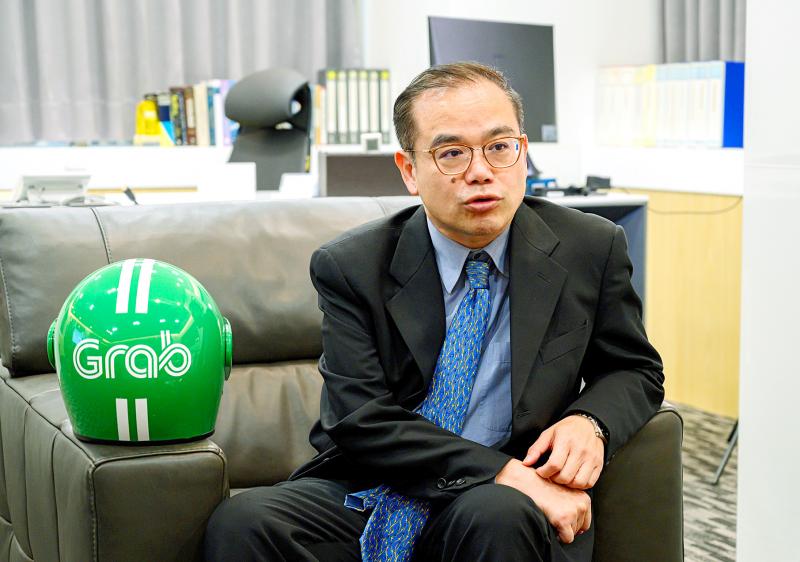

“The partnership with KYMCO creates a win-win situation for all three parties,” Taiwan Taxi chairman Gary Lin (林村田) said in the joint statement.

Photo courtesy of KYMCO

“It demonstrates our long-standing and continuous efforts to explore new business opportunities for our rider partners and to provide better services for our clients. Together with our strategic partners, we will be able to build a sustainable and environmentally friendly transport network,” Lin said.

With the help of KYMCO, GBG Express aims to convert more than 50 percent of its 26,000-strong fleet to electric by 2023.

Meanwhile, KYMCO is speeding up its deployment of battery swapping stations in Taiwan, including by installing in-house battery swapping stations for GBG Express, the company said.

Photo courtesy of KYMCO

Photo courtesy of KYMCO

Photo courtesy of KYMCO

SEMICONDUCTOR SERVICES: A company executive said that Taiwanese firms must think about how to participate in global supply chains and lift their competitiveness Taiwan Semiconductor Manufacturing Co (TSMC, 台積電) yesterday said it expects to launch its first multifunctional service center in Pingtung County in the middle of 2027, in a bid to foster a resilient high-tech facility construction ecosystem. TSMC broached the idea of creating a center two or three years ago when it started building new manufacturing capacity in the US and Japan, the company said. The center, dubbed an “ecosystem park,” would assist local manufacturing facility construction partners to upgrade their capabilities and secure more deals from other global chipmakers such as Intel Corp, Micron Technology Inc and Infineon Technologies AG, TSMC said. It

EXPORT GROWTH: The AI boom has shortened chip cycles to just one year, putting pressure on chipmakers to accelerate development and expand packaging capacity Developing a localized supply chain for advanced packaging equipment is critical for keeping pace with customers’ increasingly shrinking time-to-market cycles for new artificial intelligence (AI) chips, Taiwan Semiconductor Manufacturing Co (TSMC, 台積電) said yesterday. Spurred on by the AI revolution, customers are accelerating product upgrades to nearly every year, compared with the two to three-year development cadence in the past, TSMC vice president of advanced packaging technology and service Jun He (何軍) said at a 3D IC Global Summit organized by SEMI in Taipei. These shortened cycles put heavy pressure on chipmakers, as the entire process — from chip design to mass

Germany is to establish its first-ever national pavilion at Semicon Taiwan, which starts tomorrow in Taipei, as the country looks to raise its profile and deepen semiconductor ties with Taiwan as global chip demand accelerates. Martin Mayer, a semiconductor investment expert at Germany Trade & Invest (GTAI), Germany’s international economic promotion agency, said before leaving for Taiwan that the nation is a crucial partner in developing Germany’s semiconductor ecosystem. Germany’s debut at the international semiconductor exhibition in Taipei aims to “show presence” and signal its commitment to semiconductors, while building trust with Taiwanese companies, government and industry associations, he said. “The best outcome

People walk past advertising for a Syensqo chip at the Semicon Taiwan exhibition in Taipei yesterday.